Wells Fargo is pushing its return-to-office plans back a month to early October, citing rising COVID-19 rates across the U.S.

Consumers who had paid down balances during the pandemic started spending more, while issuers made additional credit available, according to researchers at the Federal Reserve Bank of New York. The findings suggest the start of a return to more normal borrowing patterns in the card industry.

First Hawaiian and Bank of Hawaii are warning that a global spike in coronavirus cases could stunt the state's momentum and threaten credit quality.

With virus cases in its home state hitting their highest level since February, the San Antonio company declined to release reserves — a route that many banks took to boost their second-quarter profits.

Citigroup has gone back to requiring employees — regardless of their vaccination status — to don masks when they’re in the office, according to a person familiar with the matter.

The plan aims to cut monthly payments by roughly 25% for homeowners in government-backed mortgages who are negatively impacted by the pandemic.

The agency’s new chief said eliminating the “adverse market fee” — in place since December — will make it easier for families to refinance while mortgage rates are still low.

As attitudes about corporate responsibility evolve, regulators will expect banks to take a more proactive approach to environmental, social and governance issues. That means going beyond assessing climate-related risks to incorporate a focus on ethics, culture, inclusion and customer protection.

-

Wells Fargo is pushing its return-to-office plans back a month to early October, citing rising COVID-19 rates across the U.S.

August 5 -

Consumers who had paid down balances during the pandemic started spending more, while issuers made additional credit available, according to researchers at the Federal Reserve Bank of New York. The findings suggest the start of a return to more normal borrowing patterns in the card industry.

August 3 -

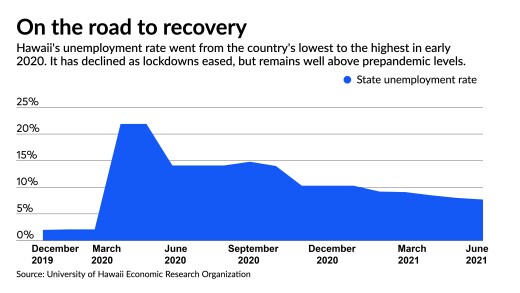

First Hawaiian and Bank of Hawaii are warning that a global spike in coronavirus cases could stunt the state's momentum and threaten credit quality.

August 2 -

With virus cases in its home state hitting their highest level since February, the San Antonio company declined to release reserves — a route that many banks took to boost their second-quarter profits.

July 30 -

Citigroup has gone back to requiring employees — regardless of their vaccination status — to don masks when they’re in the office, according to a person familiar with the matter.

July 29 -

The plan aims to cut monthly payments by roughly 25% for homeowners in government-backed mortgages who are negatively impacted by the pandemic.

July 23 -

The agency’s new chief said eliminating the “adverse market fee” — in place since December — will make it easier for families to refinance while mortgage rates are still low.

July 16