As Morgan Stanley's bankers scattered from Manhattan's Times Square to their home offices during the pandemic, some asked: How are the coffee-cart vendors doing? The answer: terribly.

Speaking at an investor conference, Bank of America's CEO said that additional aid is needed to help consumers, businesses, nonprofits and local governments ride out the pandemic.

Lawmakers need to create a coronavirus relief program targeting owners of smaller businesses facing more hardship than larger competitors that received much of the aid from the Paycheck Protection Program.

Executives from U.S. banks continue to play down near-term expectations, but they say customers are growing more confident ahead of the rollout of coronavirus vaccines, and that key commercial lending segments could drive an economic rebound.

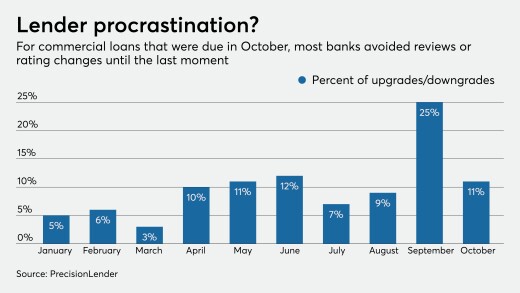

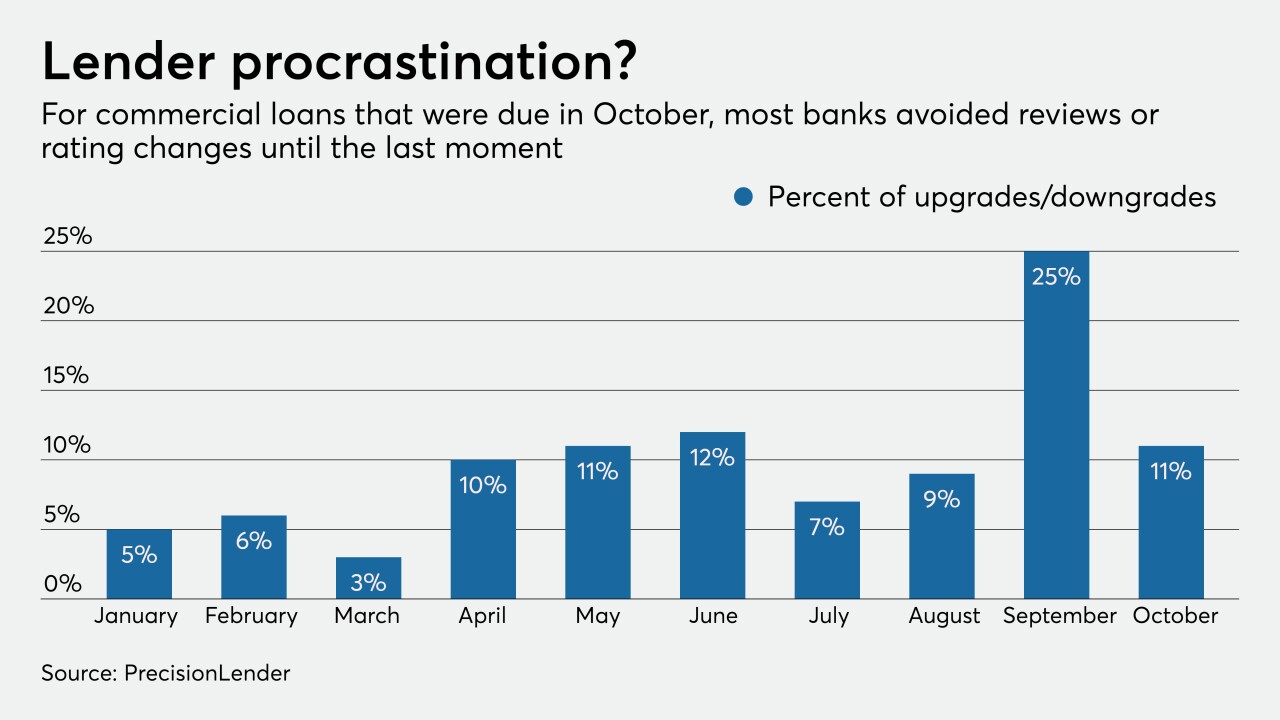

Some lenders are poring over commercial portfolios more frequently than normal — perhaps as often as once a month — to uncover problems hidden by payment deferrals and government stimulus before it's too late.

Once vaccines are widely available, some Americans may revert to old habits of paying cash and swiping cards, but many will stick to digital and mobile payment methods, says Paysend's Matt Montes.

It includes simpler Paycheck Protection Program forgiveness and a consistent approach from federal regulators to reforming the Community Reinvestment Act, says Bank of America's Christine Channels, who chairs the Consumer Bankers Association's board.

U.S. consumer borrowing rose in October by less than forecast, reflecting a decline in credit card balances as the pandemic continued to limit some purchases.

-

As Morgan Stanley's bankers scattered from Manhattan's Times Square to their home offices during the pandemic, some asked: How are the coffee-cart vendors doing? The answer: terribly.

December 9 -

Speaking at an investor conference, Bank of America's CEO said that additional aid is needed to help consumers, businesses, nonprofits and local governments ride out the pandemic.

December 9 -

Lawmakers need to create a coronavirus relief program targeting owners of smaller businesses facing more hardship than larger competitors that received much of the aid from the Paycheck Protection Program.

December 9 Signature Bank of New York

Signature Bank of New York -

Executives from U.S. banks continue to play down near-term expectations, but they say customers are growing more confident ahead of the rollout of coronavirus vaccines, and that key commercial lending segments could drive an economic rebound.

December 8 -

Some lenders are poring over commercial portfolios more frequently than normal — perhaps as often as once a month — to uncover problems hidden by payment deferrals and government stimulus before it's too late.

December 8 -

Once vaccines are widely available, some Americans may revert to old habits of paying cash and swiping cards, but many will stick to digital and mobile payment methods, says Paysend's Matt Montes.

December 8Paysend -

It includes simpler Paycheck Protection Program forgiveness and a consistent approach from federal regulators to reforming the Community Reinvestment Act, says Bank of America's Christine Channels, who chairs the Consumer Bankers Association's board.

December 7