-

Prosperity Bancshares finalizes the second of three acquisitions it's announced since July; Sumitomo Mitsui Banking Corporation appoints a new chief information security officer for its American operations; Huntington Bancshares, Third Coast Bancshares and Heritage Financial completed acquisitions; and more in this week's banking news roundup.

February 6 -

Unlike some of its expansion-minded regional bank peers, Montana-based First Interstate is reconfiguring its business model to be smaller and more focused on relationship banking. The blueprint is the work of CEO Jim Reuter, who joined the bank 15 months ago.

February 5 -

-

Bowing to industry pressure, the Consumer Financial Protection Bureau is warning consumers with notices on its complaint portal not to file disputes about inaccurate information on credit reports, among other changes.

February 5 -

American Banker's 2026 Predictions report finds that nonbank entities and check fraud are major threats to local banks in the coming months.

February 5 -

This month, Bank of America plans to unveil new incentives for cardholders with higher account balances. Reworking the rewards program is one lever the firm is pulling in its effort to lift the annual profit of the consumer unit to $20 billion by the end of the decade.

February 5 -

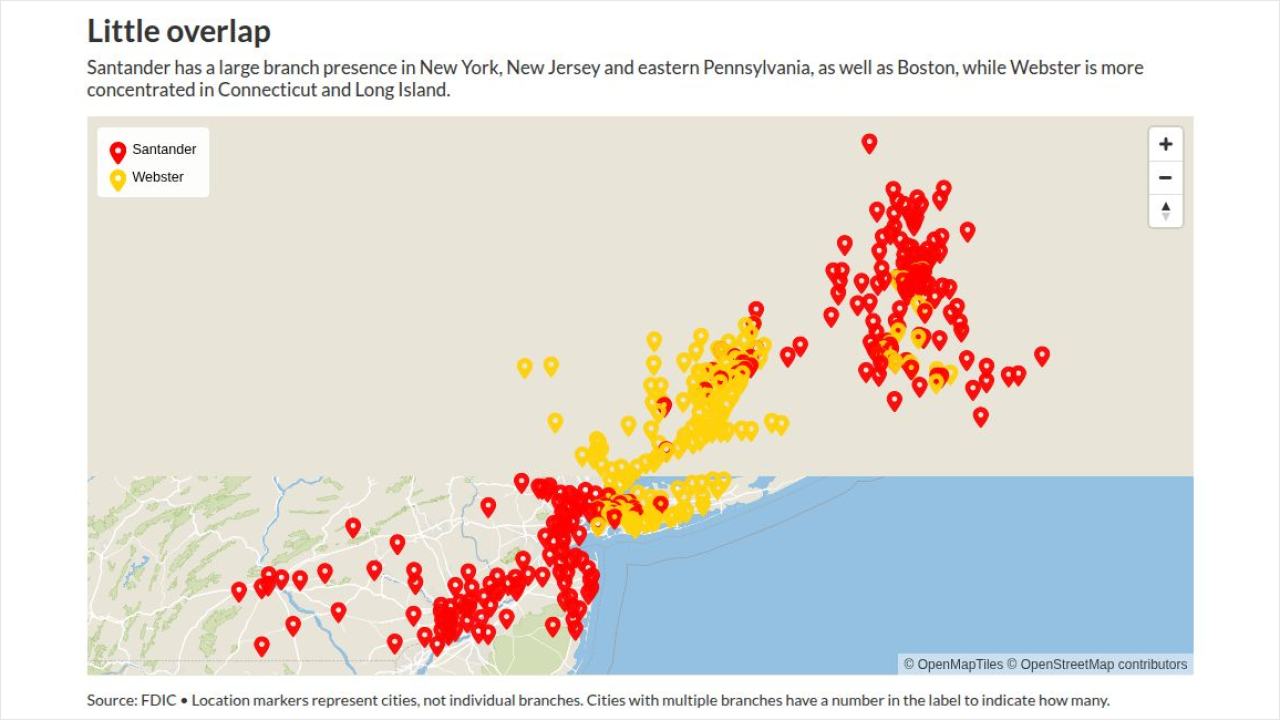

The Spanish banking giant is accelerating its U.S. growth plans with the pending acquisition of Webster Financial in Connecticut. The combined entity will be the second-largest foreign-owned bank operating in the country.

February 4 -

The Spanish banking giant, which has been trying to grow its U.S. business, plans to acquire the Connecticut-based parent company of Webster Bank.

February 3 -

The crypto and payment fintechs both debuted on the stock market in late January with strong openings, then traded down ahead of a four-day partial government shutdown.

February 3 -

Acquiring the $5.8 billion Northfield Bancorp would give Columbia a presence in both Brooklyn and Staten Island. The deal provides a window into the impact of New York Mayor Zohran Mamdani's plan to freeze rents on the city's multifamily real estate market.

February 3