Consumer banking

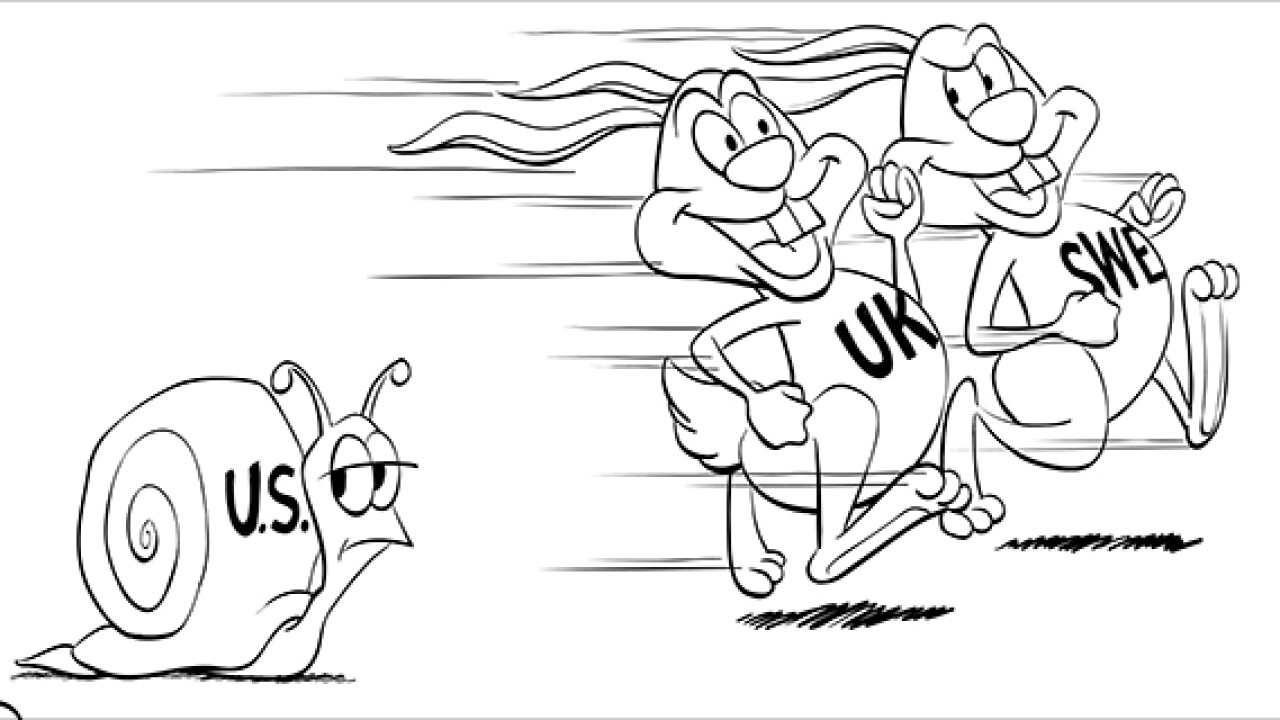

One more quick illustration of why bank customers and regulators are demanding that the U.S. move to a real-time payments system.

-

Another quick illustration of why bank customers and regulators are demanding that the U.S. move to a real-time payments system.

April 27 -

Jeffrey Robinson, author of the acerbic "BitCon," explains how he squares his admiration for blockchain technology with his contempt for the Bitcoin currency and community in the final part of a conversation with American Banker's Marc Hochstein.

April 22

-

A quick explanation of why bank customers and regulators are demanding that the U.S. move to a real-time payments system.

March 30 -

Ultra-high-net-worth investors can have complex needs. That's why family historians and psychologists are on staff at Abbot Downing, the wealth-management business founded by Wells Fargo to serve investors with $50 million or more.

March 23 -

One way to help the global economy prosper is to think of the poor and the middle class as untapped assets for entrepreneurship and job creation. That was the premise underlying a panel discussion at a recent conference on financial inclusion.The panel included, from left, Clare Woodcraft-Scott, the chief executive of the Emirates Foundation; Monica Mehta, managing principal of Seventh Capital in Houston, a family office that invests in lower-market consumer businesses, and author of "The Entrepreneurial Instinct: How Everyone Has the Innate Ability to Start a Successful Small Business," and Aja Brown, the mayor of Compton, Calif. Their discussion took place in Atlanta at the 2015 Hope Global Forum, presented by Operation Hope.

February 23 -

Aja Brown, the mayor of Compton, Calif., says introducing young people to what's possible, so that they don't feel limited by their current circumstances, is a way of continuing the mission that Martin Luther King Jr. started. Brown was a featured speaker at the recent Hope Global Forum, which focused on the theme of financial inclusion. She was there to discuss several initiatives underway in Compton, including one with the University of Southern California to offer industry-specific employment training.

February 23 -

Banks need outside help to deliver credit to the underserved, says Tim Wennes, the West Coast president of MUFG Union Bank, who shares advice on what kind of partners to seek and how to vet them.

February 23 -

Rallying bank employees to participate in outreach projects takes hard work in the beginning, but their involvement is essential to building a rapport with the community, OneWest Bank CEO Joseph Otting says.

February 23 -

There are some fairly basic, decisive steps banks could take to educate people outside the financial mainstream, and it would make banking more profitable, says John Bryant, the chairman and CEO of the nonprofit Operation Hope.

February 23