Consumer banking

Diversity takes a lot of different forms, and the need for it in the boardroom is becoming more widely recognized as an imperative. Some of our Most Powerful Women in Banking and Finance including Northern Trust's Jana Schreuder and Citi's Julie Monaco offer their perspectives.

-

Why is the goal of better gender balance in the senior ranks so elusive? And what can we do about it? Some of our Most Powerful Women in Banking and Finance weigh in.

September 22 -

Brayden McCarthy of Fundera contends that unfair practices are commonplace in the online lending industry, and that self-regulation is needed to protect small-business borrowers.

September 8

-

In the second part of a three-part conversation, CommonBond Chief Executive David Klein weighs the competing goals of gaining market share and posting a profit in the nascent marketplace lending industry.

May 29 -

In the first part of a three-part conversation, CommonBond Chief Executive David Klein argues that large and small banks have different roles to play in the marketplace lending ecosystem.

May 20 -

Moody's managing director Will Black asks whether regulators may eventually sour on the arrangements between P-to-P platforms and the banks that technically originate their loans.

May 18 -

Todd Barnhart, head of retail banking at PNC Financial Services Group, discusses the conversion of branches to emphasize digital banking and why it's good to teach consumers to better manage their own accounts, even at the expense of fee revenue in the short term.

May 8 -

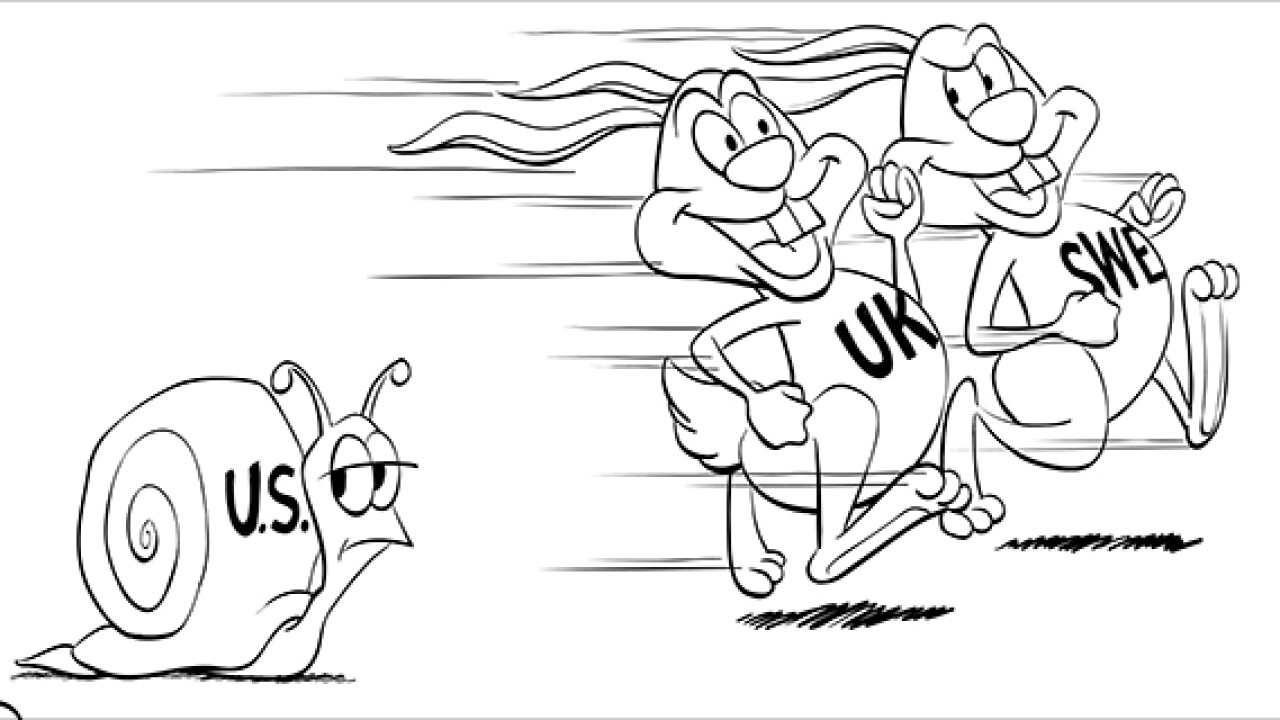

One more quick illustration of why bank customers and regulators are demanding that the U.S. move to a real-time payments system.

May 7 -

Another quick illustration of why bank customers and regulators are demanding that the U.S. move to a real-time payments system.

April 27 -

Jeffrey Robinson, author of the acerbic "BitCon," explains how he squares his admiration for blockchain technology with his contempt for the Bitcoin currency and community in the final part of a conversation with American Banker's Marc Hochstein.

April 22