-

The infrastructure fund dubbed BXINFRA targets individuals with at least $5 million of investments.

August 7 -

Third-party origination operations are also going to Mr. Cooper in the $1.4 billion deal, in which the seller cited interest in improving its capital position.

July 25 -

Investors are set to start the week scrambling to decide if President Joe Biden's decision to end his reelection campaign and endorse Vice President Kamala Harris increases or decreases Donald Trump's chances of regaining power.

July 21 -

With Americans suffering from high housing costs and declining supply, we cannot afford to watch a massive government-sponsored enterprise sit on billions in retained earnings.

July 12

-

The U.S. 30-year yield reached the highest level in a month on Monday amid predictions that a Trump presidency would lead to higher inflation.

July 3 -

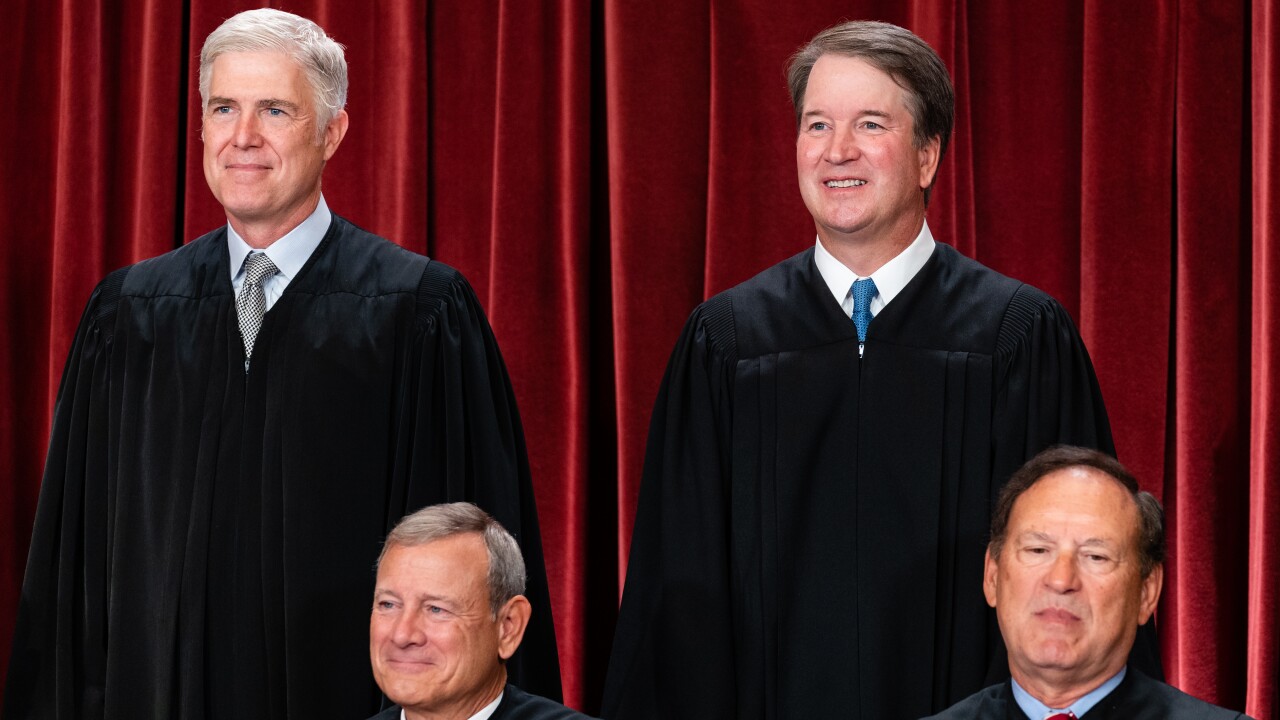

In this month's roundup of top banking news: a cease-and-desist issued by the Federal Reserve, high CFO turnover, the end of Chevron deference and more.

July 3 -

Two days after the Fed released the results of its annual stress tests, the nation's eight largest banks all announced plans to supplement their payouts to shareholders. At the same time, most of the banks also said that their capital requirements are expected to rise.

June 28 -

Trading halts caused by an error affected 40 stocks Monday morning, including BMO Bank and Banco Santander-Chile.

June 3 -

Though written before the internet era, the book about working at Salomon Brothers in the 1980s that launched Michael Lewis' writing career still holds important lessons about the true costs of success.

April 30 Arizent

Arizent -

Orders on the NASDAQ exchange were unable to execute early Monday morning because of an error with the exchange's price discovery tool. The error has since been resolved.

March 18