(Bloomberg) --Silicon Valley Bank's blunders were encouraged by U.S. regulation, went untested by the Federal Reserve and were "hiding in plain sight" until Wall Street and depositors grew alarmed.

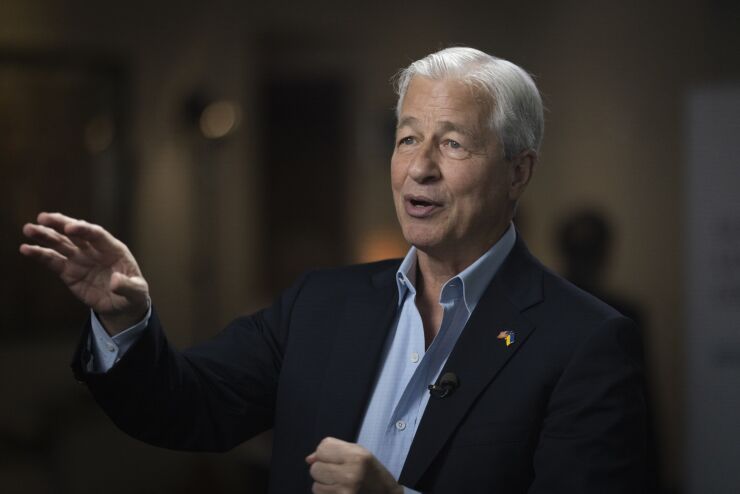

That's JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon's assessment of the U.S. banking crisis that sent markets careening last month, an episode he predicts is "not yet over" and will be felt for years. He said U.S. authorities shouldn't "overreact" with more rules.

In his wide-ranging

"Ironically, banks were incented to own very safe government securities because they were considered highly liquid by regulators and carried very low capital requirements," Dimon said. "Even worse," he added, the Federal Reserve didn't stress-test banks on what would happen as rates jumped.

When Silicon Valley Bank's uninsured depositors realized it was losing money selling securities to keep up with withdrawal requests, they raced to pull their cash. Regulators then intervened and seized it.

"This is not to absolve bank management – it's just to make clear that this wasn't the finest hour for many players," he said. "All of these colliding factors became critically important when the marketplace, rating agencies and depositors focused on them."

Dimon, 67, has run JPMorgan since 2005 and is now the only big-bank CEO from the 2008 financial crisis still in command. As the industry's most prominent and vocal leader, his annual letter is parsed by bankers, traders and investors for his opinions but also signs of what's to come in the business.

Artificial intelligence is "extraordinary" and will be crucial to JPMorgan's future, Dimon wrote. The bank already has more than 300 use cases for the technology and is exploring ways to "augment and empower employees," including with ChatGPT, the popular natural language processing tool.

While AI can be helpful in areas such as marketing and spotting risks, it's essential for heading off fraud and defending against attacks on the bank and markets, Dimon said. "Because you can be certain that the bad guys will be using it, too," he said.

'Free-Market Capitalist'

In a section unveiling JPMorgan's newly stated purpose — "make dreams possible for everyone, everywhere, every day" — Dimon wrote that "lest anyone think that I've become a little soft, rest assured your CEO is a red-blooded, patriotic, free-enterprise and free-market capitalist."

He also called for governments to consider using eminent domain to accelerate investments in both renewable energy and fossil fuels.

"We simply are not getting the adequate investments fast enough for grid, solar, wind and pipeline initiatives," he said, urging authorities to make it easier to get permits. "The window for action to avert the costliest impacts of global climate change is closing."

JPMorgan is looking to ease the impact of rules that require it to hold more capital, exploring business lines that require little or none, Dimon said. That can include expanding in trading analytics or even travel. The bank is more rigorously evaluating the clients it does business with, he added.

Complex regulation is pushing banks out of the mortgage business by driving up the cost of making and servicing loans, while also increasing legal liability, Dimon wrote. JPMorgan is "hanging on," but many banks have already gotten rid of much of this business, he said. Wells Fargo announced earlier this year that it's scaling back mortgage operations dramatically.

This year's letter spans 43 pages, one fewer than last time. Just over halfway through, Dimon assured readers the board isn't neglecting planning for his potential successor.

"It is on the agenda every time board members meet — both when they are with me and when I am not in the room," he wrote. "You can rest assured that our board members are on the case and are very comfortable with where we are."