Coinbase Global is bowing to pressure from U.S. regulators and tabling plans to launch a product that would pay users interest for lending out their tokens.

The decision to shelve its Lend product, which the company announced quietly in a

Coinbase’s about-face comes as the SEC under Chair Gary Gensler takes a tougher line on cryptocurrency products that may fall under the agency’s purview and the platforms that they trade on. The planned Lend program, which would have let users earn 4% by lending their tokens, has become a flashpoint in a growing tensions between the regulator and the burgeoning crypto industry.

“As we continue our work to seek regulatory clarity for the crypto industry as a whole, we’ve made the difficult decision not to launch,” the firm said in its Sept. 17 post. “We had hundreds of thousands of customers from across the country sign up and we want to thank you all for your interest. We will not stop looking for ways to bring innovative, trusted programs and products to our customers.”

An SEC spokesperson declined to comment.

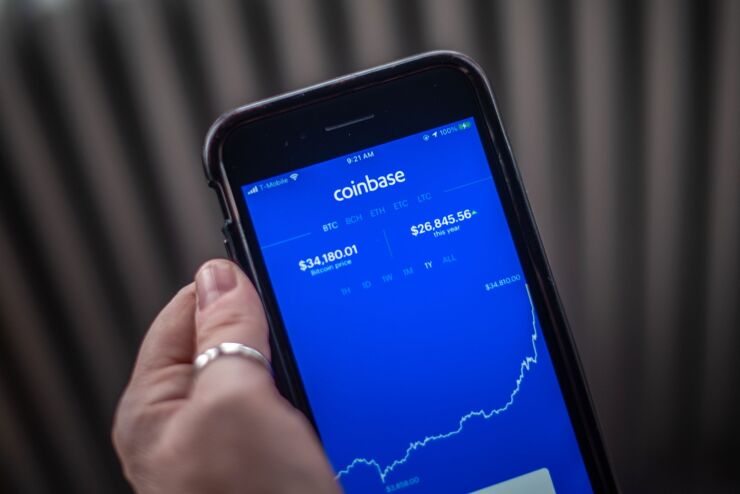

U.S. investors in many ways consider Coinbase, the largest American digital-asset trading platform, to be a standard-bearer for the entire industry.

In April, the firm’s valuation surged to as much

For his part, Gensler’s plans to crackdown on what he calls the “Wild West” of finance have earned

In a Sept. 7 Twitter tirade over the SEC’s opposition to Lend, Coinbase Chief Executive Brian Armstrong accused the regulator of “sketchy behavior” and “intimidation tactics.” The post won praise from the crypto die-hards among his 825,000-plus followers, but also stoked concern that he was taking a page from Elon Musk in doing battle with the agency at a time when the crypto industry was seeking broad acceptance.

On Friday when announcing its plans to back away from Lend, Coinbase took a much more muted approach. The firm mentioned it as an addendum to a June 29 post on its blog, where the company posts news.

The post wasn’t billboarded on the website. No press release was sent or potential customers who signed up early for the program contacted. It wasn’t signed by Armstrong or Paul Grewal, the company’s chief legal officer, who also blasted the SEC on Sept. 8.

To be sure, having to shelve Lend is a major blow for Coinbase as the firm tries to diversify revenue beyond its trading fees. The company is also playing catch-up to competitors such as BlockFi Lending, which are already offering higher-yielding products.

New Jersey is among states that have ordered BlockFi to stop marketing some products. There are also no indications that the SEC green-lit BlockFi’s product.

In his comments on Sept. 7, Armstrong blasted the SEC for not working with Coinbase to launch its lending product. “We’re being threatened with legal action before a single bit of actual guidance has been given to the industry,” Armstrong wrote on Twitter at the time.

Coinbase declined on Monday to comment further on the blog post.