Barely noticed in a corner of the financial markets, leveraged loans originally worth about $40 billion are staging their own private meltdown.

Loans tied to more than 50 companies have lost at least 10 percentage points of face value in just three months, according to data compiled by Bloomberg. Some have dropped a lot more, with lenders lucky to get back just two-thirds of their investment if they tried to sell.

The list is growing as lenders and credit raters lose patience amid the slowing economy with borrowers that took on mountains of debt to fund private equity buyouts, dividends and other transactions that didn't improve earnings.

The companies range across sectors, from energy to health care to communications. The biggest losers as of Tuesday included Amneal Pharmaceuticals LLC, whose $2.7 billion loan due 2025 has sunk to about 80 cents on the dollar, and Seadrill Operating LP, whose $2.6 billion loan maturing in 2021 fetches around 53 cents. The biggest losses in terms of total value included Deluxe Entertainment Services Group Inc., whose first-lien loan dropped as much as 77 cents in three months to 12.5 cents — more than $600 million.

It's hardly a full-blown apocalypse for the junk-rated leveraged loan market, which totals $1.2 trillion. But it does reflect a shift in sentiment, and perhaps a latent market risk, as speculation about a recession spurs investors to flee shaky names.

"People want the well-performing loans, and are more wary of taking chances on the situations that have turned negative," said Andrew Sveen, co-director of bank loans at Eaton Vance Management.

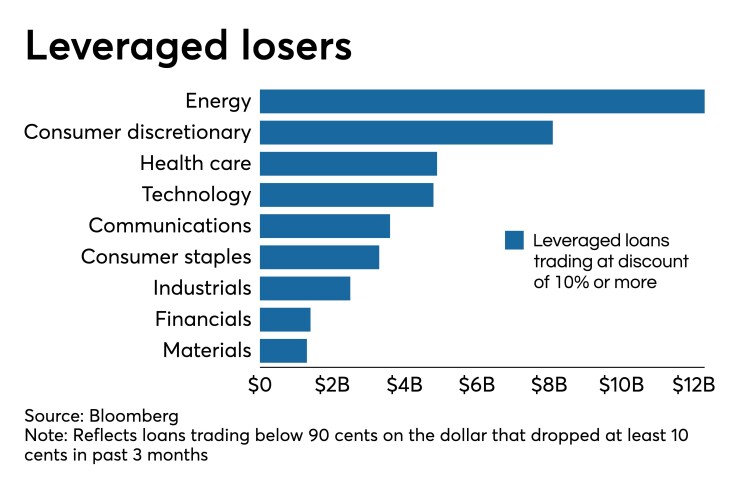

Energy is the hardest-hit sector on the list, with more than $12 billion of loans falling more than 10 cents on the dollar. Consumer and health care follow, comprising around $8 billion and $5 billion of loans outstanding, respectively.

Some of the drops track the slide in a borrower's financial fortunes, and some were made worse by downgrades to the CCC bucket by ratings firms.

In turn, the downgrades can trigger selling by money managers who are limited from holding such names once they fall below a certain ratings threshold. This includes collateralized loan obligations, groups of loans that asset managers package into bonds. Most CLOs can't hold more than 7.5% of their portfolios in loans rated CCC.

The CLO market has mushroomed in recent years as investors have clamored for higher yields, and CLOs are the biggest holders of loans to junk-rated companies. Concerns are mounting about how the structures owning so much of corporate America's debt will react if a recession hits and more downgrades hit.

When the now-bankrupt Deluxe Entertainment was looking for a loan to keep it afloat, its lenders, made up mostly of CLOs, were prohibited from providing the company with more capital because of legal limitations. Their hands were tied after the company was downgraded three notches to CCC- by S&P Global Ratings. Deluxe wound up in Chapter 11 bankruptcy.