Election 2024

Election Preview

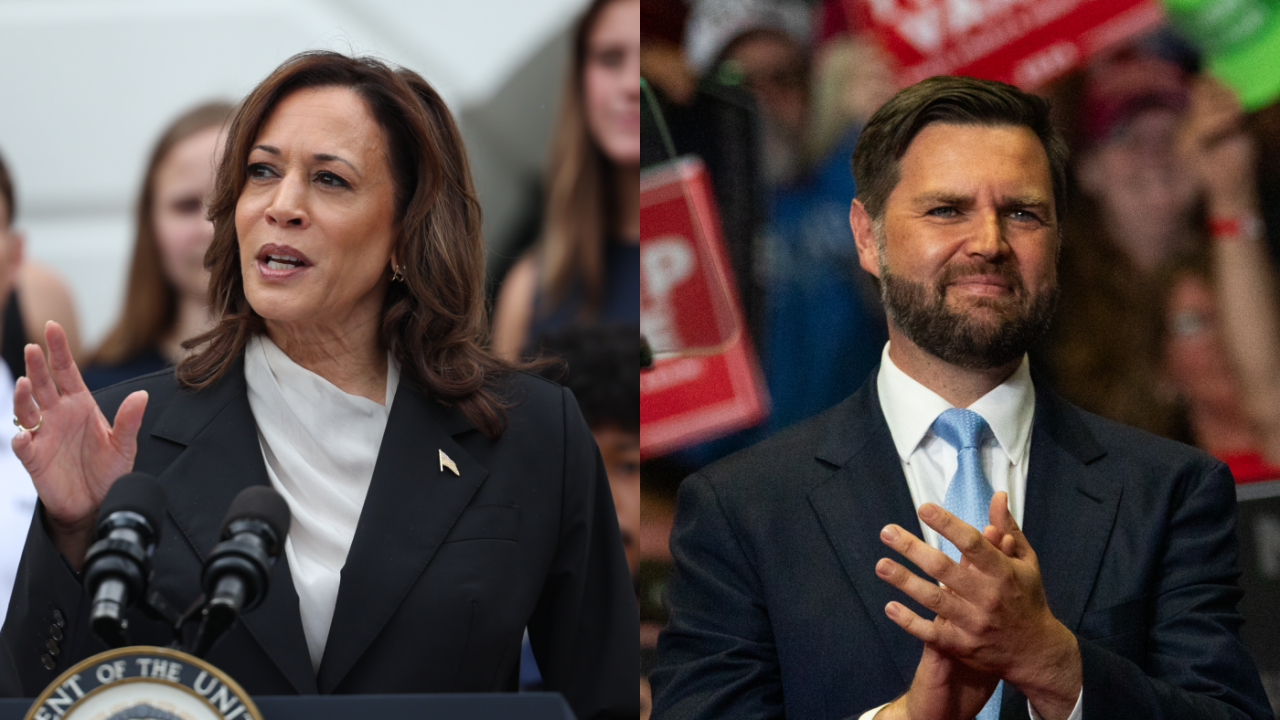

Analysts are watching both Vice President Kamala Harris and former President Donald Trump for potential regulatory picks, as well as how strongly Trump advocates for policies like tariffs and deportations that could impact the economy, inflation and bankers' prospects.

Markets welcomed the news of a second Trump presidency.

"If you had the Trump trade on for the last six weeks, it's been outstanding," said... READ MORE

Regulatory reform – rather than Biden's proposed solutions – is needed to fix the inventory crisis, some say, but others applauded the president's buyer cost-cutting initiatives.

Multimedia

The failures of Silicon Valley Bank, Signature Bank and First Republic shook the banking system and sparked renewed debate among regulators and lawmakers about deposit insurance, bank capital and liquidity rules and resolvability. One year later, some of those policy debates have fallen by the wayside while others have been amplified.

-

The head of the U.S. Department of Housing and Urban Development under the Biden Administration said she will transition from public life starting March 22.

March 11 -

Regulatory reform – rather than Biden's proposed solutions – is needed to fix the inventory crisis, some say, but others applauded the president's buyer cost-cutting initiatives.

March 8 -

Here's how the former regulator thinks Fannie Mae and Freddie Mac could exit conservatorship and where he sees the residential market headed this year and next.

March 8 -

The title proposal is part of a broader housing cost reduction proposal being discussed in the State of the Union speech.

March 7 -

The letter, which was sent to bank regulators, represents a further escalation of lawmaker criticism of the Basel III endgame proposal, and comes just as Federal Reserve Chairman Jerome Powell is set to testify in the House Financial Services Committee.

March 6