After a federal judge allowed a new state law to ban interchange fees on taxes and tips, a coalition of banks and credit unions struck back.

Some traditional bankers are unsettled by the wave of crypto and fintech banks getting bank charters. This Nashville bank CEO sees opportunity.

-

Banc of California appoints Chris Healy its new executive director and head of payments; Lia Fordjour is named chief financial officer of the American Bankers Association; Airwallex is the latest fintech to lean on sports sponsorships; and more in this week's banking news roundup.

-

Investors were encouraged by Global Payments' fourth-quarter earnings results – the first post WorldPay acquisition – but some analysts remained skeptical that the legacy fintech could turn its business around.

-

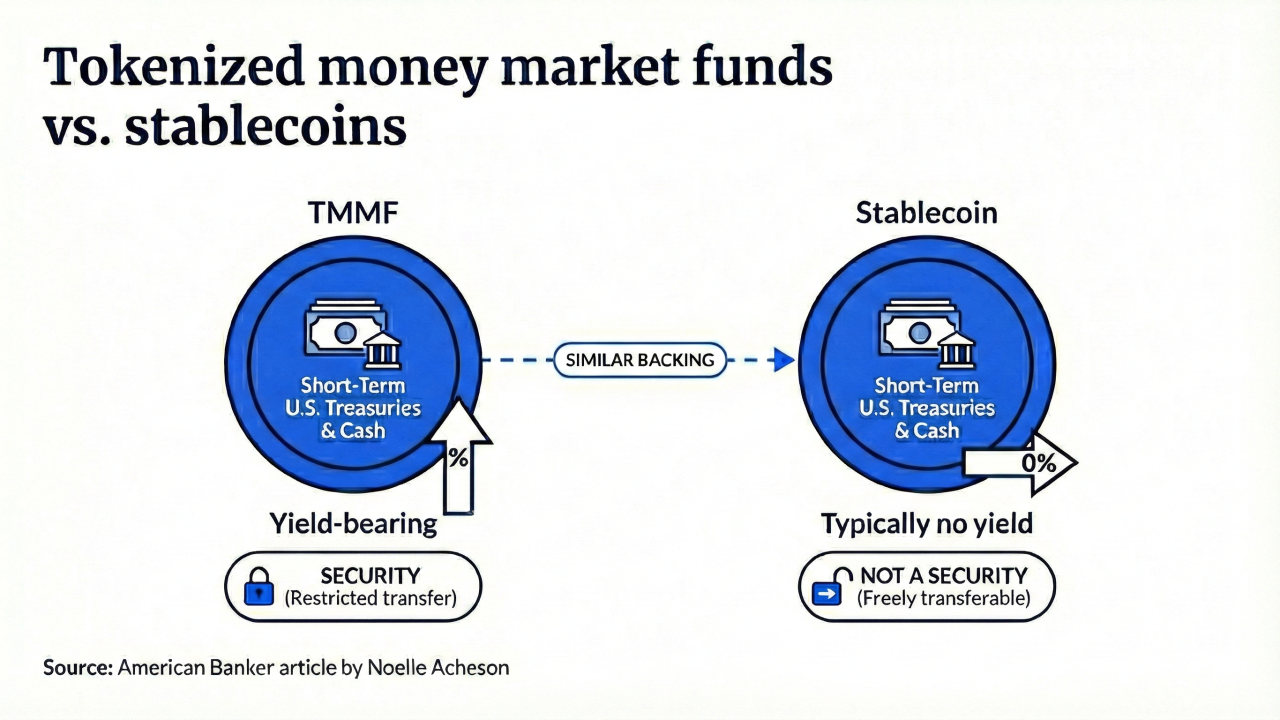

Tokenized money market funds are becoming more money-like — but, unlike the payment stablecoins that share the same backing, they are securities. Noelle Acheson looks at what this means for our understanding of money.

Bank employees are likely adopting the OpenClaw AI assistant on the sly to boost productivity, but the tool's deep integration exposes networks to cyber threats.

The North Carolina-based megabank is making a $25 billion commitment to private credit — the latest signal that banks are undeterred, even as Wall Street raises alarm bells about the sector.

In a letter to regulators, the consortium of organizations recommended regulatory changes affecting a range of rules from risk weights to warehouse financing.

-

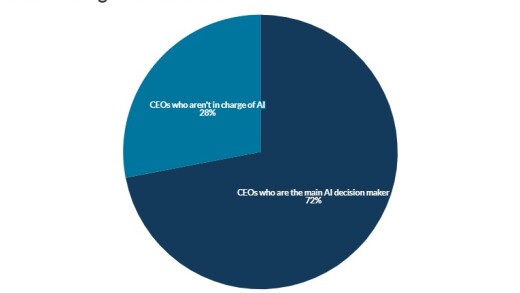

Banks are deploying extremely powerful AI systems but expecting generalist employees to operate them safely and consistently without redesigning workflows around the technology. That virtually guarantees a bad outcome.

-

Doubling down on what has worked in the past — especially if it's still working now — may inadvertently trap banks into business models ill-suited for the future. Smart bankers make room for change before it is forced on them.

-

As artificial intelligence increasingly plays a role in the regulation of banks and other financial services firms, regulators need to be certain that these new systems aren't importing old biases into modern oversight.

-

Research from Andrew Davidson claims a significant number of mortgage borrowers would have a wide variance in credit score if less than three pulls are used.

-

Senate Banking Committee ranking member Elizabeth Warren, D-Mass., warned the Treasury Department and Federal Reserve in a Wednesday letter not to bail out cryptocurrency firms in the wake of sharp declines in digital asset values over the last several months.

-

Federal Reserve Vice Chair for Supervision Michelle Bowman said in comments Wednesday that the central bank plans to publish its Basel III endgame capital proposal for public comment before the end of March.

-

Data breach extortion group ShinyHunters used social engineering to steal customer names, addresses and phone numbers from the blockchain lender.

-

A White House Council of Economic Advisers report published Tuesday found that the CFPB cost consumers between $237 and $369 billion since its creation, an analysis that consumer advocates and some financial academics say is flawed.

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

The annual rankings honor the notable performances of individuals in banking and finance and as teams.

Call for submissions for women 40 years and younger who are rising leaders at their bank or financial institution.

The 23rd annual ranking of women leaders in the banking industry.