At the beginning of 2017, bitcoin enthusiasts celebrated when the cryptocurrency closed in on its then all-time high of $1,216.7, set in 2013. Since then, it’s been month after month of record-breaking, confounding growth, accompanied by regular warnings from bankers about money laundering fears and bubble speculation.

Jamie Dimon, chairman and CEO of JPMorgan Chase, gave business journalists a gift from the news gods, serving up a series of negative sound bites on bitcoin. A number of countries also took a negative stance toward cryptocurrency, most notably China’s crackdowns on bitcoin exchanges and freezing initial coin offering funding in September.

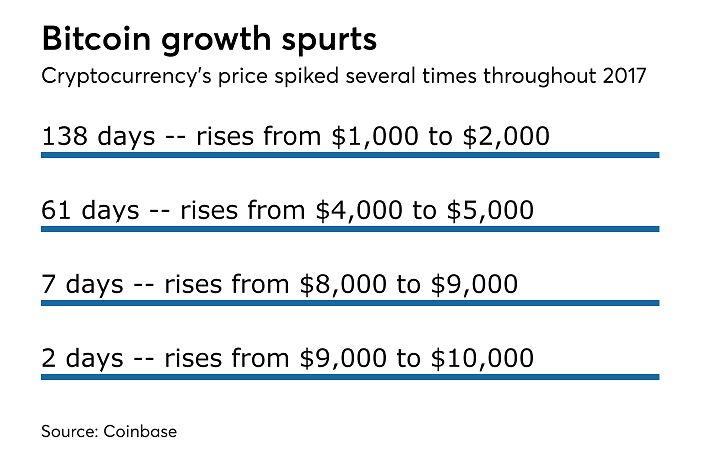

But such action and criticism amounted to momentary dips in bitcoin value, as the cryptocurrency accelerated its rise in sequential fashion. It took the first five months of the year to top $2,000; bitcoin values spiked from $9,000 to $10,000 in just two days this week.

Though bankers largely have kept their distance, other institutions, including Nasdaq, are seizing on the opportunity to serve institutional investors looking to try the market.

The frenetic gains by bitcoin this month are now triggering calls for official action. Nobel Prize-winning economist Joseph Stiglitz said “

Bitcoin's exponential growth is reportedly even

To learn more about bitcoin's wild ride, scroll through our compilation of important milestones the cryptocurrency has experienced this year.

Boom before the bust?

Overall, bitcoin has seen an increase of over 900% in value since the beginning of the year.

Repeatedly, when a public figure, central bank or government made a negative comment about bitcoin, its price would see a dip, then a fast recovery that led to a new high.

Records shattered

So far this year, the peak in bitcoin's price is $11,413.03, reached on Wednesday. The same day it saw rapid price fluctuations downward and then started inching back up by the evening.

Since the Thanksgiving holiday, the cryptocurrency was up more than $2,000.

Mainstream players see an opening

The derivatives exchange CME Group plans to begin offering bitcoin futures contracts by the end of 2017, a move that will put the cryptocurrency on an equal footing with other commodities such as gold and oil.

The most eager participants are institutional investors — more than 100 hedge funds have been created expressly to trade bitcoin, Ethereum and similar digital assets.

Asia + bitcoin = love/hate

China's reported tough measures against bitcoin exchanges included levying fines and even threatening to cut off power to bitcoin miners. The hard line pushed many bitcoin miners out of the country into neighboring Russia.

But the biggest bitcoin market in the world this year is Japan, which legalized bitcoin in April as a currency and a legitimate form of payment.

Whoops?

September 12 - “It’s a fraud” and “worse than tulip bulbs.”

September 22 - “Right now these crypto things are kind of a novelty.”

October 12 - “I’m not going to talk about bitcoin anymore.”

October 13 - "If you're stupid enough to buy it, you'll pay the price for it one day.”

Weighing alternative currencies

Crypto market cap: $313 billion

(Sources: World Gold Council, coinmarketcap.com)

Wealth advisers have been fielding client calls about investing in bitcoin. But they need to take a wider perspective, said Jeffrey Kleintop, Schwab’s chief global investment strategist, during the custodian’s annual Impact conference.

“We’ve got another alternative currency called gold,” Kleintop said. "It’s been around awhile. It’s a $7 trillion market. How big is that in people’s portfolios?”

In 2017, ICOs have raised $3.8 billion, according to Coinbase. Only a year earlier, ICOs raised just $228 million.

It was enough activity that in July, the Securities and Exchange Commission released a report concluding that parties making ICOs must comply with federal securities laws, just as if they were issuing shares of stock, unless they can find a valid exemption.

Still not convinced

“The very definition of speculation and the very definition of a bubble," he said.

It remains to be seen whether the investing public heeds the warnings of concerned bankers and skeptical financial advisers.