CUNA Mutual Group will likely handle its purchase of the fintech Mirador with kid gloves.

Mirador, which was sold to CUNA Mutual

That could help explain why CUNA Mutual appears to be giving Trevor Dryer, Mirador's co-founder and CEO, a large degree of autonomy. Dryer said Mirador will retain its brand, and CUNA Mutual is backing the Portland, Ore., fintech's expense plan in a way that allows it to focus on its platform.

Dryer argues that Mirador's sale should benefit banks and credit unions alike.

The deal allowed Mirador to expand without having to raise additional capital. And it should also help the fintech as it aims to add professional firms to its financing programs. Under a deal it recently signed with the American Medical Association, physicians who need loans will be connected with Mirador's lenders.

"Being part of a larger organization should help other partners we’re targeting move faster and sign up," Dryer said.

Still, Mirador had braced itself for backlash from its banking partners, Dryer said.

So far, that hasn't happened.

“I had expected to have some tough conversations, but they get it,” Dryer said of talks with bank participants.

“They’re not really asking those tough questions,” Dryer added. “We wouldn’t have done the deal if it wasn’t clear that the bank channel will continue to be a priority. Banks are where the bulk of small-business lending is today.”

MidFirst declined to comment on Mirador’s sale. Umpqua and Zions did not immediately respond to requests for comment.

It makes sense for CUNA Mutual, which provides insurance and other financial services to credit unions, to give Mirador a large degree of autonomy, said Keith Leggett, a retired American Bankers Association economist who

"If it’s a good product and it works, banks aren’t going to drop [Mirador] just because it also serves credit unions,” Leggett said. “Lots of third-party vendors serve both banks and credit unions.”

Chris Cole, executive vice president and senior regulatory counsel at Independent Community Bankers of America, agreed Mirador’s existing bank clients might choose to stay the course. Prospective customers might choose to look at things differently.

“It does call into question whether banks will be interested in contracting with credit unions,” Cole said Tuesday in an interview. “This is going to give some banks pause.”

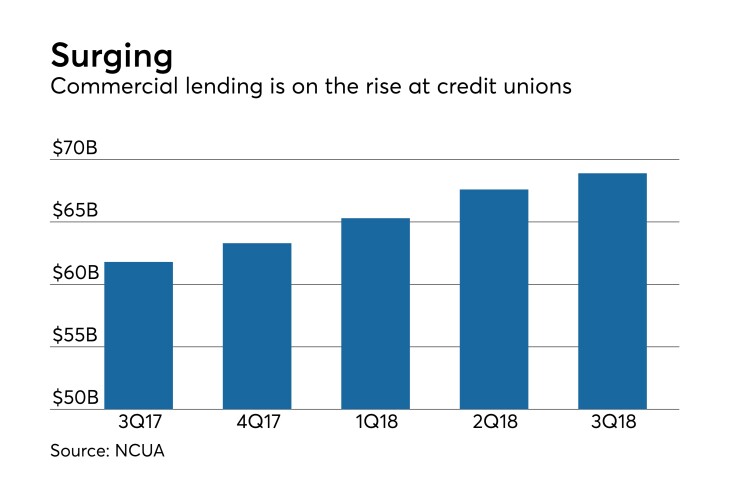

The deal's announcement comes at a time when credit unions are producing steady commercial loan growth. Commercial loans at credit unions rose by nearly 12% in the third quarter from a year earlier, to $68.9 billion, according to the National Credit Union Administration.

Community banks have fought for decades to limit business lending by credit unions. In 2016 the dispute erupted into a legal battle as the ICBA sued the NCUA to challenge a revised member business lending rule it deemed too expansive.

A federal judge

CUNA Mutual intends to walk a fine line with its new fintech subsidiary. It has left little doubt that it hopes to boost Mirador’s profile with credit unions that offer business loans. At the same time, Dryer wants to hold on to his bank clients.

“CUNA Mutual Group will now offer a leading digital lending platform to support established lenders in enhancing the small business lending experience,” Brian Kaas, the group’s vice president for corporate development, said by email Friday.

Mirador was put in play over the summer, when it received an unsolicited bid from an unnamed party, Dryer said. CUNA Mutual, which already had a minority stake in Mirador, "really leaned in" to make a deal happen, presenting a bid in August, he added.

While Mirador spoke with several bank technology providers, it did not approach any banks, Dryer said.

The acquisition is an illustration that, for many, the character loans and common bonds that have defined lending by credit unions are becoming “a quaint, old-fashioned idea that’s now obsolete,” Leggett said.

“Smaller credit unions still exhibit those characteristics,” he said. “For larger ones, there’s no way now for them to know their members like the old days.”

Paul Davis contributed to this article.