Oil lenders have to keep their guard up.

That was the message from the Federal Deposit Insurance Corp. in a recent warning about the risks facing banks in slowing energy markets.

Guidance issued late last week was a stark reminder of ongoing troubles facing oil lenders, and it signaled that

-

WASHINGTON Despite efforts by regulators and banks to improve underwriting of commercial leveraged loans, the number of troubled large syndicated credits jumped again this year, according to a report released Friday by federal regulators.

July 29 -

Some midsize banks found ways to widen margins, and Texas lenders said weakness in the energy sector has had little effect on the broader Texas economy. But can those trends hold up?

July 27 -

Panic around energy lending has subsided somewhat as oil prices have climbed and banks have reduced their overall exposure. But expect more trouble ahead if prices level off.

July 19

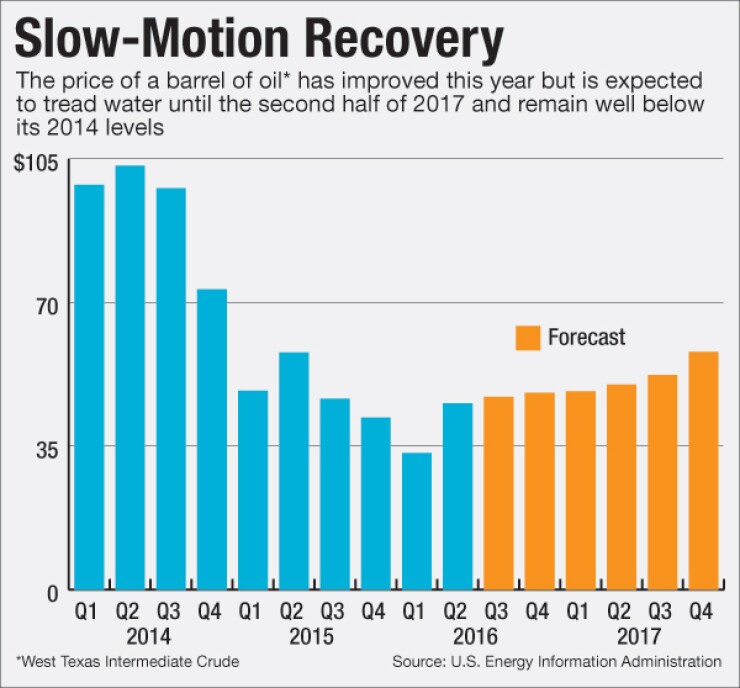

Citing forecasts for a prolonged slump in oil prices, the agency urged banks to closely monitor and stress-test their indirect exposures — including loans for office buildings, apartments and cars in energy-producing areas. It also recommended that banks use a standard tracking system for monitoring credit concentrations.

The move marked the first time the FDIC has publicly warned banks about potential ripple effects from the faltering oil market. And it could be a precursor to tougher regulatory scrutiny — and higher capital requirements — for struggling energy lenders, according to industry experts.

"My guess is you will see a follow-up on this" in the coming months, said Dallas Salazar, the chief executive at Atlas Consulting Group, who works with energy lenders.

Regulatory guidance letters "are meant for visibility purposes" and have historically been a signal to banks that tougher action is around the corner, Salazar said.

Others described the guidance as yet another commonsense reminder to banks to maintain a diversified portfolio.

Indirect exposure becomes a concern for regulators "when you have a concentration issue" in troubled asset classes and "no way to diversify away from it," said Emlen Harmon, an analyst with Jefferies.

Harmon added that concerns about oil's potential spillover effects are not new even though regulators have not explicitly called them out with guidance in the past.

The timing of the FDIC guidance is significant and, in some ways, opportune.

It comes as oil prices have once again taken another dive, dropping by nearly a third in the last two months to around $40 per barrel. The price of West Texas crude oil was $39.58 per barrel in

It also comes as regulators have raised red flags about growing signs of weaknesses among large energy loans. Regulators said Friday that oil concerns contributed to a rise in problems

In

For instance, a drop in the demand for commercial real estate could pose problems to banks that are already struggling with bad oil loans.

The FDIC also urged bank executives to report the results of internal stress tests to their boards of directors.

"Failure to effectively monitor concentrations can result in management and the board being unaware how significant economic events might impact the overall portfolio," the agency said in its letter, pointing to forecasts of a "slow and uncertain recovery" in oil prices.

Banks should be prepared to reduce their concentrations if necessary and could face the need for capital levels "higher than the regulatory minimums," the letter said.

The Office of the Comptroller of the Currency also recently said in its

Recent economic data suggest there is reason for heightened concern.

During the first half of 2016, several major cities in Texas reported weakening growth compared with a year earlier.

Employment growth has slowed in Austin, Fort Worth and elsewhere, according

Additionally, the unemployment rate in Houston edged up in June to 4.8%, compared with 4.4% a year earlier. Meanwhile, the national unemployment stood at 4.5% at the end of June.

"It's little pockets here and there," Harmon said, describing signs of a slowdown in Southern shale regions.

The Dallas Fed currently expects jobs to grow in Texas by 0.5% in 2016, compared with 1.3% a year earlier and 3.7% in 2014, the bank's president Robert Kaplan

Geoff Greenwade, the president of Green Bancorp in Houston, said he has noticed "softness" in demand for offices and high-end real estate.

He also said that the industry as a whole has been surprised by the duration and severity of the oil cycle. That is one reason why his $4 billion-asset company announced plans

"It's just hard to predict and determine where the price of oil is going," Greenwade said.

Forecasts from the

If regulators decide to impose tougher capital restrictions, it could put added pressure on struggling regionals in the oil patch, Salazar said.

During quarterly calls with investors, bank executives have sounded mostly upbeat about their energy books, describing

Still, most observers agreed that energy lenders face many challenges ahead.

Stagnant prices will continue to put pressure on oil producers in the coming months as concerns linger about a supply glut.

Greenwade said that the industry has seen the "first group" of bankruptcies, mostly from highly leveraged oil companies. If prices stay low, more companies could run into trouble trying to break even.

The FDIC's guidance may simply be a reminder that the troubles facing energy lenders are far from over.

"This is getting serious," Salazar said.