-

Banks with assets totaling between $10 billion and $50 billion have begun publishing the results of their Dodd-Frank Act mandated stress tests this week and will continue to do so through the end of the month, providing a new window into the workings of regional institutions.

June 16 -

All 31 firms that took this year's Dodd-Frank Act Stress Test had enough capital to withstand the Fed's hypothetical severe economic scenario, but several of the largest banks were teetering on the edge of the leverage and risk-based capital requirements.

March 5 -

JPMorgan Chase, Morgan Stanley and Goldman Sachs were each forced to resubmit their capital plans in order to pass the Fed's CCAR stress test, while Bank of America was publicly faulted for weaknesses in its capital planning process. While some saw that as a bad sign, others contended the banks appear more comfortable in pushing the limits of the stress testing process.

March 11

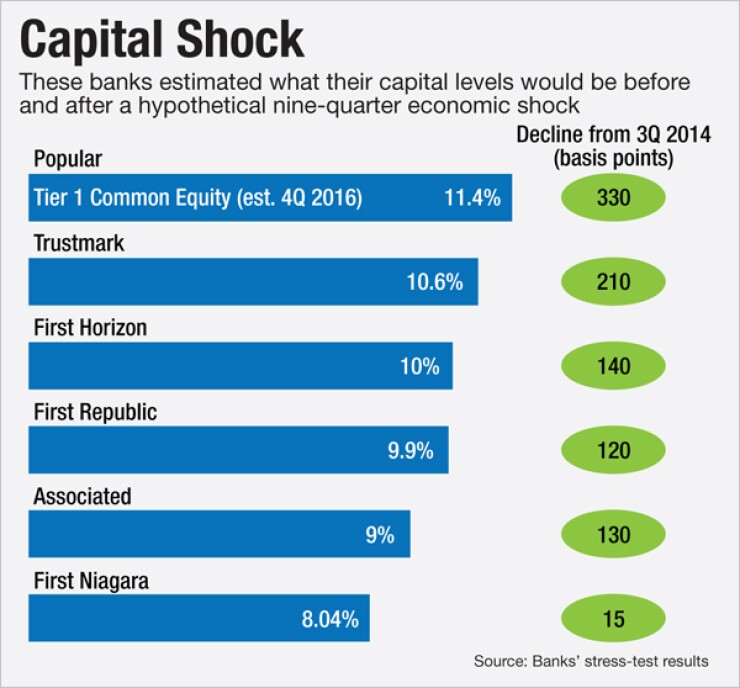

At least half a dozen regional banks have disclosed Dodd-Frank Act stress-test results, and none reported that their Tier 1 common equity ratio would fall below regulators' minimum guideline.

However, several said they would have accumulated tens, if not hundreds of millions of dollars, in net losses under the hypothetical economic shock drawn up by regulators.

This is the first time that institutions with between $10 billion and $50 billion in assets have been required to disclose such information. The DFAST process requires midsize banks to administer their own stress tests, based on a variety of negative economic conditions, over a cumulative nine-quarter period ending in the fourth quarter of 2016.

Forty-two financial institutions are expected to file results before June 30.

For all six companies that had reported as of Tuesday morning, their Tier 1 common equity ratios remained above 5% at the end of the nine-quarter period. Although the banks' DFAST results do not include an official statement of regulators' approval or rejection, banks are required to hold at least 5% Tier 1 common equity at all times.

In the "severely adverse" economic scenario designed by regulators, the unemployment rate climbs to 10.1%; real gross domestic product falls to -6.1%; the Dow Jones Industrial average drops to 8,600 by the end of 2015; and other negative factors occur.

The $51 billion-asset First Republic Bank in San Francisco projected that its Tier 1 common equity ratio would hit 9.9% by the fourth quarter of 2016 under the severely-adverse scenario, down from 11.1% in the third quarter of 2014. First Republic would report cumulative net income of $148 million for the nine-quarter period.

Its challenge would be that tangible and risk-weighted assets would grow at a faster pace than the bank's capital base, First Republic said. Pre-provision net revenue would decline "substantially from current levels" thanks to lower net interest income, lower advisory and other fees and higher noninterest expenses, the report said.

Still, First Republic would have "the financial resources to successfully navigate a severe economic downturn" while growing assets and ensuring that capital levels exceed "regulatory well-capitalized levels" throughout the stressful period, the bank said.

The $39 billion-asset First Niagara Financial Group in Buffalo N.Y., said its Tier 1 common equity ratio would drop to 8.04% from 8.19% during the nine-quarter test period. First Niagara would post cumulative net income of $63 million over the nine-quarter period. The results "validate the low-risk nature of First Niagara's balance sheet," the company said in a presentation on its website.

For the $35 billion-asset Popular in San Juan, Puerto Rico, its Tier 1 common equity ratio would fall to 11.4% from 14.7% during the nine-quarter period, according to its results. Popular would have a cumulative loss of $704 million over the period. Popular's hypothetical scenario did not include its acquisition of Doral Financial, which it

The $27 billion-asset Associated Banc-Corp in Green Bay, Wis., said that its Tier 1 common equity ratio would fall to 9% from 10.3%. Associated would post a cumulative net loss of $205 million over the nine-quarter period. Associated noted in its report that its economic modeling included "increases in financial distress that are even larger than what would be expected in a severe recession."

The $26 billion-asset First Horizon National in Memphis, Tenn., projected that its Tier 1 common equity ratio would fall from 11.4% to 10%. First Horizon projected a cumulative $231 million net loss at the end the nine-quarter period.

The company's First Tennessee bank unit "would remain capitalized at levels significantly better than 'adequate' even in severely adverse economic and financial conditions," First Horizon said in an accompanying news release.

The Tier 1 common equity ratio at the $12 billion-asset Trustmark in Jackson, Miss., would fall to 10.6% from 12.7%. Trustmark would have a cumulative net loss of $70.1 million over the nine-quarter period.

The results show that the company "will have the financial resources at its disposal to successfully navigate a hypothetical severe and protracted economic downturn," Trustmark said in its report.

To be sure, the results have to be

Analysts at Keefe, Bruyette & Woods said in a research note last week that regional banks were expected to disclose fewer details in DFAST results than those disclosed in the Federal Reserve's more-rigorous Comprehensive Capital Analysis and Review process.

Additionally, regional banks' report will vary, as each institution can change the various factors that it tests. Banks can alter the stress factors to resemble their own geographies and business models.

Because each bank uses its own modeling process, it is hard to draw conclusions about a bank's health from its DFAST results, said Chris McGratty, an analyst at Keefe, Bruyette & Woods.

"It's a necessary exercise for the banks themselves, but comparing different banks' results is really apples to oranges," he said.

However, now that the process is over, the DFAST banks should be able to turn their focus to capital-planning through stock buybacks and changes to dividends, and may have more leeway with regulators for M&A discussions, McGratty said.