As often as big banks shoot themselves in the foot, they can score a public relations win now and again.

JPMorgan Chase did just that Tuesday when 92% of investors voiced their support for its pay plan as part of a nonbinding "say-on-pay" vote. The vote attracted only 61% a year earlier.

It won over more investors this time around by taking real steps toward linking Chief Executive Jamie Dimon's pay package more closely with profitability. The board this year trimmed his cash bonus and tied a larger portion of his stock awards to shareholder returns.

Perhaps JPMorgan directors have had their eyes on their peers. At annual meetings over the past month, shareholders have backed executive pay plans at other big banks. At Citigroup's annual meeting, however, investors pressed the company for more details about the compensation process.

While JPMorgan's annual meeting in New Orleans was filled with impassioned commentary on a host of other issues — including breaking up megabanks — the issue of executive pay generated minimal discussion. But the vote nonetheless gave credence to one of the company's key messages to major shareholders: we hear your concerns, and we're willing to make some changes.

"Last year, we heard shareholders ask, 'Why don't we tie the vesting of a portion of incentive awards to a predetermined performance metric, as opposed to simply time?' " Lee Raymond, the JPMorgan's lead independent director, said at the annual meeting. "We followed up on this feedback, with further, extensive shareholder engagement."

Senior executives had more than 90 conversations with major shareholders last year, representing more than 40% of the company's outstanding stock, according to JPMorgan's proxy statement.

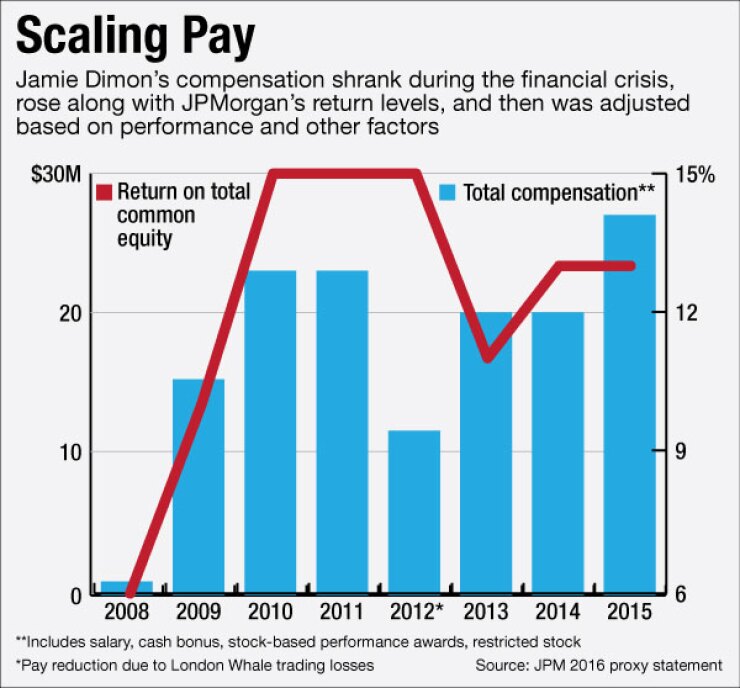

Yes, in the end, the board gave Dimon a 35% pay raise in 2015, offering him a total compensation package of $27 million.

The raise reflected a strong performance at the company as well as "demonstrated leadership," Raymond said. JPMorgan earned a record profit in 2015, though its returns were relatively flat. Return on tangible common equity was 13% for both 2015 and 2014.

Still, the board made a series of changes to Dimon's pay mix in response to investor concerns. The board lowered his cash bonus by 32%, to $5 million, while holding his annual salary steady at $1.5 million.

It also tied the remainder of Dimon's compensation — approximately $20.5 million — to performance-based stock awards. The payout for those awards is determined, in part, by profitability metrics, including the company's annual return on common equity. Just $11.1 million of his pay package in 2014 involved performance-based stock awards.

"It's a continuous process," Raymond said, commenting on the way JPMorgan evaluates its executive compensation programs.

The strong show of support for Dimon's compensation plan comes a year after it attracted the ire of major shareholder groups.

The proxy advisory firms Institutional Shareholder Services and Glass Lewis last year recommended a vote against Dimon's pay package, arguing that the company did not outline its performance criteria clearly enough.

ISS noted, in particular, that there was no "compelling rationale" for the size of Dimon's cash bonus.

Over the past year, JPMorgan has taken steps to meet with its largest shareholders and make several major policy changes based on their feedback, it said in its proxy.

In response to "strong" feedback from investors, the company in January approved a new long-term incentive compensation program. For members of the firm's operating committee, equity-based awards are paid based in part on shareholder returns over a three-year time frame.

"Our shareholders expressed strong views that a portion of the long-term incentive program should be tied to quantifiable financial performance measures," the company said.

At the meeting, JPMorgan shareholders also considered a number of proposals on hot-button topics.

Investors soundly defeated a resolution that could have jump-started efforts to break up the bank.

The proposal, submitted by the left-leaning advocacy group Public Citizen, would have required the bank to establish a committee to address whether divesting all noncore banking units would enhance shareholder value. It received 3% of the shareholder vote.

Additionally, shareholders defeated a proposal to strip Dimon — and his eventual CEO successor — from serving as chairman.

In a sometimes rambling speech at the beginning of the meeting, Dimon praised the company's performance over the past year.

He also offered a few kind words for regulators. Post-crisis regulations and higher capital requirements have made the banking system stronger, he said.

The comments come just one month after the Federal Reserve and Federal Deposit Insurance Corp. rejected the company's living will. Resolution plans from several other large banks, including Wells Fargo and Bank of America, were also rejected.

"Regulators should take more credit for the extraordinary amount that has been accomplished," Dimon said.