Remember the gloomy tone of January earnings calls? Expect more of the same next month.

Speaking at a conference Tuesday in New York, executives from big banks across the country warned investors that first-quarter revenue growth will be flat.

"It's been a tough quarter," said John Gerspach, the chief financial officer at Citigroup.

-

Lenders repeatedly reassured skeptics that their credit risks from the energy slump were under control. But more oil and gas companies are filing for bankruptcy, and more of them are said to be drawing down their credit lines signaling that the worst may be yet to come.

March 2 -

Bankers in the Bakken Shale region of Montana and North Dakota are keeping an eye on exposure to hotels, apartments and retail space as economic slowdowns occur in energy-producing markets. Bankers in the Marcellus Shale region are also on alert, though there might be less exposure since that region had not yet had a development boom.

February 29 -

Judging from the questions executives fielded about everything from the slowdown in China to the bank's energy exposure to the potential for another 2008-style crisis, worries are running high.

January 15

Market volatility has been a drag on income so far this year, bankers said. Oil prices plunged deeper. Equity markets crashed. And banks have scaled back expectations for future rate increases.

While markets and oil had rebounded slightly in the past week, it may be too little too late with only three weeks left to go in the quarter, representatives of Citigroup, BB&T, SunTrust and other banks said at an all-day conference sponsored by RBC Capital Markets.

Citi — which missed analyst estimates in January — faces a host of challenges. It will take a $400 million "repositioning charge" as it continues to "resize" its operations, Gerspach said. He gave few details on the nature of the changes.

Additionally, Citi is currently projecting a 25% decline in investment banking revenue. It also plans to add $350 million in reserves in its corporate bank — a move that will boost its energy reserves to 4.5% Gerspach said.

Throughout the presentations, executives tried to put a positive spin on what has amounted to a rocky few months.

Low oil prices have pushed consumers to buy new cars, executives said. Most bankers also said that, outside of the energy markets, corporate clients have not reported significant stress, despite the recent volatility.

"Main Street and Wall Street are not seeing the same thing for their outlook in the economy," said Chris Gorman, head of corporate banking at the $93 billion-asset KeyCorp in Cleveland.

Still, most bankers said the market crash — along with the declines in oil — will be a heavy weight on their first-quarter results.

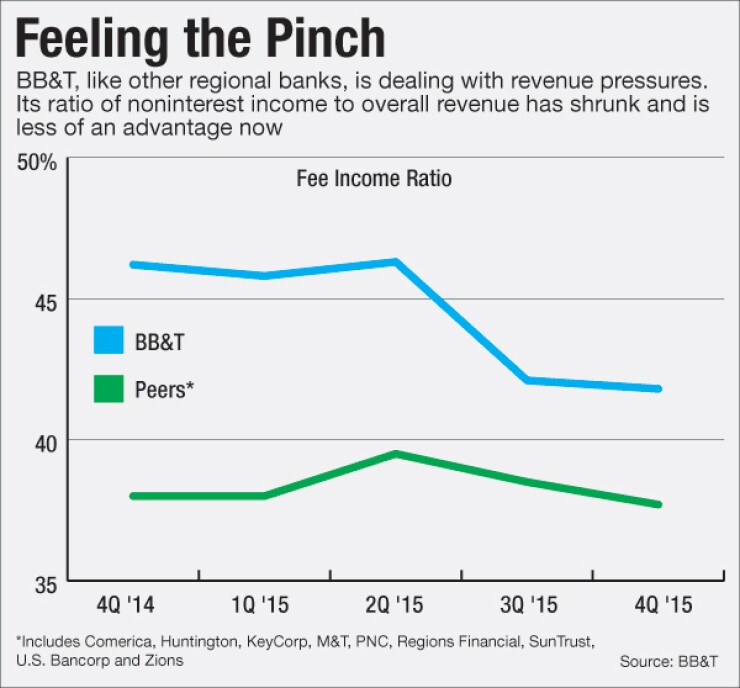

BB&T in Winston-Salem, N.C., said it expects slow revenue growth across the board.

The company

Additionally, the company is projecting flat loan growth, due to a "little softening in the commercial market," said Christopher Henson, chief operating officer at the $210 billion-asset company.

Fee income will also be flat, in light of lackluster performance in the company's sales and trading division, Hansen said.

SunTrust Banks in Atlanta also warned investors that it sees challenges ahead.

With future rate increases in question, the Atlanta bank has begun to scale back its expectations for revenue growth, according to Aleem Gillani, the company's chief financial officer.

"As we moved into January, February, we saw the Fed completely reverse course," Gillani said.

In line with its competitors, SunTrust has seen investment banking revenue decline over the past few months, putting a drag fee-based revenue.

With few other options to drive growth, SunTrust has begun looking at ways to boost profits by cutting costs.

"Knowing that we're going to have some first-quarter volatility in our revenue base, we're starting to calibrate our expenses against that," Gillani said.

The $186 billion-asset SunTrust has been scaling down for months, cutting expenses across the board as it aims to lower its efficiency ratio below 60%.

At various points during the conference, bankers pointed to the Fed's recent directive on negative interest rates as an illustration of the recent economic malaise.

The central bank said last month that it would require banks to model a negative-rate scenario as part of their annual stress-testing scenarios.

Many of the industry's biggest players have been modeling the change for months, after central banks in Japan, Switzerland and elsewhere lowered rates below zero.

But the Fed directive caught several smaller institutions by surprise, bankers said.

"There were banks that were caught on their heels a bit," said Neal Blinde, corporate treasurer at Wells Fargo. He added that the San Francisco-based company began modeling the potential for a negative-rate scenario in the fall.

"It would surprise me if the U.S. ended up with negative interest rates, certainly in the near term," Gerspach said.