-

Bank of America's expenses still far exceed those of JPMorgan Chase and Wells Fargo, so analysts were clearly disappointed Thursday when CEO Brian Moynihan failed to outline any specific plans for further lowering overhead.

January 15 -

JPMorgan Chase, Morgan Stanley and Goldman Sachs were each forced to resubmit their capital plans in order to pass the Fed's CCAR stress test, while Bank of America was publicly faulted for weaknesses in its capital planning process. While some saw that as a bad sign, others contended the banks appear more comfortable in pushing the limits of the stress testing process.

March 11 -

Citigroup Chief Executive Michael Corbat will still have a job tomorrow (and probably several days after that). The bank's capital distribution plan was approved by the Federal Reserve on Wednesday, undoubtedly to the delight of shareholders who were surprised by last year's rejection.

March 11

Bank of America's flawed capital plan has drawn headlines lately, but Chairman and Chief Executive Brian Moynihan will probably fix it long before his company's other problems.

There is B of A's

Compared to all that, the new capital plan may be the easiest of Moynihan's challenges.

B of A received a conditional non-objection to its capital plan, with the Federal Reserve asking it to correct weaknesses in some elements of its capital-planning process by Sept. 30. The Fed asked B of A to correct weaknesses in loss- and revenue-modeling practices for its banking unit and some aspects of the parent company's internal controls.

"It's more of a nuisance, in the sense of having to retool the capital plan and resubmit it," said Marty Mosby, an analyst at Vining Sparks.

What worries Mosby and other analysts and investors are the broader issues. Moynihan is almost certain to face lots of questions on April 15, when B of A reports earnings, and on May 6, when it holds its annual meeting in Charlotte, N.C., about how he plans to address the litany of concerns.

"The failure to get a clean Fed approval on its stress test, if this was just an isolated event, then it's not such a big deal," said Mike Mayo, an analyst at CLSA. "But if this is part of a mosaic of less-than-stellar oversight and governance, then it's a bigger issue, and we think that's what it is."

Jerry Dubrowski, a B of A spokesman, declined to comment about the company's capital plan but on Wednesday defended its turnaround efforts. "Since 2010 we have streamlined and simplified the company, built record levels of capital and liquidity and continued to deliver long-term value to our shareholders," Dubrowski wrote in an email after this story was published. "There is more work ahead, but the direction is clear."

Moynihan's experience during the bank's fourth-quarter earnings report likely set the stage for what he can expect for most of this year. On Jan. 15, as B of A wrapped up its $8 billion expense-reduction plan called "New BAC," he was pressed for details on where he planned to cut further costs. His

"We work on expenses every day and we have teams of people working to do all the things that you expect us to do," Moynihan said during a Jan. 15 conference call, in response to repeated questioning about expenses.

Bank of America has less upside potential than other large banks if short-term interest rates later this year, Mosby said. If rates were to rise this summer, B of A would receive a benefit of about $1.5 billion in yearly net income, Mosby estimated. That compares with the company's own projection of a $3 billion benefit, which it says assumes simultaneous increases in short-term and long-term rates.

The company still faces potentially massive costs associated with legal settlements, even though it has had some of the

Its stock price has been a disappointment, falling 10% over the past 12 months to $15.39 per share at the end of Tuesday's trading. B of A's Dubrowski noted Wednesday that the stock rose 109% in 2012, 34% in 2013 and 15% in 2014.

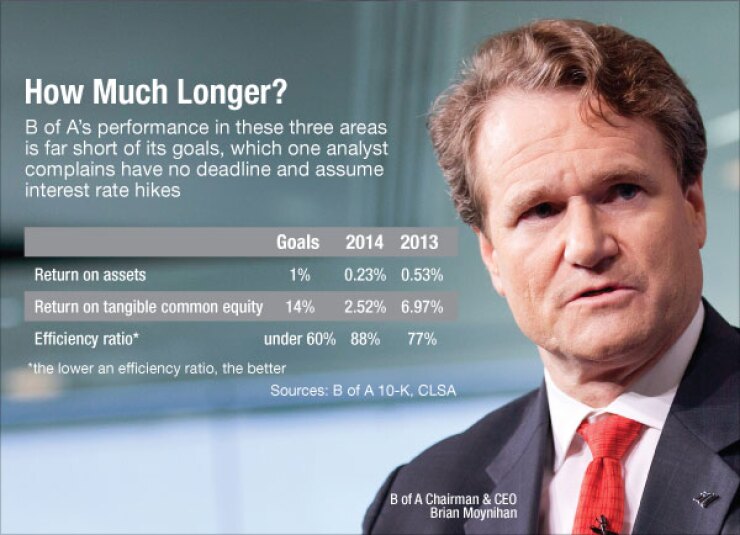

And then there are questions about B of A's financial projections themselves. B of A set financial targets for things like returns on equity and assets, and shareholder returns, but many of them assume rates will rise and the bank has not included time frames. Those factors make it hard to determine whether the company is getting closer to meeting its goals, Mayo said.

"Did they meet their financial targets in 2014?" Mayo said. "It's not clear to us because it's not clear what the targets were."

Not everyone is as bearish on B of A's prospects. Jason Goldberg, an analyst at Barclays, wrote in a March 19 research report that Bank of America was one a handful of banks whose profits were likely to get a boost from higher interest rates, based on an assessment of the rate sensitivity of its loan and securities portfolios.

But continued disappointment in the several areas of concern could lead to a more-restive shareholder base. B of A could even begin to face rumblings from activist investors, who have turned up the heat lately on corporate America,

"The shareholder base at Bank of New York Mellon has been very frustrated," Mayo said. "There is not the same degree of discontent at Bank of America, but that can certainly change, based on performance."