Officials in three large U.S. states – Illinois, New York and California – are simultaneously taking initial steps aimed at taming the largely unregulated realm of online small-business lending.

The recent burst of activity in state capitols comes in response to pleas by nonprofit lenders that operate in New York City, Chicago, Los Angeles and elsewhere. Those lenders are being barraged with requests for help from troubled business owners whose financial problems became more severe after they took out high-cost online loans.

The state-level push to regulate

-

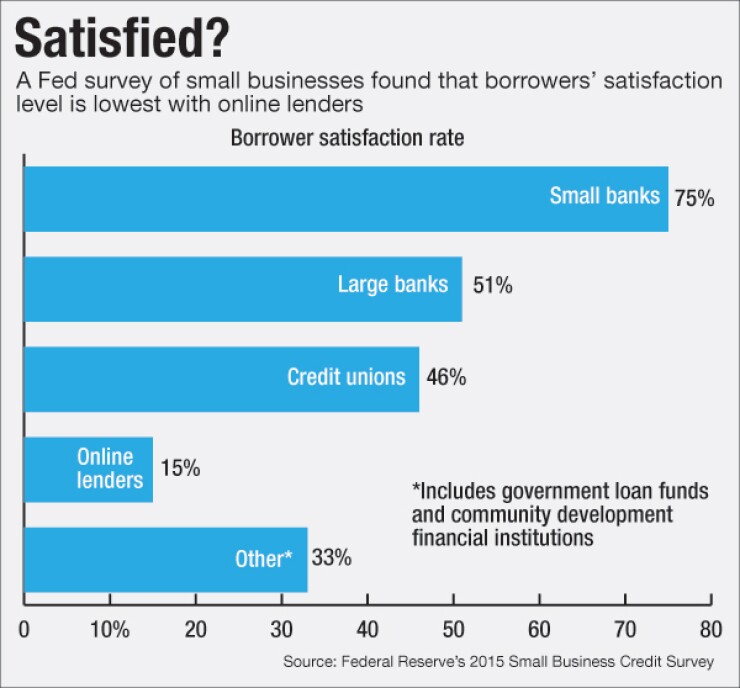

A new survey from seven regional Federal Reserve banks found that many small businesses are going online to access credit. But even when they are approved, applicants often end up dissatisfied because the loans carry high interest rates or have unfavorable repayment terms.

March 3 -

As regulators begin taking a harder look at marketplace lenders, questions are being raised about how fair-lending rules are being applied and what, if any, obligations those new participants might have to low- and moderate-income borrowers.

April 15 -

In a rapidly growing market outside the purview of the Truth in Lending Act or state usury caps, online lenders' rates and fees can be next to impossible to compare.

August 26 -

Many online small-business lenders worry that future regulations could stymie innovation in this fast-growing industry. But well-designed requirements would simply ensure that online lenders can offer adequate borrower protections without giving up market share.

August 4

"The issue that faces U.S. regulation is that we don't have a single regulator who is entrusted with this responsibility," said Karen Mills, the former head of the U.S. Small Business Administration who is now a senior fellow at Harvard's business school and school of government.

A survey last year by seven regional Federal Reserve banks found a 15% satisfaction rate among small-business owners who got approved by an online lender. That compared to a 51% satisfaction rate at large banks and 75% at small banks.

The business practices that are under the microscope include annual interest rates that often exceed 50%, disclosures that

Many of the complaints involve providers of merchant cash advances, which obligate business owners to pay a fixed amount of their future receipts.

Calls for action at the state level are still in their early stages, and it is not clear whether they will succeed. In Illinois, where the effort has progressed furthest, pushback is coming not only from online lenders, but also from bankers and groups that represent small-business owners.

If legislation that is currently under consideration by the Illinois Senate is enacted, it would be the toughest in the nation.

The Illinois bill would bar online lenders from making loans in which the total monthly payments exceed 50% of the borrower's monthly net revenue. It would also make digital lenders liable for any misrepresentations that their brokers make to borrowers. And it would mandate clear disclosures of the loan's term, its annual percentage rate, any prepayment penalty, and the total amount the borrower owes over the course of the loan.

A separate requirement would require lenders to disclose the percentage of their loans that have defaulted. In addition, online small-business lenders based in other states would be required to obtain Illinois lending licenses.

The bill's supporters argue that many small businesses are mom-and-pop operations, and need the same kinds of borrower protections that have long been in place for consumers.

"They're not that sophisticated," Dory Rand, president of the Chicago-based Woodstock Institute, said in a February interview. "They don't understand what they're getting into."

"These are truck drivers and people who run day-care centers and barbers," added Jonathan Brereton, the chief executive officer of Accion Chicago, a nonprofit lender that seeks to help overburdened small businesses.

But opponents of the Illinois legislation argue that self-regulatory initiatives like the eight-month-old Small Business Borrowers Bill of Rights should be given a chance to succeed. They also contend that a state-by-state approach to regulation will make it hard to operate a nationwide online lending business.

"My members would prefer one uniform national framework, under which transparency and disclosure provide an environment where small business owners have choice for capital," said Tom Sullivan, executive director of the Coalition for Responsible Business Finance, a

The Illinois legislation, which has bipartisan sponsorship, was approved earlier this month by the state Senate's Financial Institutions Committee. But the measure encountered opposition during a public hearing last week, and its backers promised to work with critics to refine the measure.

The Illinois Bankers Association is among the industry groups that oppose the bill. The legislation contains language stating that its provisions do not apply to banks and credit unions, but the state banking association is concerned that banks will eventually be swept in. And even if they aren't, President Linda Koch said that the trade group will still oppose the legislation, based on the principle that business-to-business lending should not be regulated at the state level.

"Illinois is not equipped to address the shadow banking sector that reaches far beyond Illinois. This is a national issue," she said.

The Consumer Financial Protection Bureau, the Federal Trade Commission and the federal banking agencies all could play a role in combating predatory online business lending. But none of them have clear jurisdiction over nonbanks that provide credit to small businesses.

"It is possible that the current online marketplace for small-business loans falls between the cracks for federal regulators," three Democratic senators

In California, the push for stricter regulation is not coming from lawmakers, but rather from the state Department of Business Oversight, which in December sent a series of detailed questions to 14 large online lenders.

That list includes financial firms that make loans to both consumers and small businesses, but California officials sound especially concerned about lenders in the latter camp. "It seems that the conduct on the small-business side is more problematic," said Tom Dresslar, a Department of Business Oversight spokesman.

Dresslar said that the state's inquiry could result in both enforcement actions and proposed legislation aimed at combating abuses in online business lending.

One of the groups calling for a crackdown is Opportunity Fund, a nonprofit lender based in San Jose, Calif. For small businesses that cannot manage their high debt levels, Opportunity Fund seeks to find refinancing solutions that offer a way out.

"Small businesses, when they're desperate for money, are willing to pay just about any price for capital, especially when you market it in a way that's hard to understand," Opportunity Fund Chief Executive Eric Weaver said in an interview late last year.

In New York, three state legislative committees held a joint hearing last week on borrower abuses in online business lending.

Legislation to rein in digital lenders in the Empire State has yet to be introduced.

But Patrick MacKrell, CEO of the New York Business Development Corp., told lawmakers that these lenders should be required to disclose the annual percentage rates they charge. The New York Business Development Corp. is a consortium of banks and economic development agencies that lends money to small businesses.

During the hearing, Assembly Member Victor Pichardo, a Democrat who represents the Bronx, expressed concern about the lack of regulation today. "Because it's such a new frontier, it's almost to the point where it's the Wild West," he said.

MacKrell expanded on that metaphor, noting that borrowers don't have the means to engage in a fair fight.

"In the wild, wild West, both the bad guys and good guys had guns," he said. "Not so much here."