"Location, location, location" is as pertinent to banking as it is to real estate.

Hampton Roads Bankshares in Virginia Beach recently agreed to buy Xenith Bankshares in a $107 million deal that features a decision to move the corporate headquarters to Richmond, Va., where Xenith is based, once the deal closes.

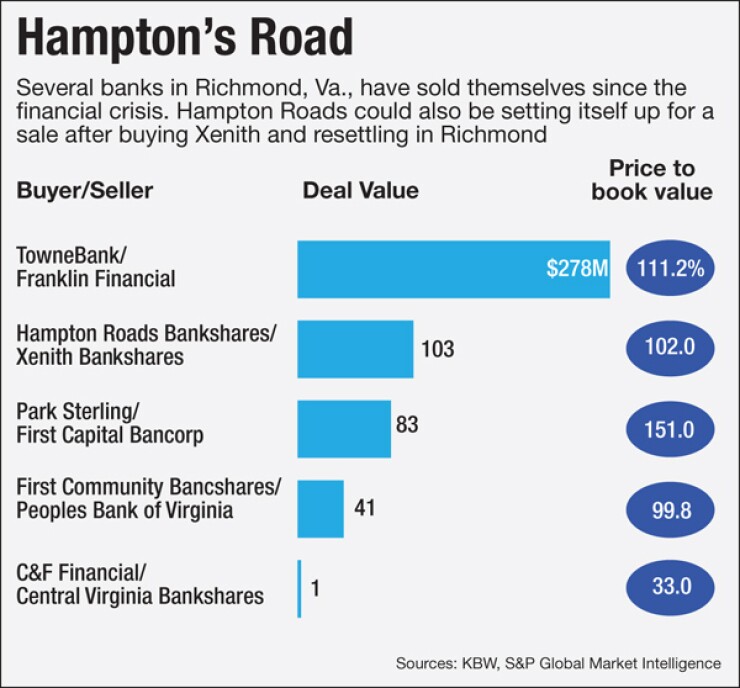

The decision makes sense on many levels, industry experts said. Richmond, generally considered a higher-growth market than Virginia Beach, has attracted a fair share of attention from out-of-market banks in recent years. The move could position the company, which will take the Xenith name, to eventually sell itself.

-

The $2 billion-asset Hampton Roads said in a press release Wednesday that it will pay $107.2 million in stock for the $1 billion-asset Xenith.

February 10 -

The $2 billion-asset company said in a press release Wednesday that Douglas Glenn resigned as president and chief executive. Glenn, who was 48 as of the company's April 27 proxy, also resigned as a director. He had been the chief executive since August 2011.

September 16 -

Bankers need to let investors know in advance what types of deals they are willing to pursue, along with the financial parameters. Doing so is a critical step in managing shareholder expectations at a time when consolidation is heating up.

February 8

"You always want to go to the bigger market," said Christopher Marinac, an analyst at FIG Partners in Atlanta, adding that it is typically viewed as a "very positive" change when a bank relocates from a small town to a city.

The deal came together at an opportune time for each company, said T. Gaylon Layfield, Xenith's president and chief executive. The $2 billion-asset Hampton Roads, which was looking for a

The deal was structured to let Hampton Roads keep $150 million on its books tied to a deferred-tax asset. The DTA could have been at risk had Hampton Roads been the seller. So Hampton Roads shareholders will own roughly 74% of the company, even though Xenith will keep its name, many top management posts and headquarters city.

Calls to Hampton Roads, which is controlled by the New York private equity firm CapGen Capital Group, were not returned.

The $1 billion-asset Xenith, meanwhile, had been looking for a transformative deal to help it bulk up quickly after completing two smaller acquisitions since 2011. The company, which has the capability to make larger loans, was held back by legal lending limits. Merging with a bank twice its size will allow Xenith to target bigger borrowers, especially around Washington, while holding more loans on its balance sheet.

The deal "shows how a lot of banks are being strategic in their M&A," said Catherine Mealor, an analyst at Keefe, Bruyette & Woods. "A lot of eyes will be on the execution of this deal. Other banks will look at being more creative."

Excess capital will also give Layfield the flexibility to buy back stock, deal with problem assets or pursue more acquisitions, industry observers said. Xenith is open to additional deals, though its focus for now is the current merger and upcoming integration, Layfield said.

"The deal fits like a glove on both sides," Layfield said. "Social issues can get in the way of these transactions, but this was uniquely suited for everyone's needs."

Xenith could still become a seller, industry observers said. Once the transaction closes, the company will have assets of about $3 billion — a size that has become

Virginia's capital city is attractive because it is has strong universities and employers that are able to hire young, talented employees at a lower cost, Marinac said. Moving a bank's headquarters to larger market also makes the institution more visible to investors that may screen potential targets by geographic areas.

Several community banks already in the Richmond area are interested in expanding their market share, while also looking at ways to keep out new entrants, Marinac said. There could also be larger regional banks with limited market share that could look to boost their presence.

Xenith would become the third-biggest community bank operating in Richmond by total assets, behind the $7.7 billion-asset Union Bankshares and the $6.3 billion-asset TowneBank, according to data from the Federal Deposit Insurance Corp. It would be the fourth-largest community bank by market deposits, behind Union, TowneBank and Citizens and Farmers Bank.

"There are a lot of buyers across the Virginia and the mid-Atlantic region that continue to look at Richmond," Mealor said. "The move brings some franchise value and adds to that over the long term."

An eventual potential sale "was not an explicit part of this conversation, but certainly our collective boards looked down the road in terms of how we position our individual institutions and as a combined institution," Layfield said. "You have to think about building a franchise that is not only attractive on its own, but is also ultimately attractive to other acquirers."