BofI Holding is on the hunt for acquisitions and it says allegations of misconduct by a former employee or a subsequent big hit to its stock aren’t going to slow it down.

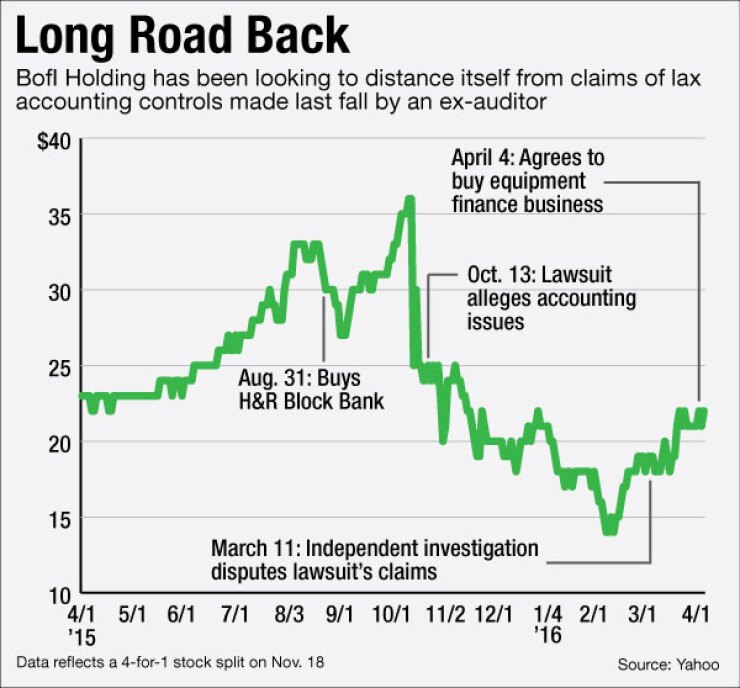

The San Diego company’s stock price sank dramatically last year after a former auditor accused the company of violating anti-money-laundering laws. It still hasn’t fully recovered, with shares trading at about $21, down 40% from October.

“There is not a single regulatory impediment to an acquisition,” Greg Garrabrants, BofI's president and CEO, said in an interview. Meanwhile, the $6.7 billion-asset company tends to pay for acquisitions with cash, so its stock price doesn’t matter as much.

-

BofI Holding in San Diego has bought an equipment finance business from PacWest Bancorp in Beverly Hills, Calif.

April 4 -

BofI Holding's CEO Greg Garrabrants should be basking in the glow of his bank's record earnings growth and its potentially transformative acquisition of H&R Block Bank. Instead, he's fighting to regain the confidence of shareholders spooked by allegations that the online bank violated anti-money-laundering laws.

December 24 -

BofI Holding in San Diego is poised to end a tumultuous week, after a lawsuit accusing it of lax controls sent investors scurrying.

October 16 -

The long-delayed approval of the merger of M&T and Hudson City should have been a bright spot in postcrisis M&A, but a small footnote from the Fed quickly reminded bankers that dealmaking will remain a demanding process.

October 1

A company claiming that those sorts of issues aren’t going to affect its acquisition plans might seem unrealistic, but so far the evidence is working in its favor.

Since then allegations arose last year, BofI has received regulatory approval for several deals, including the high-profile H&R Block deal. It has also gone through several regulatory exams, Garrabrants said.

On April 4, BofI announced it had bought certain assets and operations of Pacific Western Equipment Finance, including roughly $140 million of equipment leases in 36 states and Canada.

Of course, regulators are on high alert for issues surrounding compliance with AML and the Bank Secrecy Act, so BofI’s string of successes could change. For instance, a deal by the serial acquirer M&T Bank to buy Hudson City Bancorp was delayed for more than three years because of compliance issues.

“The bank regulators are sensitive to any type of complaint,” said Chip MacDonald, a partner at Jones Day. “It sometimes feels like they have a low bar to investigate, especially at the Federal Reserve.”

The Fed warned in its approval of the M&T-Hudson City deal that it would require future banks to withdraw their merger applications if AML and BSA compliance issues arise. Other regulators are likely to be just as sensitive about this issue, MacDonald said.

Matt Erhart, a former BofI employee, has alleged that the company has violated AML laws by making loans to certain foreign nationals. According to a lawsuit filed by Erhart, he was fired in June after complaining about the bank to the OCC. An attorney for Erhart did not return a call requesting comment.

The Office of the Comptroller of the Currency, which is BofI’s primary regulatory, said it couldn’t comment on a specific bank. But the agency does review an institution’s AML efforts in addition to looking at existing supervisory records, any comments received during the public notice period and commentary from other regulators and public officials.

Observers say they are finding comfort in the fact that the allegations haven’t caused a problem so far.

“If anything, things are much clearer now than the first time someone says they have concerns,” said Bob Ramsey, an analyst at FBR Capital Markets. “They haven’t had difficulty getting deal approval before and I think the further we get away from the allegations the better it is for them.”

The battering of the stock price could be enough to put most hopeful acquirers on the sideline, but BofI is a bit of an unusual buyer. It focuses on online deposits and niche lending, and it often finds cash deals with companies looking to exit the industry or a specific line of business.

“In the past they’ve done acquisitions that fit in with what they do, that brought them a new product or service or additional deposits,” Ramsey said. “It definitely hasn’t been a traditional bank acquirer.”

BofI purchased the operations of H&R Block Bank, deposits from Union Federal Savings Bank last year and deposits from Principal Bank in 2013.

The company is looking to purchase another deposit platform, especially one that has few or no branches to fit its online model, Garrabrants said. BofI has a higher loan-to-deposit ratio than some of its peers and it’s “asset generation has been very strong so you have to fund that,” said Gary Tenner, an analyst at D.A. Davidson.

It will avoid acquiring a bank heavy in branches because of the regulatory difficulty in closing that network, Garrabrants said. However, he believe customers would be more accepting of branch closures given that BofI could offer them lower or no fees compared with a bank with a traditional brick-and-mortar presence.

“Customers are being killed by overdraft fees and all of these charges and we could just abolish those,” Garrabrants said.

The company is also open to acquiring a specialty commercial and industrial business that is national and has a “specific market niche,” Garrabrants said. It already has some national lending platforms, such as its health care lending portfolio, and is looking to further diversify its risk, he added.

BofI has looked at some of the GE Capital assets being sold as General Electric winds down that unit, Garrabrants said. Earlier this month Western Alliance Bancorp said it was purchasing a portfolio of $1.4 billion of hotel loans from GE Capital, and State Street announced an agreement to buy GE’s asset management unit.

Benefits of the deal for the equipment leases from Pacific Western include a strong credit underwriting platform, a national distribution network and diversification of the company’s assets, Andy Micheletti, BofI’s chief financial officer, said during a call discussing the acquisition.

Finally, a robo-adviser could also make sense as an acquisition for BofI, or alternatively, the company could look to build those capabilities organically, said Andrew Liesch, an analyst at Sandler O’Neill.

Garrabrants says he believes there are currently too many robo-advisers in the marketplace, which will lead to consolidation in that area. BofI could be able to pick one up relatively cheaply.

A robo-adviser would help boost the company’s fee income, which lags its peers, Ramsey said. More traditional wealth management providers might scoff at this business model, but a robo-adviser would fit with BofI’s online business model and doesn’t require an extensive physical footprint to make it work, Liesch said.

Others agree.

“It won’t be the right product for everyone, especially very-high-net-worth people,” Ramsey added. “But it could work for more mainstream people who are looking for a product. It fits well with what BofI does elsewhere.”