-

Where there's a will, there's a way for Chris Bauer, who guided Anchor through bankruptcy as a means of recapitalizing the once-struggling Wisconsin company. The turnaround was punctuated with the company's October IPO.

December 16 -

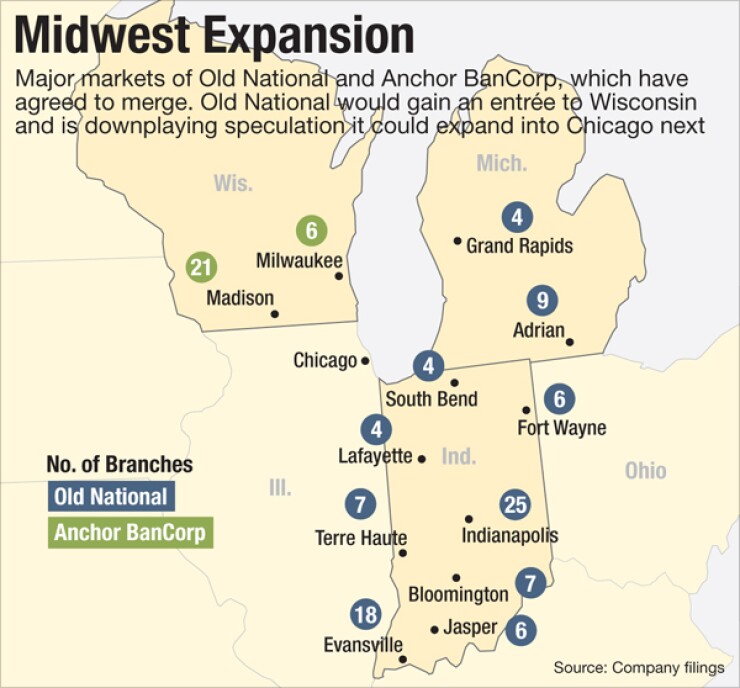

Old National Bancorp in Evansville, Ind., has agreed to buy Anchor BanCorp Wisconsin in Madison.

January 12 -

Having shored up capital following the financial crisis, many banks are flush with cash and in search of ways to put it to use. One option for banks that did sale-leasebacks in the past is to reacquire their branches.

January 12

Anchor BanCorp Wisconsin in Madison, by agreeing to sell itself to Old National Bancorp in Evansville, Ind., is writing the final chapter to its unlikely comeback story.

Less than three years ago the $2.2 billion-asset company emerged from an ambitious bankruptcy process that helped it recapitalize. Anchor just went public — again — in late 2014.

Anchor had become so well capitalized that investment bankers had started approaching management about making acquisitions, Chris Bauer, the company's president and chief executive, said in an interview.

The company, however, opted to find a buyer, largely based on a view that recent momentum — its stock had increased more than 40% since its initial public offering — was destined to plateau. Anchor invited a "handful of good companies to visit" before selecting Old National, Bauer said.

"Our mission was to turn it around, save it, stabilize it and grow it again," said Bauer, who will remain with Old National in an unspecified role. "But we also have a responsibility to shareholders, and I think this turned out to be a perfect timing for everyone involved."

It is amazing that the deal values Anchor at 128% of its tangible book value, given how unhealthy the company was when Bauer was

As a result, Bauer had to quickly find ways to shore up capital and keep Anchor out of the regulators' crosshairs. He did so by slashing costs, selling off parts of the company's investment portfolio and generating fees from its mortgage business.

But Anchor had to worry about repaying a $183 million loan from a trio of lenders, and it still held funds from the Troubled Asset Relief Program. Anchor eventually filed for bankruptcy to lock up $175 million in capital.

"That's a pretty fast return in a short amount of time," Bauer said. "It's hard to replicate that going forward. There's a lot of heavy lifting that comes with that next step, and [selling] allows our shareholders flexibility in what they want to do. … Old National came out on top on almost every box I would check."

For Old National, the deal was unsurprising after management recently hinted that it was ready to return to acquisitions after a self-imposed break, Christopher McGratty, an analyst at Keefe, Bruyette & Woods, wrote in a research note. He noted that pricing for the

The fact that the $12 billion-asset Old National inked a deal in Wisconsin was a bit of a head scratcher, Scott Siefers, an analyst at Sandler O'Neill, said during the company's conference call to discuss the acquisition. Management had been candid about looking at deals in Kentucky, Indiana and Michigan.

Old National management joked that they weren't drawn to the state for its weather, with President and CEO Bob Jones noting that the Tuesday morning temperature in Madison was minus 15 with the wind chill included.

Wisconsin presents strong economic opportunities and, in the case of Anchor's markets, superior demographics. The state was tied for No. 7 in the nation last year in job creation. The household median income in Anchor's markets is 20% higher than markets currently served by Old National.

Bauer "and his team have clearly positioned this company in the right markets with the right growth parameters," Jones said during the call.

Old National will keep looking for acquisitions in Wisconsin and the other states where it already conducts business, Jones said during an interview after the call, with an emphasis on banks with assets of $1 billion to $3 billion. Other factors, such as culture and markets, will also remain important, he said.

Old National notably skipped over Chicago by entering Wisconsin. It is unlikely that the company will enter the Windy City anytime soon, Jones said.

"Chicago has a lot of great banks that have been there a long time," Jones said during the interview. "They don't really need us up there, but I do love it for its restaurants and entertainment."

Bauer, meanwhile, said in the interview that he doesn't have any regrets about how he ran Anchor, though he is sure he made some mistakes along the way.

"You don't look back," he said. "You just keep looking forward. The outcome is superb for all the parties involved."