The bankruptcy of Wingspan Portfolio Advisors epitomizes the existential crisis facing default servicing. This once-thriving sector of the mortgage industry now finds itself declining in lockstep with the drop in loan delinquencies and foreclosures.

The magnitude of the housing crisis saw demand for default servicing and high-touch loss mitigation soar to unprecedented levels. And while there was little doubt the opportunity would be short-lived, just how long it would last was a question industry veteran Dave Vida grappled with after founding Acqura Loan Services, the Dallas-based specialty servicer now known as ClearSpring Loan Services. Vida is now the president of LenderLive, which provides technology, outsourcing and other services to mortgage lenders and servicers in Glendale, Colo.

"One of the things that kept me up at night was what happens when this is all cleaned up? But the cleanup just took a lot longer than everyone thought," Vida said in an interview prior to Wingspan's bankruptcy filing.

At its zenith, Dallas-based Wingspan was the high-flying darling of the default servicing industry that built a reputation for leveraging technology to successfully resolve the most difficult of delinquent loan scenarios. But the specialty servicer may have run into trouble in part because it outspent its resources as it sought to grow and diversify with moves like the acquisition of hazard claims firm Dimont & Associates and two facilities from JPMorgan Chase in 2013.

Last fall, after a wave of layoffs, Wingspan divested itself of Dimont, and changed its leadership. It said at that time it had received a cash infusion from investors that left it "debt-free." However, recent bankruptcy filings show it operated at a gross operational loss of roughly $24.9 million in 2014.

The court documents also show there are claims against former officers and directors for "fiduciary breaches," including entry into "self-interested" contracts, insider loans "at supra-competitive interest rates," and "provision of false and misleading financials and reports" to Wingspan's managing member and board.

There are additional claims against tthe accounting firm Grant Thornton for fiduciary breach, "including failure to identify and report internal accounting and financial problems"; Huron Consulting Group "for breach of contract and for providing false and misleading financial information"; and JPMorgan Chase for "fraudulent inducement and other business torts."

Wingspan's bankruptcy attorney Daniel Morenoff, Wingspan spokesman Guy Davis and former CEO Steve Horne could not be reached for comment. The company's phones had been disconnected. Representatives from Grant Thornton, JPMorgan Chase and Huron had no comment.

Informative Research chief operating officer Stan Baldwin, whose mortgage risk management and data firm recently partnered with Wingspan to test homeowners association lien services and technology, said the shutdown of the company was sudden.

"We had completed a test file and literally that day Wingspan announced [the bankruptcy]," he said. "Then we couldn't deliver the data, unfortunately, because it wasn't our customer to deliver it to."

Baldwin said he did not know what the bankruptcy's cause was, but he said some of the former employees have been seeking other industry work in the Dallas area where his company recently established a facility, as well as other markets.

"I can't speak to the Wingspan offering or the tragedy of their demise. It really is a shame. But I think some of their talent will spill out into the Texas area and beyond," he said.

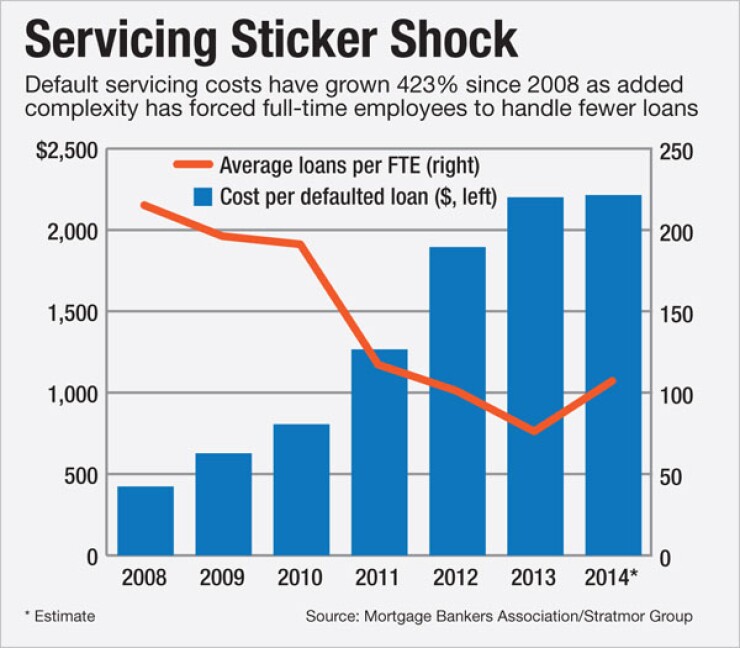

Before the bankruptcy, there had already been at least one wave of default servicing consolidation and during the past few years, heightened regulatory requirements have further pressured margins. Although many servicers and vendors have survived by diversifying, other delinquent mortgage units are shutting down.

"Compliance costs have risen for everybody in the servicing space," said Thomas Crowe, a senior director at Fitch Ratings, which rates 18 special servicers.

Crowe couldn't comment on Wingspan's situation because Fitch didn't rate the company, but in general, special servicers have been under increased pressure to grow in other areas as distressed loan volume has dwindled.

"The larger the operation you have, the more you can spread that cost over more units," he said.

If Wingspan left any customers with special servicing contracts in the lurch, other servicers could pick them up. But there could be liabilities they would have to consider, said Gordon Albrecht, senior director at servicer FCI Lender Services Inc.

A servicer going out of business might do so by voluntarily distributing its contracts to others, avoiding gaps in compliance and servicing. But in a bankruptcy, assets may get temporarily neglected as they go through the courts and into receivership, Albrecht said.

"If they do it under receivership, there's protection there," he said, noting that this protection addresses some liability concerns for servicers in the transfer of assets.

While compliance, thin margins and the manual nature of some of the work remain challenges for servicers, there also are opportunities for survivors with strong data and reporting technology, said Albrecht. There is new supply from consolidation as well as recent NPL sales by government entities, he noted.

Michael Laidlaw, a director at Fitch, said he doesn't expect a further shortage of distressed product in the immediate future. But the concern hasn't disappeared.

"I think there's still a pretty significant volume, but a couple of years down the road it could wind down," he said.