Banks that feast on commercial real estate better have plenty of capital set aside.

Many institutions

Suffolk Bancorp in Riverhead, N.Y., expects the Office of Comptroller of the Currency to require its bank to maintain a 12% total risk-based capital ratio, Howard Bluver, the $2.3 billion-asset company's chief executive, said in a press release tied to quarterly results. Suffolk, as a result, will "temporarily pull back" from CRE lending, despite having ample capital, he said.

-

Competitive pricing and softening demand at the high end of the apartment- and condo-building market had executives at BankUnited, Signature and New York Community answering tough questions about their growth projections and diversification strategies.

April 20 -

A number of bankers used quarterly earnings calls to assure investors that they are carefully monitoring their exposure to commercial real estate at a time when regulators are expressed concern about eroding underwriting standards.

February 4 -

Suffolk Bancorp in Riverhead, N.Y. has promoted Anita J. Nigrel to executive vice president and chief retail officer, a newly created position, effective Monday.

July 6

Bluver's comments come five months after federal regulators

While it is unlikely Suffolk is facing a formal regulatory order, Collyn Gilbert, an analyst at Keefe, Bruyette & Woods, wrote in a note to clients that it is possible that regulators are quietly pushing new capital requirements on other CRE-heavy lenders.

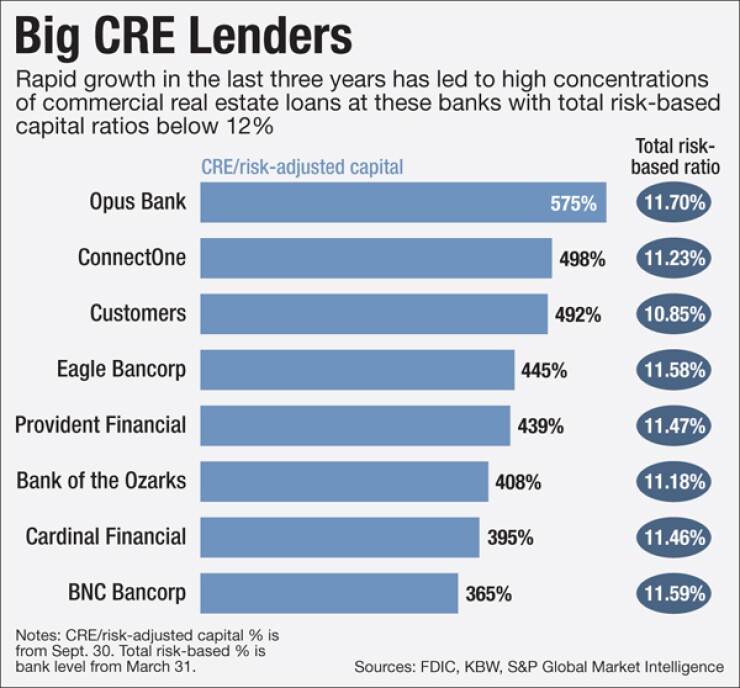

Regulators have been paying close attention to banks where CRE loans make up 300% of total risk-adjusted capital, particularly as a result of ramped-up originations over the last three years, industry experts have said.

Those trends are evident at more than two dozen banks covered by KBW. While several institutions are multifamily lenders in New York, the list also includes California companies such as Opus Bank, BBCN Bancorp and PacWest Bancorp, as well as Bank of the Ozarks, BNC Bancorp and Stonegate Bank in the Southeast.

At Suffolk, CRE loans were equal to 356% of total risk-adjusted capital, based on Sept. 30 data compiled by KBW that includes loans for multifamily projects and farmland.

Bluver, who once worked for the Office of Thrift Supervision, also said he expects the OCC to require Suffolk's bank to maintain a 9% Tier 1 leverage ratio and an 11% Tier 1 risk-based capital ratio. He said Suffolk, where capital levels current exceed those targets, could sell selected investment securities and multifamily loans, if necessary, to maintain those ratios.

Those capital requirements would be significantly higher than the typical standard for well-capitalized banks, which have to maintain a 5% Tier 1 leverage ratio, an 8% Tier 1 risk-based capital ratio and a 10% total risk-based capital ratio.

An OCC representative declined to comment.

So far, no other bank has publicly discussed higher capital requirements, though First of Long Island, another company with significant CRE concentrations, recently disclosed plans to raise $35 million to support organic growth.

Gilbert called the timing of the $3.2 billion-asset company's stock offering "interesting," given Suffolk's disclosure. "While we do not believe that [First of Long Island] is explicitly subject to similar minimums at this point, this capital raise will bolster regulatory ratios and should allow for continued CRE growth," she said.

A call to First of Long Island, where CRE loans were equal to 330% of total risk-based capital at Sept. 30, was not immediately returned.