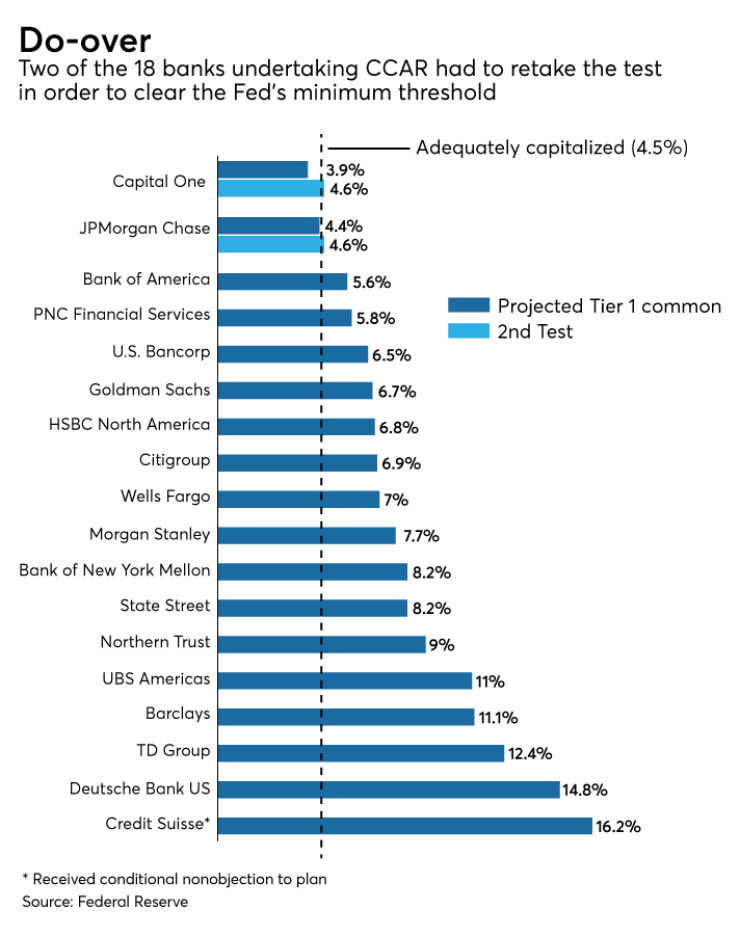

WASHINGTON — In a year where most of the 18 institutions taking the second round of the Federal Reserve's stress tests showed improvements over 2018, JPMorgan Chase and Capital One struggled, with both forced to adjust their capital plans in order to meet the central bank's minimum thresholds.

All of the large banks graded under the Fed's annual Comprehensive Capital Analysis and Review test ultimately cleared the mark, with only Credit Suisse receiving a "conditional non-objection" to its capital distribution plan due to weaknesses in certain assumptions used to project stressed trading losses.

But the close call for JPMorgan and Capital One is notable, demonstrating how aggressively many institutions approach the test, attempting to maximize capital distributions. It also reflects how tough the test was on certain areas, such as credit cards, in its projections of a severely adverse economic scenario.

Despite the more demanding projections of the test, however, banks performed better than last year, when they struggled with the impact of the tax reform law, causing the Fed to issue an objection to DB—the U.S.-based affiliate of Deutsche Bank—and a conditional nonobjection to Goldman Sachs, Morgan Stanley and State Street.

Fed officials said the results demonstrated that the nation's largest banks continue to make capital adequacy a high priority.

“The results show that these firms and our financial system are resilient in normal times and under stress,” Randal Quarles, the Fed's vice chairman of banking supervision, said in a press release.

Under the test, each bank is graded on four different ratios, each with its own minimum: Tier 1 leverage (4.0%), common equity Tier 1 ratio (4.5%), Tier 1 capital (6.0%) and the total capital ratio (8%).

Capital One’s original plan trailed behind the required common equity Tier 1 ratio, tier 1 capital ratio and total capital ratio, while JPMorgan Chase fell behind on the minimum common equity Tier 1 ratio, Tier 1 leverage ratio and the supplementary leverage ratio.

In the severely adverse scenario, Capital One’s common equity Tier 1 ratio came in initially at 3.9% (below the minimum of 4.5%) while JPMorgan Chase’s was initially 4.4%. Upon resubmission, the ratios for both banks raised to 4.6%, a hair above the 4.5% minimum.

Credit Suisse, meanwhile, received a "conditional non-objection" due to its stressed trading loss projections. As a result, it must resubmit its capital plan. Between now and Oct. 27, the bank will be limited to its capital distribution levels from last year, according to a senior Federal Reserve official.

This year, only 18 banks were subject to this round of CCAR, compared to the 38 that participated last year. The Fed announced in February that it would exempt banks with assets of $100 billion to $250 billion from the 2019 supervisory stress testing cycle, and instead require them to undertake supervisory stress testing every other year, beginning in 2020.

The central bank also only curbed the use of the “qualitative objection” in this year’s tests. The qualitative portion of the test has, in the past, given regulators greater discretion to fail certain banks due to risk management or operational failures. But under the Fed’s new guidance issued in March, banks that have already participated in four previous stress tests and that passed the qualitative evaluation in their fourth year will be exempt from that portion.

This cycle, only Barclays, Credit Suisse, DB USA, TD Group and UBS were subject to the qualitative evaluation, which they each passed.

While DB still has progress to make on some of its operations, the bank has made headway on addressing foundational weaknesses since last year's tests, a senior Federal Reserve official said.

However, the Fed did note that firms newer to the stress testing regime—which include Barclays, Credit Suisse, DB USA and UBS—showed “varying degrees of weaknesses in stress loss and revenue projection in association with their most significant risks and exposures.”

“Certain firms that are newer to CCAR have additional work to undertake to have sound, established capital planning practices, and a limited number of firms that have been subject to the qualitative assessment for a number of years have certain weaknesses that limit their capital planning capabilities,” the Fed said.

The agency also warned banks from using large trading positions to limit the impact of market shock on their capital reserves under periods of stress, calling the effectiveness of that strategy “uncertain.”

The CCAR results were preceded by

Both stress testing regimes require systemically important banks to submit their balance sheets each year to the Fed, which evaluates how the firms would perform under varying hypothetical economic conditions. The two tests differ in that DFAST uses a standard capital plan, whereas CCAR uses each bank’s own capital plan. Banks that fall below capital minimums in CCAR can be prevented from issuing dividends, while there is no penalty for not meeting the requirement in DFAST.