-

The financial industry and the Federal Reserve are finally on the same page about the U.S. payment system's need for speed. But achieving consensus about what the new system should look like remains a tall order.

March 30 -

Apple's high-profile app could give mobile wallets the jump start they needed.

October 30 -

Decisions about when and how to implement EMV technology in credit and debit cards are difficult. Many banks have decided to slowly phase it in, despite the fact the delay will open them up to greater potential liability.

February 18

Banks are putting a high-tech spin on the oldest type of payment. And it is giving them a much-needed boost in fees.

Cash good, old-fashioned cash remains the most popular way to pay, even as the industry tries to make transactions

Banks are making a big push to court retailers with large stacks of cash, including fast-food chains, gas stations and big-box stores. Regional banks, in particular, are expanding their "smart safe" business a niche treasury product that retailers use to sort and remotely deposit dollar bills.

"The usage of cash has not seen the decline that many would expect to see," said Bill Wasco, a senior executive for enterprise commercial payments at the banking unit of Cleveland-based KeyCorp. "And what we do know is that cash, for all intents and purposes, is very commonly used for small-dollar transactions."

The push into cash automation comes as banks look for ways to generate fee income. Regional banks considerably expanded their noninterest sources of revenue

Several regional banks, including KeyCorp and PNC Financial Services Group, reported that fee income rose

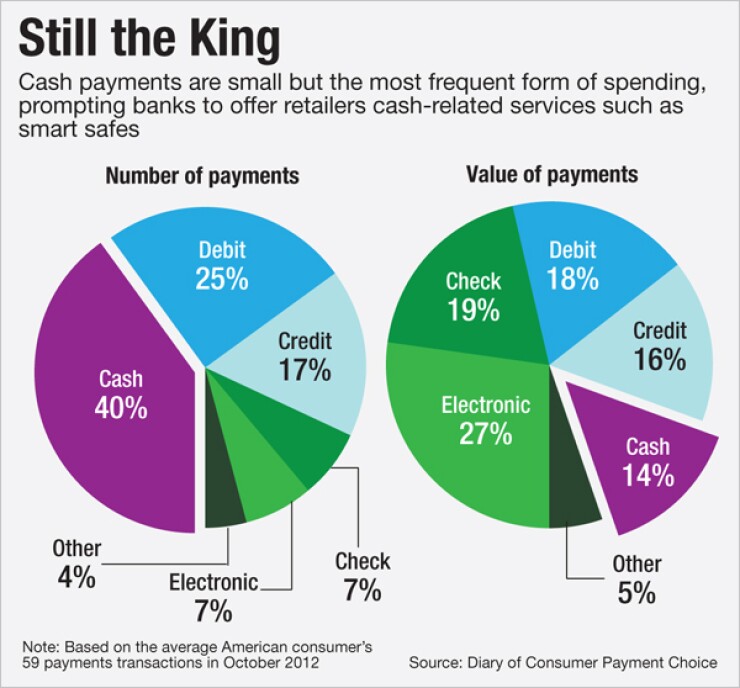

Ironically the rise of the smart safe coincides with the industry's rising investment in digital payments. Amid an industrywide clamor to make mobile wallets mainstream and satisfy the presumed preferences of younger consumers, cash still plays a key role, accounting for 40% of all transactions, according a

The "perception that young people don't use cash is actually wrong," said Barbara Bennett, a vice president in the cash product office at the San Francisco Fed. "There is a very, very robust demand for cash."

Cash also accounts for a majority of small-dollar payments, primarily under $10, Bennett said.

And that is creating a big if unexpected business opportunity for banks. "Over the near term, cash is still the dominant vehicle for transactions, particularly for the markets we serve," said Bert Sciulli, senior vice president at the $340 billion-asset PNC, pointing to the "gas-and-go types, and the Wawas of the [convenience store] world."

The focus on sales of smart safes is notable, particularly since the technology is not brand new. Banks of all sizes have offered them as a service

Smart safes are primarily used to assist retailers with end-of-the-day deposits. The machines which look like large ATMs with touch screens on top count and sort cash. They also automatically credit the money to customers' accounts, although the deposits have to be verified later. They are made by manufacturers such as Tidel and Armor Safe.

Bankers say that retailers' desire to trim labor costs is driving the surge in demand. Cash may be popular with consumers, but, from a retailer's perspective, it can be time-consuming to manage. Counting it can be tedious, and scheduling frequent armored-car pickups can be expensive.

"The marginal cost of handling cash is only going up," said John Bultema, head of treasury management at the $138 billion-asset Fifth Third Bancorp in Cincinnati. "So why spend that time that unproductive time having valuable people do low-value-add activity?"

In other cases the sheer volume of dollar bills used at large retail franchises is enough to justify the investment. "The large merchants tell us that they have enough cash transactions that it makes sense for them to invest in some of these devices," Bennett said.

So banks are, well, cashing in. Fifth Third has nearly 9,000 safes in the marketplace, mostly in the "sweet spots" of quick-service restaurants, convenience stores and sports facilities, Bultema said.

The business generates just over $30 million per year, according to a bank spokesman, who declined to provide projections for the coming year. That figure equals about 1% of the bank's noninterest revenue last year.

Fifth Third, like other banks, offers smart safes as a part of bundle of services. The bank leases the safe to retailers, and arranges for periodic pickups by armored cars. Clients pay for the service monthly.

Part of the bank's product pitch is that, if issues arise, clients have "only one throat to choke just call the bank," Bultema said.

PNC's smart-safe installations rose by 60% last year, said Sciulli said, declining to provide more specific figures on revenue or sales. He added that the Pittsburgh bank has seen an uptick in demand among health care providers, which are collecting more co-pays and other medical payments on site.

Additionally, the $92 billion-asset KeyCorp another Rust Belt regional is getting into the game. The bank began offering smart safes in April, Wasco said.

Smaller banks are also angling for a piece of the business. The $21 billion-asset Hancock Holding is planning to grow its smart-safe business in the coming year. The bank currently has 84 clients, but it hopes to expand by a clip of about 20 customers per year.

The Gulfport, Miss., bank has recently noticed an interest among retailers in rural areas, where it is often inconvenient to drive to a bank branch every day, said Marc Bourn, a senior vice president at the bank.

"It's not very big right now, but it's certainly something that we expect to grow," Bourn said.