The drama surrounding the Wells Fargo board vote has faded, but the battle over its future makeup is just beginning.

In recent interviews, Wells investors that have been critical of the board's role in the phony-accounts scandal — including the California State Teachers' Retirement System and the New York City pension funds — urged the company to pick up the pace of its previously announced "refreshment" plan.

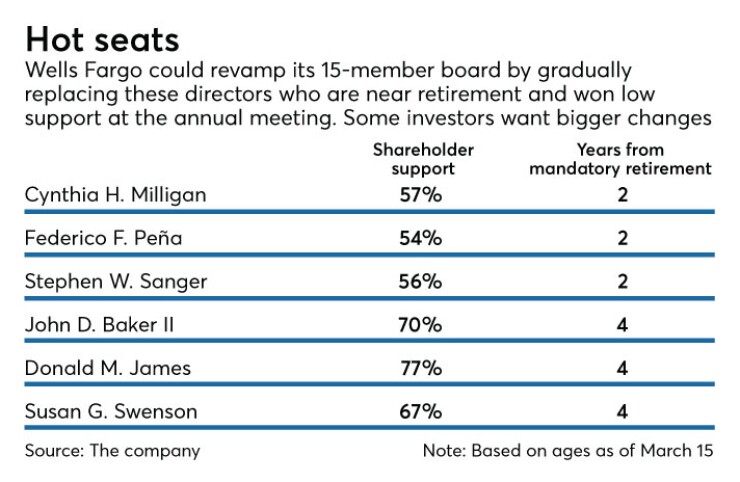

Over the next four years, six of Wells Fargo’s 15 directors will reach the mandatory retirement age of 72 and be gradually replaced, Chairman Stephen Sanger reiterated at the company’s annual meeting last week. Wells officials have said they have begun looking for replacements.

All directors at the meeting received majority votes, though most received received the

The vote “signals displeasure with the board leadership and should prompt the expediting of the board’s previously announced refreshment efforts,” Aeisha Mastagni, a portfolio manager at CalSTRS, wrote in an email to American Banker. CalSTRS owns 11.6 million shares.

Other investors agreed. “I’m not going to wait around for four years,” said Brandon Rees, deputy director at the AFL-CIO office of investment, which owns 1.6 million shares. Rees argued that the company is in need of “fresh blood” in the boardroom.

The calls for more aggressive action follow the company’s

Wells Fargo agreed in September to pay $190 million to settle charges that more than 5,300 employees wrongfully opened roughly 2 million unauthorized accounts.

In the weeks leading up to the annual meeting, recommendations from the influential proxy advisory firms to vote against at least half of the directors up for re-election raised the prospect of a historic ouster.

If Wells allows its plan to run its course, giving directors the leeway to stay until they are 72 years old, then three directors would be required to step down in the next two years: Sanger, Federico F. Peña and Cynthia Milligan. They each received votes within the 50% range.

Additionally, within four years, another three directors — John Baker, Donald James and Susan Swenson — would retire. All three received votes of between 60% and 80%.

Enrique Hernandez, 61, who received the fewest votes, at 53%, would not be required to step down for another decade.

Investors said that the low vote results indicate that shareholders want to see quicker, more sweeping changes.

“They can do it faster,” particularly with the help of outside recruiting firms, said Gerald Armstrong, a longtime shareholder activist in the industry who owns about 24,000 of the company's shares.

Wells’ strategy of turning over the board through voluntary retirements fails to hold individual directors accountable for their missteps, according to an official at the New York City pension funds who asked not to be named. The funds hold $594 million of Wells shares.

Reached for comment Tuesday, a Wells Fargo spokesman pointed to comments Sanger made after the board meeting, in which he reiterated the company's commitment to working with stockholders in the months and years ahead.

During a press briefing after the annual meeting, Sanger said that the company has no plans to replace individual members based on their vote results.

“The board isn’t replacing directors because of the percentage votes,” Sanger told reporters. “What we saw is that many shareholders … didn’t really have a strong desire to replace any given director; they were trying to pick those who seemed logical to send a message to the board.”

Wells remains committed to “refreshing the board over time” and will add new directors as “the longer-serving ones roll off the board,” Sanger said.

Observers said there are a number of steps Wells could take to soothe the frayed nerves of its investors.

One option is for the company to announce a multiyear plan for board departures that clarifies who is departing and when exactly they plan to leave.

“I would be surprised if more than four could leave within a year, but you could pre-announce it over a longer period,” said Brian Tayan, a researcher with the Rock Center for Corporate Governance at Stanford University.

Tayan said investors who want to see changes in the Wells boardroom have few options at their disposal beyond pushing for a change in personnel. He noted that the

Given that most board activity occurs behind closed doors, investors need to be able to trust that directors are asking the right questions.

“Was the board skeptical enough? Were they pushing back?” Tayan said.

Another option to quell investors’ worries would be to publish a matrix that shows the skills that each board member brings to the table — and what kinds of experience the board seeks in new recruits.

The New York City comptroller and other overseers of public retirement funds have previously

As Wells searches for new directors, investors said the board should look for candidates with a mix of skills in organizational culture, crisis management, human resources and communication with rank-and-file employees.

Experience in financial services is also a must. Investors, however, declined to offer names of potential candidates.

“Fortunately, candidates with banking experience also have crisis management experience,” Tayan said half-jokingly.