-

The U.S. office property market has become a model of a disciplined, well-functioning real estate market since listed equity real estate investment trusts changed the calculus driving new construction.

June 12 -

Banking activity slowed in January, particularly consumer lending, as cold weather and snowstorms stymied new construction and consumer transactions. Still, bankers maintained an optimistic view of overall business conditions.

March 14

The banking industry is starting to hold the line on loan pricing, though the trade-off has been decelerated loan growth, according to newly available data.

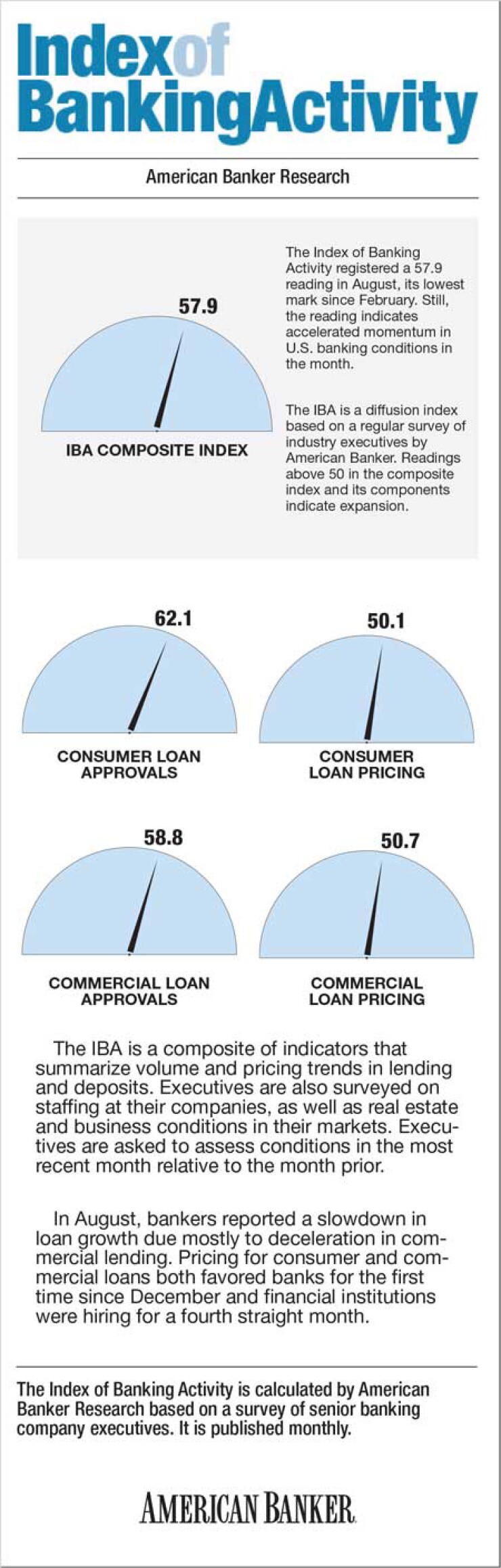

The American Banker Index of Banking Activity fell to 57.9 in August from 58.5 a month earlier, marking its lowest level since

Loan pricing, which has been a challenge for banks of all sizes, seemed to reach an inflection point as the end of the third quarter neared. For the first time since December, index readings for both consumer loan pricing (50.1) and commercial loan pricing (50.7) indicated that banks

The data corresponded with anecdotal comments by many bankers that, while loan competition remains intense, fewer lenders are willing to aggressively cut pricing. In some instances, even outliers that previously offered steep discounts to win business are starting to behave more rationally.

"What I've seen is the pricing competition that really came up last year has settled down a little bit," Geoff Greenwade, president and chief executive of Green Bancorp in Houston, said during a Sept. 16 conference hosted by RBC Capital Markets. Thin pricing is catching up with the most ambitious lenders in the form of compressed net interest margins, forcing them to exercise more restraint, he said.

Geography also matters.

"Reasonable pricing is present" in San Francisco as economic growth provides ample lending opportunities, David Payne, chairman, president and chief executive at Westamerica Bancorp. in San Rafael, Calif., said during the same conference. Pricing is more competitive in California's Central Valley, which includes Sacramento and Fresno, though Westamerica is still committed to "proper terms and pricing," he said.

Index readings above 50 indicate monthly expansion of activity; readings below 50 point to contraction. For contrary indicators, such as the components that track loan delinquencies and loan-rejection rates, a reading above 50 is evidence of deteriorating business activity. The further from 50 a reading is, the stronger the indicated change.

As banks dig their heels in on pricing, they are also booking loans at a slower growth rate. August's reading for consumer and commercial loans outstanding fell to 67.6 from 71.5 in July. While still a strong showing, it was the lowest reading for loan balances since February.

A slowdown in commercial loan growth contributed to the overall deceleration. The reading for loan applications fell to 58.1 in August from 60.1 a month earlier, while the showing for approvals slipped to 58.8 from 60.1.

Consumer lending continued to expand at a faster rate. The reading for loan applications rose to 59.5 from 58.2 a month earlier. Approvals were stable, edging up slightly to a 62.1 reading in August.

Financial institutions are continuing to hire, though many bankers have stated that compliance jobs are the positions they are looking to fill. The reading for staffing rose to 53.3 from 52.4 a month earlier.

The IBA is a product of American Banker's monthly surveys of bank executives. The latest installment of the diffusion index was based on 320 responses.

The IBA's composite index is a simple average of readings on a range of indicators based on responses to survey questions on topics that include volume and pricing trends in commercial and consumer lending, loan balances outstanding and deposit-account activity.

Respondents are also asked to weigh in on staffing levels at their institutions, as well as business and real estate conditions in markets where they do business. Every effort is made to ensure that the breakdown of companies included in the executive panel is representative of the industry.

The values for individual components of the index are equal to the percentage of responses indicating increased activity plus half of those indicating "no change." Component scores are then averaged to arrive at a composite. When calculating the composite, contrary indicators such as delinquencies are scored inversely the component figure is subtracted from 100.