-

Regulators' recent moves to encourage mortgage lenders to relax standards have reignited a contentious debate.

May 19 -

The Federal Deposit Insurance Corp.'s fourth-quarter report on industry health showed continued challenges to growth, but the second straight increase in net interest margins is a promising sign for the future.

February 26 -

Increases in medium- and long-term interest rates still pose risks, but the Federal Deposit Insurance Corp.'s Quarterly Banking Profile revealed that a rate recovery can also have advantages.

November 26

WASHINGTON Banks are still feeling negative effects from last year's sudden rise in medium- and long-term interest rates, but plenty of signs in the Federal Deposit Insurance Corp.'s latest industry update continue to point to a lending resurgence in the near future.

Institutions took a definite hit in the first quarter as the higher rates which took effect in the second quarter of 2013 have caused mortgage refinancing to dry up, posing an immediate profit challenge. But returning loan growth particularly at community banks is still persistent in other categories that had languished following the crisis, offering hope that the credit market is on its way again to producing revenue growth.

"Consumer confidence is coming back gradually, even small business appetite for credit is coming back gradually. Those real sectors that depend on banks are showing some gradual improvement in activity," said Richard Brown, the FDIC's chief economist, at a briefing Thursday to release the agency's Quarterly Banking Profile.

The industry's $37.2 billion in profit last quarter was a 7.6% drop from a year earlier, only the second decline in nearly five years. The agency attributed the decrease in part to lower revenue from mortgage sales, securitization and servicing, as last year's rate hike has quieted the post-crisis refinancing boom. Yet the earnings decline was milder for community banks only falling 1.5% as reflected in a new QBP section isolating earnings data for the community banking sector.

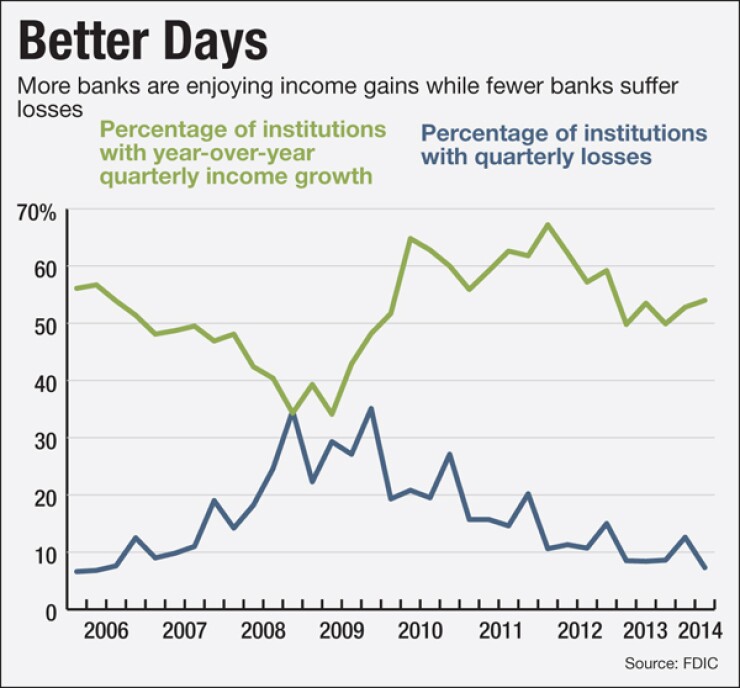

Smaller institutions also showed stronger loan growth as compared to the rest of the industry. Their 0.9% growth in loans during the quarter was higher than that of the industry as a whole, which reported 0.5% growth. More than half of the industry, meanwhile, reported higher profits from a year earlier.

Still, noninterest income for all banks fell nearly 11% from a year earlier to $59.5 billion, driven by a sharp 53.6% drop-off in noninterest, mortgage-related revenue to $3.5 billion. Trading revenue also declined, by 18.3%, to $6 billion. Overall, net operating revenue declined 4% from a year earlier to $163.7 billion. However, the decline in year-over-year earnings was also somewhat skewed, since net income a year earlier had benefited from certain idiosyncratic events at large banks including a reduction in legal expenses at JPMorgan Chase that did not factor in to the most recent earnings report.

"Industry revenue has been affected by narrow [net interest] margins, modest loan growth and a decline in noninterest income as higher interest rates have reduced mortgage-related activity and trading income fell," said FDIC Chairman Martin Gruenberg.

Yet officials noted signs that the negative effects of the higher interest rates could be running their course. Many of the indicators the FDIC uses to analyze the industry's condition are based on year-over-year comparisons. Since the rate increase was in the second quarter of last year, the decline in noninterest revenue could ease later this year.

"The weakness has been noninterest income" which is "primarily a reflection of the drop-off in mortgage activity, principally reflecting the drop-off in refi activity," said Ross Waldrop, the FDIC's senior banking analyst.

"We've seen a fairly consistent pattern over the last three quarters, looking back before the rate increase. That's still going to play out for one more quarter for the industry."

And while noninterest income was down, net interest income was up though by a smaller degree. Net interest income rose by 0.4% from a year earlier to $104.2 billion. Community banks appeared to report stronger interest-related revenues. Whereas over two-thirds of the entire industry reported higher net interest income, that was true of only seven of the 20 largest banks. The industry's overall average net interest margin declined 10 basis points to 3.17%, but 54% of banks reported higher net interest margins.

"Community banks have benefited most over the past year from the steeper yield curve, as their average net interest margin was up 4 basis points from a year ago," Gruenberg said. "In contrast, larger banks have increased their portfolio of lower-yielding, short-term assets and they saw their margins decline."

Despite modest loan growth overall, certain categories showed signs that banks are poised to accelerate expansion of their balance sheets. Gruenberg noted that, unlike this past quarter, over the previous three years loan balances had declined in the first quarter. The 12-month growth rate in loan balances of 3.6% was a post-crisis high, while loan balances at community banks over the past 12 months have grown 6.7%, he said.

"The seasonal decline in credit card balances along with fewer mortgages held for sale were more than offset by growth in almost other major loan categories," Gruenberg said.

Construction and development loans, which before last year had declined every quarter since the middle of 2008, have now grown in each of the last four quarters. The first quarter showed the strongest growth, with C&D loans rising by 2% or $4.4 billion to $214 billion. Meanwhile, commercial and industrial loans increased by 1% to $1.6 trillion. Multifamily residential loans increased by 3.4% to $271.7 billion. Automobile loans rose 1.8% to $359.6 billion.

Yet single-family residential mortgages were still an Achilles' heel, falling by 0.3% to $1.8 trillion. Home equity lines of credit were down for the 20th straight quarter, declining by 1.4% to $503.5 billion.

Institutions were still buoyed by improvements in asset quality. Net charge-offs fell year over year for the 15th straight quarter, dropping by 34.8% to $10.4 billion. It was the lowest quarterly total since the second quarter of 2007. The industry's balance of noncurrent loans fell below $200 billion for the first time since the third quarter of 2008. Banks on the FDIC's "Problem List" declined by 56 institutions to a total of 411.

Due to strong growth in deposits last quarter, the ratio of FDIC reserves to insured deposits rose by only one basis point to 0.80%. At the end of last quarter, the Deposit Insurance Fund held nearly $48.9 billion.