-

CEO John Kanas is letting rivals know in advance that he's coming to New York — and that he's targeting their employees.

February 13 -

BankUnited (BKU) of Miami Lakes, Fla., reported better-than-expected earnings in the fourth quarter as a surge in interest income more than offset a dip in fee income and the impact of a penalty for pre-paying Federal Home Loan bank advances.

January 29 -

Eight months after abandoning plans to sell itself, BankUnited (BKU) in Miami Lakes, Fla., is once again weighing offers from potential buyers, the New York Post reported Friday.

August 17

BankUnited's private-equity backers are giving up a big chunk of their stakes today with the hope of a better tomorrow — one that could include buying more banks.

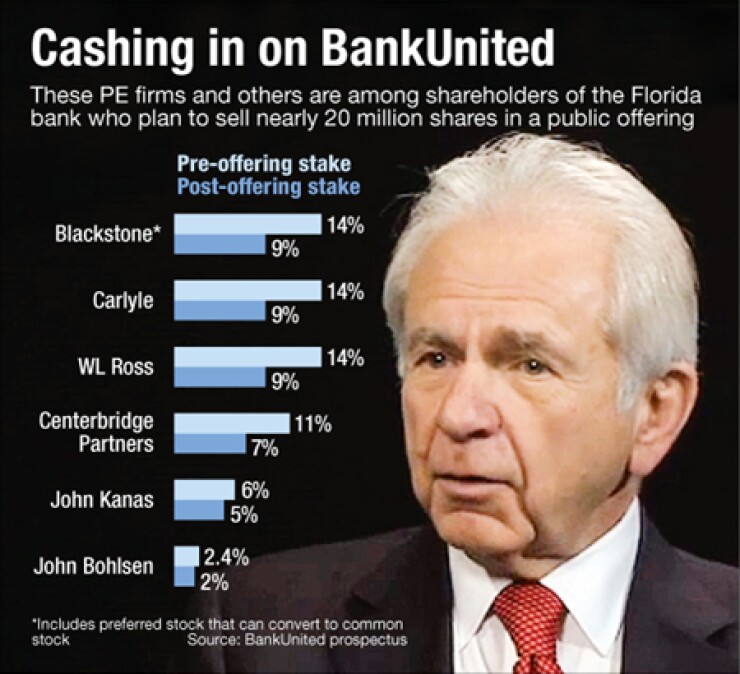

On Wednesday the $12.2 billion-asset BankUnited (BKU) announced the start of an offering of 19.6 million of its 95 million common shares outstanding. Big investors are selling the shares, and they get the proceeds.

But moving 20% of the Miami Lakes, Fla., company's stock out of PE hands is the next step in its evolution from a bank purchased out of failure into a traditional banking company, Chief Executive John Kanas said in an interview. Kanas is also selling 14% of his holdings in the deal and will have a 4.9% stake in the company following the offering.

"We've always told the market that over time we wanted to normalize our shareholder base to one that is less dependent on private equity," Kanas said in an interview on Wednesday. "Insiders and private equity control over half the stock now, so [BankUnited's] float is not as big as institutional investors might prefer."

Having a bigger float means more liquidity and more liquidity should result in a higher valuation. Having a strong valuation is particularly important for acquisition-minded banks right now, as sellers are keener on stock deals with buyers who trade at a significant premium to book value.

That will likely be more of an issue in New York, which BankUnited

"A higher valuation in the stock is going to help them do more open-bank acquisitions," says Brennan Ryan, a partner at Nelson Mullins.

Before the announcement of the offering, BankUnited's stock was trading at 161% of its tangible book value. Secondary offerings are typically priced at a discount around 5% of a company's share price, sources say. Likewise BankUnited's stock fell 5.5% on Wednesday, to $26.99.

The news of the secondary offering came roughly two years after BankUnited raised $783 million in its initial public offering, priced at $27 a share. A year ago it

Kanas says he hopes the offering puts the kibosh on such talk for a bit.

"This should indicate that it was chatter. [The offering] is real life," Kanas says. "This is about helping the bank grow."

Private equity has had an interesting run in the banking world since the onset of the crisis. The opportunities they saw in a lot of failed banks and hopes of a strong recovery never materialized, and many are getting antsy with their investment.

"Private equity wants out, and if they don't take them out in an offering like this they'll likely push a sale," Stephen Klein, a partner at Graham & Dunn in Seattle, said broadly about the industry. "The whole idea of regulated industry was foreign to them and I think a lot of them just

BankUnited has been a bit an exception to the lament of private equity in banking. The team, which includes Blackstone, Carlyle, WL Ross and Centerbridge Partners, was the first allowed to buy a failed bank — also called BankUnited - from the Federal Deposit Insurance Corp. in 2009 immediately after its closure. It got a larger platform and a more attractive deal than those who followed, observers say.

"In the history of PE-backed groups, BankUnited is one that has been pretty successful," Ryan of Nelson Mullins says. "It is generally viewed as a pretty decent transaction and a good example of a time when private-equity investors would not be disappointed with their investment."

Kanas says his investors are not looking to exit.

"This is monetizing some of the profitability and letting the rest ride. Our investors are very long-term thinkers," Kanas says. "None have given us an indication that they want to get out of it. They had to be convinced to sell even this much."

Blackstone did not return a call for comment, Carlyle deferred to BankUnited and Centerbridge declined to comment. Wilbur Ross, the head of WL Ross, reiterated Kanas' point that the offering is motivated by the desire to have a more traditional shareholder base. Other shareholders were possibly scared away by the overwhelmingly large private-equity presence.

"This will deal with the overhang, which worried some investors," Ross said in an email.

The reduced private-equity interest will likely be welcome news to regulators, too, Kanas says.

"Regulators have always been sensitive to private-equity investors, and this deal brings each of them significantly less than 10%," Kanas says. "We were not pressured, and I don't want to leave you with that impression, but it is well known that they are not crazy about private equity."