-

The federal income tax exemption benefits credit union members and bank customers as credit unions provide a check on banks through their competitive rates and fees.

August 28

Talk about a punch in the gut for community bankers.

Their nemeses, credit union executives, are beating them out for new loans and getting paid a lot more than many bank execs to do it, according to the latest lending and compensation data.

Those realities

"Fighting the credit unions' tax-exempt status is like trying to outlaw apple pie," David Hanrahan Sr., the president and chief executive of Capital Bank of New Jersey, said during a recent meeting in Washington hosted by the American Bankers Association. "It isn't going to happen."

They find the pay differentials especially galling.

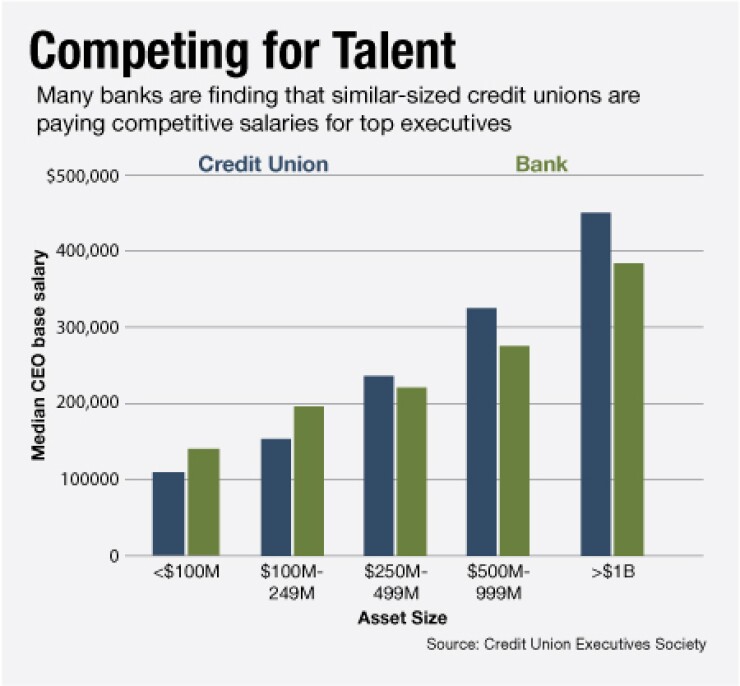

Credit unions with $250 million or more in assets are paying CEOs more than banks of similar size,

"Credit unions are paying their folks more than two times what I pay mine," Jeffrey Mozena, president and CEO of Premier Financial in Dubuque, Iowa, said during the meeting. "In many ways, we are losing to hyper-competitive credit unions," including performance, staffing and customer satisfaction.

Mozena discussed a recent visit he made to the Securities and Exchange Commission, where his son was an intern, in which he found a credit union branch in the agency's lobby. (The Federal Deposit Insurance Corp. and Federal Reserve System have their own credit unions, and employees of the Office of the Comptroller of the Currency share the same credit union with the Treasury Department, SEC and other workers.)

Meanwhile, loan growth at banks seems to be lagging.

Total credit union assets at Sept. 30

"On balance, our forecast shows annual gains averaging 6.5% through 2015," Colby said.

At June 30 loans at small banks grew at a 4.7% annual rate while they increased less than 1% at big banks, according to data from the Federal Reserve Board.

Competition is fierce for commercial loans. "We're seeing more activity from credit unions," says Susan Still, president and CEO at HomeTown Bankshares (HMTA) in Roanoke, Va., including a credit union that fought for a $5 million project.

Expansion is going beyond just making loans. R. Van Bogan, the chairman of Florida Bank of Commerce in Orlando, expressed concern that CFE Federal Credit Union, a $1.4 billion-asset institution in Lake Mary, Fla., had

Bankers say it is difficult to compete on price, and many say they are unwilling to compromise on credit standards. Many are content to let their trade groups

Community Bank & Trust, a unit of QCR Holdings (QCRH) in Moline, Ill., has simply tried to spread the word that, as tax-exempt organizations, credit unions are not doing their part to boost the community, said Stacey Bentley, the bank's president and CEO. "We are seeing ridiculous prices and less underwriting [discipline] from credit unions," she said.