-

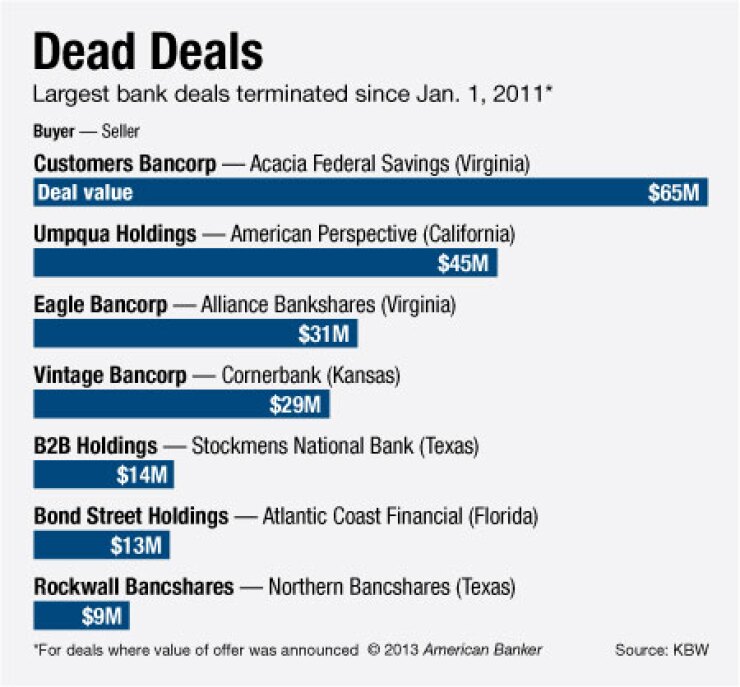

The proposed sale of Atlantic Coast Financial in Jacksonville, Fla., did not sail with investors. Shareholders rejected Bond Street Holdings' $13.1 million, or $5-per-share, offer on Tuesday.

June 11 -

Shareholders who hoped proxy firms ISS and Glass Lewis would help them decide on Bond Street's controversial $5-per-share offer for Atlantic Coast Financial in Florida are out of luck: ISS says "aye," while Glass Lewis says "nay."

June 7 -

They have spent the last few years building mass through acquisitions, but AmericanWest Bank and First PacTrust Bancorp are now shedding the nonessential parts.

June 5

Atlantic Coast Financial (ACFC) shareholders are hoping to be on the right side of history.

Their 55%

Now the hard part begins. By rejecting the deal, the shareholders made a defiant bet that they can find a successful plan B. Rising investor activism means more bank shareholders will be forced to make such choices, and they have to make sure they understand the consequences of their actions.

"You have to be careful what you wish for," says V. Gerard Comizio, a partner at Paul Hastings. In considering rejection of an offer, shareholders have to ask: "What are your chances of raising capital? What are the chances that there is another deal out there?"

Atlantic Coast and Bond Street declined to comment for this story. In separate press releases each consented to shareholders' wishes. Bond Street said it would move forward with other opportunities to deploy its capital, while Atlantic Coast said it will begin evaluating strategic alternatives including a possible recapitalization.

Sidhu, who is the former chairman of Atlantic Coast and heads Customers Bancorp (CUBI) in Wyomissing, Pa., says he will participate in any kind of recapitalization. But he declined to say how he thinks it would be structured or the amount the $784 million-asset company would need to raise.

Atlantic Coast had said it needs about $35 million to fix its problem credits and satisfy regulatory orders for more capital.

Sidhu called for an overhaul of the board and management, including the replacement of President and CEO G. Thomas Frankland, before the capital is sought.

"There is no question in my mind, that in a few weeks we will have a reconstituted board and new CEO," Sidhu says, adding that regulators would need to approve the changes. "And within 90 days, we will execute on the orders of the regulators to raise capital."

Bank advisors differed on Atlantic Coast's odds of success. However, they agreed that the shareholders have picked the tougher path. There is more money out there, but it takes more work to raise and requires sacrifices, they warned.

"Capital raising for community banks is getting better but not easier," says Lee Bradley, senior managing director of Community Capital Advisors, an Atlanta firm that has helped a dozen community banks raise $122 million since late 2008.

The pool of investors has changed.

While the big funds are gone, more accredited investors and small bank funds those who invest $500,000 to $1 million are showing interest in banks, Bradley says.

Meanwhile, Atlantic Coast shareholders who were appalled by the $5 offer, which roughly equaled a third of Atlantic Coast's stated book value, should expect any kind of capital raise to be highly dilutive.

"You take some dilution if you think it is going to get you somewhere better in a few years," Bradley says.

Atlantic Coast executives will have to be prepared to make substantial changes to get capital.

One firm, which asked not to be named, said it has begun preliminary due diligence on Atlantic Coast for a client, and in step with Sidhu says the client's investment would likely be hinged on a "dramatic change" to the board and management.

The business plan might also be changed. Several recapitalizations over the last few years have also

"Investors want a business plan that is not plain vanilla. They are looking for something that has a different type of revenue stream," says Byron Richardson, a consultant with Bank Resources in Atlanta. "My gut reaction is that [Atlantic Coast shareholders] should have taken the money; it was a sure thing."

Another capital advisor, who holds a tiny position in Atlantic Coast and didn't cast his vote for the deal, endorsed the gamble.

"They are in a good market and could potentially be attractive to some people," says Joe Maloney, a senior vice president at Banks Street Partners in Atlanta. "I don't think they are crazy to try their luck and raise additional capital, work through the problems, get growing again and hopefully realize a better return down the road."