-

PNC Financial Services Group Inc.'s (PNC) first-quarter profit fell 3.8% as the lender saw higher noninterest expense, masking a sharp decline in credit-loss provisions.

April 18 -

Click on individual bank names in the table below to access American Banker's coverage of each company's earnings report. Links to relevant coverage, filings, releases, and bank benchmark profile data can be found in the Related Links area of each article.

April 24 -

PNC Financial Services Group Inc. intends to open as many 60 branches and will substantially increase its sales force this year as it looks to strengthen its presence in the Southeast and take advantage of market disruption to add new clients throughout its 15-state footprint.

March 9 -

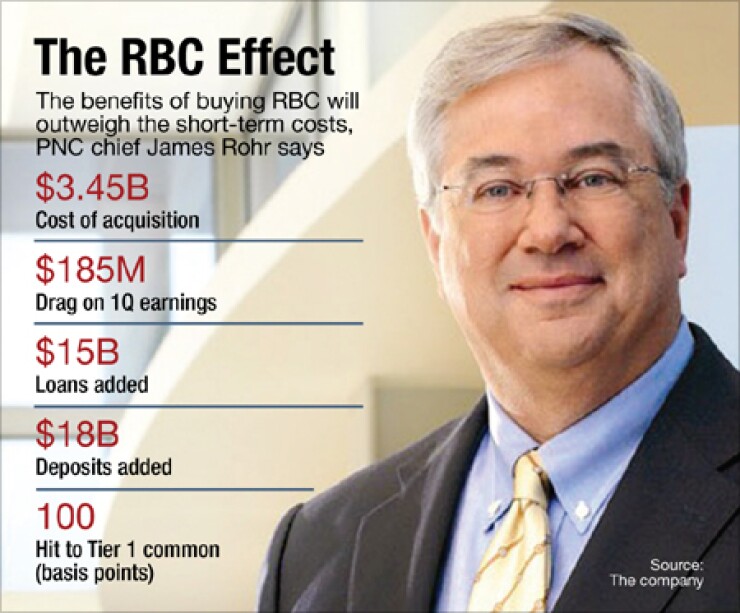

PNC CEO James Rohr said more deals are possible after it completes the acquisition of RBC USA, but he vowed to be "very judicious" and said PNC could open new branches where needed.

January 18 -

With its deal for RBC Bank nearing completion, PNC takes a big step toward goal of reducing overhead by $150 million by early 2013.

January 9

Don't let the headline numbers fool you — we like the deal.

That was the message executives of PNC Financial Services (PNC) sought to send Wednesday about the company's

Yes, they acknowledged, the acquisition dragged down earnings. Profits fell 2.5% to $811 million ($1.44 per share) from a year earlier, the Pittsburgh company

But PNC's executives played up RBC's prospects for adding to earnings this year (40 cents a share for the full year, excluding integration costs), its immediate boost to revenue and loans and the fertile ground for cross-selling PNC services that RBC had lacked.

"The product set that they had was very narrow and to some extent antiquated," Chairman and Chief Executive James Rohr said in a conference call with analysts. "The cross-sell initiatives are already underway."

Interest in treasury management services has been strong already, and PNC has developed a "substantial" pipeline of corporate and institutional business, Rohr said.

To that point, PNC plans to hire 200 people in corporate institutional and asset management over the next nine months in the Southeast, officials said Wednesday. Previously on the jobs front, it had announced plans

PNC gained 900,000 customers and more than 400 branches in North Carolina, Florida, Alabama, Georgia, Virginia and South Carolina from RBC.

Overall, Rohr said the acquisition is "off to a great start" and that he sees tremendous opportunities for PNC to grow in these markets.

He cautioned, though, that based on PNC's experience with absorbing National City in 2009 that it could take two to three years before the full potential can be realized across all business lines.

If anyone doubted that the RBC acquisition is important to PNC, they had to take the hint Wednesday. PNC referred to RBC more than 40 times in its 18-page press release, and Rohr spent a third of his nine-minute opening address playing up the benefits of the acquisition.

Among the benefits the company cited:

• It added $17 billion of loans from the previous quarter, $15 billion of which were from RBC.

• Net interest income for the first quarter increased 4%, to $2.3 billion, compared with the fourth quarter, thanks partly to those RBC loans.

• Its nearly 10% deposit growth, to $206 billion, came almost exclusively from the $18 billion of deposits it inherited from RBC.

• Nearly 75% of its $12.3 billion increase in commercial loans from the prior quarter came from RBC.

• Nearly 90% of its 517,000 new checking accounts came from RBC.

However, there were costs, too. Besides the integration and operating expenses, PNC's nonperforming assets increased 6%, to $4.4 billion, from yearend partly because of foreclosed properties inherited from RBC.

There were capital consequences, too. The company reported that its a Tier 1 common equity ratio fell 100 basis points, to 9.3%, from three months earlier as a result of the acquisition.

And, as with any deal, there were some surprises. "The gap between the RBC product offerings and our product set was larger than we had anticipated," Rohr said, noting, for example, that RBC customers did not receive online statements.

Officials stuck to previous projections of a 19% internal rate of return from the acquisition and $230 million of annual savings on RBC operations by next year. They said the deal was immediately accretive to profits and could add 40 cents per share this year excluding expenses; that EPS forecast was more upbeat than originally expected, officials said.

Meanwhile, Rohr deflected questions from analysts fishing for any news about plans for new deals.

"What we are looking at right now is really building out the RBC franchise" and taking further advantage of the National City acquisition, Rohr said. In the Southeast, PNC will be primarily focused on building a relatively small number of branches and hiring a lot of talent, he said,