-

The embattled Lansing, Mich., company announced earlier this week that it had entered into agreements with two units of ValStone Partners, a private-equity firm in Birmingham, Mich.

October 5 -

Dealmakers have been pushing bankruptcy recapitalizations for a few years. The time may now be ripe with credit quality improving while debt loads linger.

August 21 -

The Lansing, Mich., company has turned to court to try and recapitalize itself. The move would leave all existing stakeholders with a 53% equity stake in the company. Capitol, meanwhile, is still searching for an investor to take the other 47%.

August 10 -

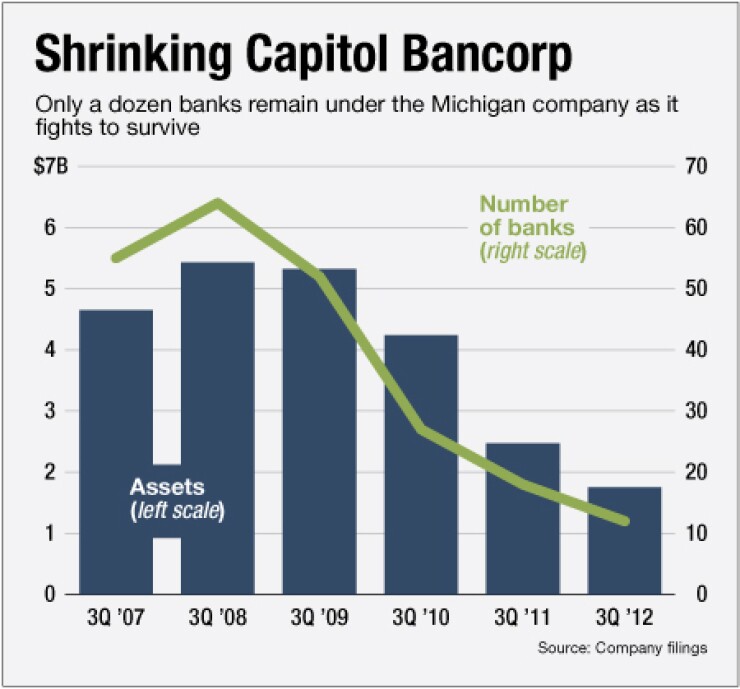

The Lansing, Mich., company has turned its inventory of community banks into a garage sale to bring in capital to support its struggling banks. With fewer banks left to sell, industry observers say Capitol has few options to keep capital levels above regulatory minimums for failure.

April 6

Capitol Bancorp (CBCRQ) has skillfully avoided collapse for several years, but the next few weeks could provide the biggest tests to its survival.

The Lansing, Mich., company's recapitalization — and perhaps its fate — lies in the balance on two key December dates. A bankruptcy confirmation hearing is set for Dec. 4, though the court session has already been pushed back twice, indicating to some industry observers that Capitol is struggling to find the equity necessary to make the plan work.

A more ominous deadline is set for Dec. 20. That is when the New Mexico Regulation and Licensing Department reserves the right to shutter the company's Sunrise Bank of Albuquerque unless Capitol addresses the bank's capital woes.

Unfortunately for Capitol, bankruptcy protection does not prevent a regulator from closing a bank, banking lawyers say. Given regulators' ability to charge related banks for a failure, the seizure of the New Mexico bank could be enough to pull Capitol under.

"You'll often hear in non-banking contexts that bankruptcy allows companies to enjoy the protection of the automatic stay," says Rob Klingler, a partner at Bryan Cave in Atlanta. "The bankruptcy of a bank holding company does not limit in any way the state regulators or the OCC from closing a bank."

Industry observers expect bankruptcies of banking companies, through asset sales or reorganizations,

Bankruptcy attorneys also note that complications may arise when banking companies file for bankruptcy without the necessary levels of new equity lined up.

"In at least a couple of cases, debtors have attempted to obtain confirmation first, and seek required capital later," says Van C. Durrer 2nd, a partner at Skadden, Arps, Slate, Meagher & Flom. "This obviously puts pressure on their ability to prove the feasibility of their exit from Chapter 11."

Durrer says he is not overly familiar with Capitol's case, but he was a part of a team involved in the 2010 bankruptcy of AmericanWest Bancorp and the related auction of its AmericanWest Bank.

The $1.75 billion-asset Capitol

In October, ValStone Partners, a private-equity firm in Michigan,

Representatives for Capitol did not return calls for comment, but the company noted in its quarterly filing with the Securities and Exchange Commission on Nov. 14 that securing outside capital was important to its turnaround.

"The anticipated equity infusion … is a critical component of the likelihood of success" of the reorganization, the filing said. "If Capitol is unable to raise capital from new investors, or raise less than the amount currently anticipated, it may be forced to operate in the Chapter 11 cases for an extended period."

Capitol has other banks that are in danger of possible seizure. The company also disclosed in its regulatory filing that Central Bank of Arizona, Sunrise Bank of Arizona and Pisgah Community Bank were critically undercapitalized at Sept. 30, with leverage ratios "below 2% before rounding to the nearest one-hundredth."

Such a classification gives regulators the legal authority to close banks, but Capitol said it plans to push the banks' ratios above the threshold by the end of this month. It would do so with the proceeds it expects from selling High Desert Bank in Bend, Ore.

Capitol has relied on a

The company's financial condition improved modestly in the third quarter; its quarterly loss of $5.7 million compared to a loss of $22.8 million a year earlier. Nonperforming assets fell 26% from the end of last year, to $231.8 million.