-

The Office of the Comptroller of the Currency has dismissed one of the consultants overseeing a massive foreclosure review after it discovered a conflict of interest in outside work the company has performed.

May 11 -

More than a month after federal and state officials announced a massive $25 billion settlement with the five mortgage servicers, the Justice Department on Monday finally released the actual legal document. The document dump provided critical new details about the terms of the agreement.

March 12 -

After months of investigation, federal banking regulators issued a final cease and desist order against the 14 largest servicers that will require them to overhaul their operations.

April 13

WASHINGTON — The Office of the Comptroller of the Currency "underestimated" the risk of poor foreclosure practices at national banks and did not devote enough examination resources to identify those problems, according to the agency's chief watchdog.

The Treasury Department's inspector general said while the OCC focused on loan workout policies at major servicers, its supervision from 2008 through 2010 was "not sufficient in scope or application to identify significant weaknesses in national banks' foreclosure documentation and processing functions."

"During this time OCC did not consider foreclosure documentation and processing to be an area of significant risk and, as a result, did not focus examination resources on this function," said the report, which was posted Friday.

The OCC has been monitoring compliance by 14 large servicers with last year's consent orders calling for improvement in their foreclosure processes. The orders required servicers to use independent consultants to gauge how many borrowers were affected by foreclosure problems.

But the IG report indicates that the foreclosure documentation and processing at the heart of the so-called "robo-signing" scandal was not high on the agency's agenda in the midst of heightened mortgage defaults. "Instead, OCC examination procedures were focused on loss mitigation and modification processes designed to prevent foreclosure," the report said.

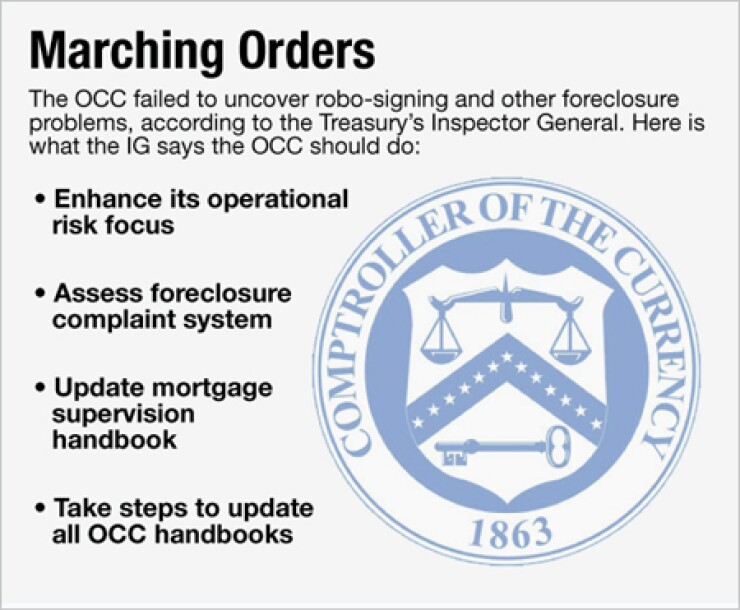

The report recommended the agency continue initiatives meant to improve supervision of banks' "operation risk"; determine if more effective coding of foreclosure-related complaints are necessary; update its mortgage banking supervision handbook; and develop ways to update OCC handbooks.

"Mortgage banking has changed significantly since the last handbook update with a greater emphasis on asset securitization and the proliferation of new mortgage products such as option ARMs and subprime mortgages, not to mention the more current increases in delinquency and foreclosure rates," the IG said.

In addition to an outdated handbook, the IG also cited the impact of state laws on foreclosure practices as among the potential reasons for the agency's not identifying key risks sooner.

"Since the expertise of most OCC examiners lies primarily in issues of safety and soundness and compliance with federal laws and regulations rather than state laws and regulations, the degree of risk associated with foreclosure documentation and processing was not fully appreciated by the examiners," the report said.

In a lengthy response letter included with the report, Comptroller of the Currency Thomas Curry generally agreed with the watchdog's recommendations. He noted several efforts already underway to improve supervision of foreclosure operations, including steps to enhance the focus of examiners on operational risk, guidance issued to banks and examiners on changes in the mortgage industry and a new manual addressing the updating of OCC handbooks.

"As we have publicly testified, a variety of factors contributed to a focus by the OCC on aspects of mortgage servicing that were viewed as presenting higher risk than foreclosure documentation and processing," Curry wrote in the May 15 letter.