Five years ago, SunTrust Banks Inc. was a low-profile, mortgage-heavy underperformer that seemed primed for takeover by a bigger competitor.

Enter a new chief executive, considerable cost-cutting and reorganizing and the Atlanta company has emerged as … a low-profile, mortgage-heavy underperformer still viewed as a takeover target.

SunTrust can rebound, but many wonder whether it will do so in time to overcome stiffening competition in the Southeast — or before a suitor arrives.

Complicating matters is a protective corporate culture that stymies outsiders who want a better look under the hood, particularly at its handling of restructured mortgages and plans to exit the Troubled Asset Relief Program.

SunTrust, the biggest bank still participating in Tarp, has posted losses of more than $2 billion in the last five quarters — a trend that is expected to continue when the company reports its first-quarter results next week.

Adam Barkstrom, an analyst at Sterne Agee & Leach Inc., describes SunTrust as "stuck in the mud."

"In many ways their hands are tied," he said. "It may be two years out before we see any sustained momentum, and there is a lack of specifics and a lack of visibility from management for sure."

A spokesman for the $174.2 billion-asset company would not comment for this story and declined requests to interview executives.

SunTrust shares have been rising steadily — trading around their 52-week high Monday — as speculation grows that it could be a target for big foreign banks such as Barclays PLC or Royal Bank of Canada that are said to be interested in expanding in the U.S.

Credit Suisse's Stephen Moss further stoked that fire by mentioning the possibility in a note to clients last week.

SunTrust has some attributes that comfort Wall Street, such as a low concentration of commercial real estate loans (13.3% of total loans at yearend 2009, compared with 20% to 30% at other regionals); solid expense control; and a branch network built around markets such as Washington, Atlanta and key Florida cities that many believe will thrive over the long term.

But many are worried SunTrust will remain distracted as it works through its sizable mortgage portfolio, built up from 2005 to 2007. Analysts say SunTrust's concentration of lower-yielding mortgages is one reason its margins have lagged other regional banks.

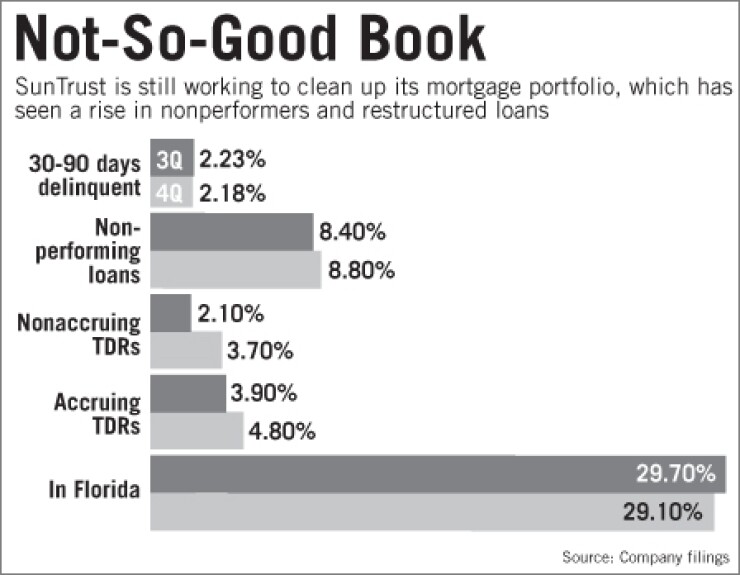

Roughly 27% of SunTrust's $113.7 billion loan book at the end of 2009 was in mortgages, and 29% of those loans were in Florida. A related concern is the growth of the company's reserve to repurchase from Fannie Mae and Freddie Mac mortgages that might default. In the fourth quarter, SunTrust increased its repurchase reserve by 63%, to $199.9 million.

Todd Hagerman, an analyst at Collins Stewart, said he expects such reserving to subside. "For now it is a potential liability," he said. "It definitely accelerated in the second half of 2009 as they were certainly playing catch-up, but I think the putbacks from [Fannie and Freddie] are declining."

Barkstrom also discussed the lack of visibility for SunTrust's troubled debt restructurings for mortgages. He said it has been difficult to get the company to discuss the redefault rates on TDRs.

"SunTrust thought they were playing it safe" by pursuing scale in mortgages, Barkstrom said. "We all thought that. The problem was that they really put a lot of eggs in that basket."

SunTrust disclosed in its annual filing with the Securities and Exchange Commission that 8.8% of its mortgage book are nonperforming loans. Roughly 2.7% of its mortgages are TDRs in nonaccruing status.

All this is happening against a backdrop of heightened competition in the Southeast, with BB&T Corp. and Wells Fargo & Co. already having left Tarp. (Wells entered the region through its December 2008 acquisition of Wachovia Corp.)

SunTrust CEO James Wells 3rd has been reluctant to talk about when it will repay the $4.85 billion it owes the Treasury Department.

"We are proceeding through an orderly pace to repay … in such time that it makes sense for us, for our regulators and for our shareholders," Wells said at a Citigroup Inc. conference in March. "The ultimate outcome and timing of this process is not something I'm prepared to comment on any further."

Hagerman said SunTrust could raise the needed funds by selling stock this quarter. Asset sales could be another part of the strategy.

On Monday, SunTrust said it is in talks to sell parts of its RidgeWorth Investments unit, though it said there is "no certainty a transaction would be consummated" and that a sale would not have a "significant" effect on financial results.

But asset sales are a double-edged sword.

Richard Bove, an analyst at Rochdale Securities, said in a report Monday that selling assets would reduce SunTrust's opportunities to increase revenue and attract new business.

Another unresolved issue is management succession, though SunTrust seemed to tip its hand strongly last month when it added oversight of investment banking to the wide-ranging duties of William Rogers Jr., who had already been named president in December 2008.

Rogers, 52, joined SunTrust in 1980 and has slowly been consolidating power since becoming the head of wealth and investment management in 2000. In December 2004, he added oversight of mortgages and commercial lending.

Wells, 63, has given no indication that he is preparing to step aside, and analysts said they are not convinced that such a move is imminent.

"Clearly they are preparing for Jim's retirement," said Albert Savastano, an analyst at Macquarie Research. "I'd be surprised if it were to happen at the end of this year. I would expect him to retire at 65."

To be sure, some see opportunities for a company that has quietly made changes since Wells succeeded L. Phillip Humann in January 2007.

Wells liquidated much of SunTrust's long-standing holdings in Coca-Cola Co., also of Atlanta, to raise capital. He also launched an aggressive expense-cutting initiative and has started to shrink SunTrust's balance sheet.

Another positive is the low concentration of CRE.

"Few people recognize" that SunTrust has such low CRE levels, Hagerman said. "There is still a fear among some investors that they will have a late-cycle correction there … but their CRE has performed relatively better than their peer group. We expect that to continue."

Savastano touted a "more intense focus on execution" at the company. "The focus now must be on revenue and getting the balance sheet right."

Specifically, he said SunTrust is entering the perfect environment to balance its ratio of loans to customer deposits, which stands at roughly 135%. That should improve margins.

SunTrust is in a position to be choosy about the loans it originates.

"They're getting better pricing on their products without taking on much risk," Savastano said.

Kevin Fitzsimmons, an analyst at Sandler O'Neill & Partners LP, said he believes "the long-term thesis for SunTrust is on track" as the company gets a better handle on credit and finds ways to expand its margin.

Still, Fitzsimmons — who downgraded SunTrust to "hold" from "buy" last week on the run-up in its stock — predicted it will not return to profitability until the fourth quarter.