Starbucks Corp. is bucking conventional wisdom by introducing a mobile payment app for BlackBerry smartphones.

Experts say that Android is the hottest smartphone for mobile banking, but when it comes to payments, the Seattle coffee retailer, which released its newest app Wednesday, hopes there is still a big opportunity in the increasingly neglected BlackBerry.

Starbucks was an early player in mobile payments, and has repeatedly made counterintuitive moves. By developing an app for Research In Motion Ltd.'s devices at a time when most banks are focused on Apple Inc.'s iPhone or phones that use Google Inc.'s Android operating system, Starbucks appears to be acknowledging that people who might want to use their phones for purchases often carry company-issued BlackBerrys.

"When you look at the Starbucks customer base … it was pretty clear to me that I had to go to BlackBerry," said Chuck Davidson, the category manager for innovation on the Starbucks card team.

Between the new Blackberry app and its existing iPhone app, Starbucks now has a mobile payment system that can be used by 70% of the smartphone users in its customer base, Davidson said. (He would not break down the numbers further to say how many use each platform.)

In cities, office workers swarm Starbucks stores between 8 and 10 a.m., then again at 2 p.m. for their afternoon break. Especially during this later period, they may not want to drag along the purses or briefcases where they keep their wallets but might bring BlackBerrys to stay connected, he said.

Much of the adoption of the iPhone app came from these office workers, who have showed off its capabilities either on coffee breaks or back at the office, Davidson said, and this led to a faster adoption among office workers than Starbucks originally anticipated.

Since Starbucks introduced its iPhone app last September, users have been requesting a similar app for BlackBerry, Davidson said. Feedback could guide its next move as well. "If our customers tell us to develop Android, we'll develop Android," he said.

George Tubin, a senior research director at TowerGroup, said BlackBerry is "losing market share because things like Android are taking over and showing tremendous growth, but if you look at pure numbers, BlackBerry is still the leader."

Second-quarter data from Nielsen Co. published last month shows that, though iPhone and Android phones each have a growing share of the smartphone market, BlackBerry is tops, used by 35% of smartphone owners. The iPhone has a 28% share, and Android 13%.

Banks that have offered apps for all three major smartphone platforms "tend to see much lower take-up on BlackBerry," Tubin said, but "there's just such a high penetration in the business environment" by BlackBerry that "it probably makes sense for Starbucks to release a BlackBerry app" ahead of Android, he said.

Starbucks' mobile payment app for the iPhone lets people link its prepaid cards to their phones, then use the phone to make purchases by bringing up a bar code on the screen that can be read by special scanners at the register. Users can also reload their prepaid cards from within the app.

With very little marketing of its iPhone payment system, which was designed by mFoundry Inc., Starbucks got massive word-of-mouth promotion.

Drew Sievers, mFoundry's co-founder and chief executive, said that developing apps for BlackBerry is generally more difficult than for Android; Starbucks would not pursue the BlackBerry app unless it was serious about reaching that market. The coffee company "knows a lot about their customer base," he said.

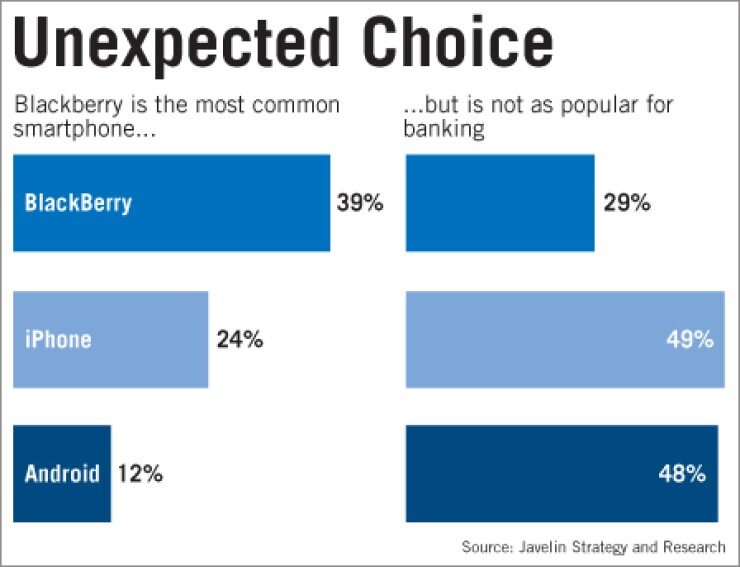

Though BlackBerry may be the most common smartphone, people with other phone brands are more likely to use them to manage their bank accounts. A March survey by Javelin Strategy and Research found that 49% of iPhone users and 48% of Android users said they had used mobile banking in the preceding 90 days but that 29% of BlackBerry users said they had done so. The same report had similar results regarding market share as Nielsen.

Starbucks has a history of marching to a different drummer than other players in mobile payments. Many payments companies are focused on putting near field communication chips in phones. For example, Bank of America Corp., Wells Fargo & Co. and U.S. Bancorp are beginning trials this year of an NFC-enabled memory card for phones supported by Visa Inc. But Starbucks favored the software approach with bar codes.

Because Target Corp. uses a similar system for its own prepaid cards, Starbucks was able to rapidly expand its payment trial in April to the 1,000 Starbucks stores that are built within Target stores and thus have access to Target's bar-code readers.

Also, whereas NFC payments can reduce the time it takes for each transaction at the point of sale, Starbucks' app focuses on reducing the number of transactions customers make at the point of sale. For example, they can reload their prepaid cards on the phone, while waiting in line, so that they need not make an extra transaction at the register.