-

Don't Look at UsThe turmoil at the Irvine, Calif., subprime lender New Century Financial Corp. has been felt in financial markets around the world, and in Dunn, N.C. — population 10,000.All the headlines about the troubles at New Century, whose stock was delisted Tuesday by the New York Stock Exchange, have forced John Q. Shaw Jr. to issue two press releases in the past week to tell uneasy customers and investors that his $554 million-asset community banking company, New Century Bancorp, is not the California subprime lender.

March 16 - Texas

It is getting to be a familiar refrain: A small bank builds a name for itself in its hometown, only to have a bigger, out-of-state bank with a similar moniker move in, setting the stage for a battle over the rights to the name.

March 6 -

Dr. Stephen Liu likes to compare the bank he co-founded six years ago to a tomato.

August 11

Guaranty wants you to know that it just raised $59.1 million in private capital and it isn't doomed.

That's Guaranty Bancorp Inc. in Denver. Not Guaranty Financial Group Inc., the Austin company that has said its failure is imminent.

With their similar names, it is easy enough to confuse the two, as Coloradans recently did when reading about the Texas Guaranty's woes — sending the Denver company into a defensive mode.

On Tuesday, The Denver Post ran a short item from the Associated Press under the headline "Guaranty group says it's in danger." The item reported that the Texas lender was working with federal regulators to find buyers, that it would not file second-quarter results on time and that it had warned about its ability to continue as a going concern.

Though those details were accurate, the item did not mention that the ailing Guaranty was unrelated to the Colorado company or its Guaranty Bank and Trust.

"There is no other Guaranty in this market. We received tons and tons of calls from worried and concerned customers," said Paul W. Taylor, the chief financial and operating officer of the $1.9 billion-asset Guaranty in Colorado. "People read that and related it to us."

Since then, the Post updated the item on its Web site to draw out the distinction. "The editor didn't put the connection together that Guaranty Bank might be mistaken for Guaranty Bank and Trust. … We didn't realize it until the company called us," said Steve McMillan, the paper's business editor. "I wish we would have had that in there. It would have been helpful to our readers and to their customers." McMillan said the paper also ran a short follow-up story "explaining who Guaranty Financial is and who Guaranty Bancorp is."

Nevertheless, Guaranty of Denver has sprung into action. The company issued a press release Wednesday and put a "news alert" link on its Web site emphasizing that it has no connection to the Guaranty in the Lone Star State. Further, Taylor said that it has instructed its staff to call borrowers and depositors.

"Some of our depositors are already a little gun-shy following the failure of New Frontier" in Greeley, Colo. on April 10, "so we are just trying to mitigate any issues," Taylor said. "We want our customers to know we are a strong bank. We just raised $59 million. No way are we related. We don't even know these guys."

Jeffry Pilcher, the president of ICONiQ, a bank branding firm, said such confusion is common and could be sidestepped if banks put more effort into picking a name that sets them apart.

"I always tell banks not to pick a generic, financial-sounding name," Pilcher said. "There are a lot of reasons why you shouldn't share your name, and one of them is so that you don't have to bear the burden of allowing someone to taint your brand by accident."

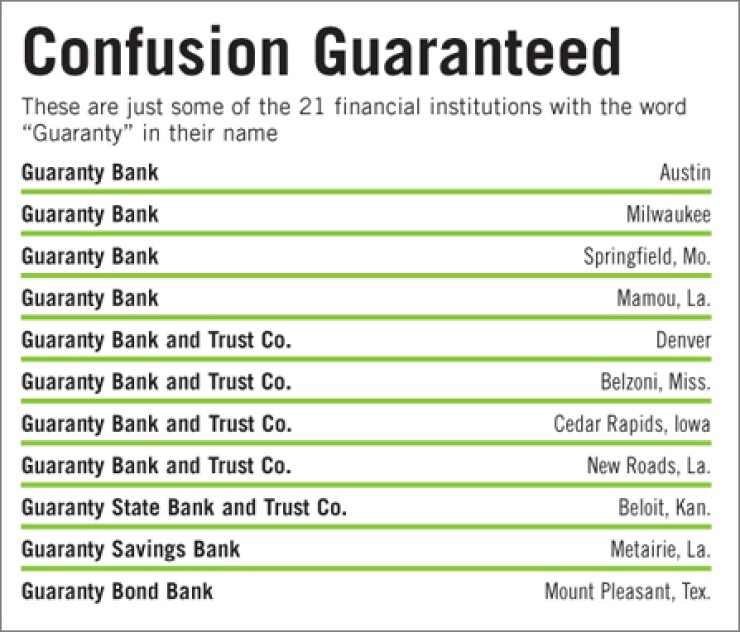

The Federal Deposit Insurance Corp. shows that 21 institutions have the word "guaranty" in their names; the Austin and Denver companies are the largest.

Taylor said that this mess could prompt a name change. "Clearly, we are thinking about it now."

Other banks have had similar public relations conundrums. Four banks around the country are named Heritage Community Bank, also the name of a Glenwood, Ill., institution that the FDIC seized in front of a camera crew from television's "60 Minutes" in February.

Peter Kenny, the president and chief executive of Heritage Community Bank in Randolph, N.J., said the "60 Minutes" piece provoked about a dozen calls when the segment first ran and an additional handful the second time it aired. He told all his staff to inform customers that there was no connection, Kenny said, but also took it upon himself to talk to every concerned customer.

"I thought the piece was presented fairly and helped calm depositors' fears around the country, but they failed to mention that there were other similarly named banks," Kenny said, adding that his hands-on approach to dealing with concerned customers resulted in no dip in deposits.

Pilcher said he liked the way Guaranty of Denver is handling the misconception and said it could use the coincidence to its advantage. "I love the phone call idea. That is a classic example of turning a negative into a positive," he said. "They could use this as an opportunity to talk up services and their condition."

Steven Reider, the president of Bancography, a consulting firm, said Guaranty of Denver is taking the right steps because misinformation could lead to an outflow of deposits from the wrong bank, or worse. "You can never be too cautious when it comes to mitigating this kind of risk because once you get a line in the lobby, it grows to a line out the door," Reider said.

Guaranty of Colorado is not without its own blemishes. It reported a second-quarter loss of $10.8 million, compared to earnings of $2 million a year earlier, as its provision for loan losses grew more than 20-fold from a year earlier, to $18.6 million.

However, its recent raising of capital from a consortium of private-equity firms, including Patriot Financial Partners LP and Castle Creek Capital Partners, put it in a strong capital position. On a pro forma basis, the infusion raised the company's total risk-based capital from 10.73% at the end of the second quarter to 13.79%.

"There is no reason to compare the two," said Jonathan D. Elmi, an analyst at Fox-Pitt, Kelton Cochran Caronia Waller. "Literally, other than their names and the fact that they are both banks, they couldn't be more different."