Two years ago, when GreenPoint Financial Corp. was shopping itself, one of the biggest hurdles it faced was the shrinking value bidders put on its sizable mortgage business.

Now the company that bought GreenPoint, North Fork Bancorp of Melville, N.Y., is selling itself to Capital One Financial Corp. of McLean, Va., and the mortgage business - while still under some pressure - has turned into a selling point.

The $14.6 billion deal, expected to close in the fourth quarter, would help both companies deal with strategic challenges.

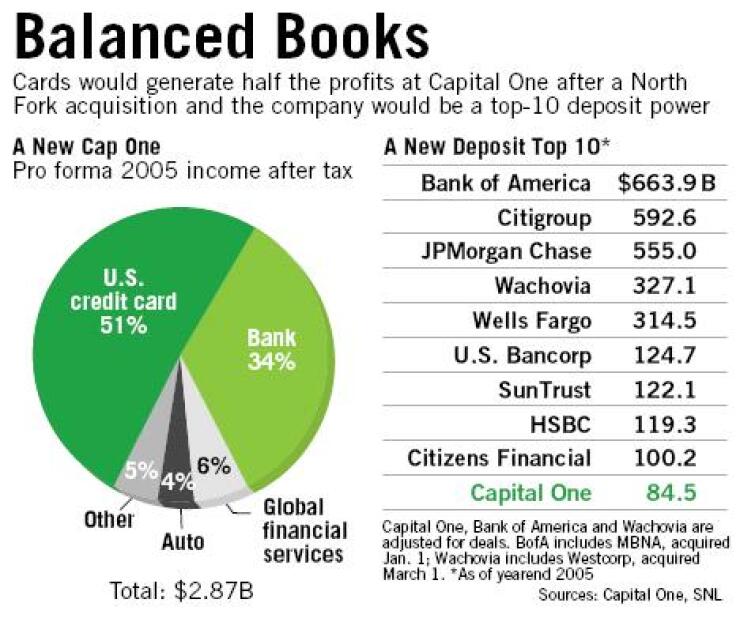

It would help North Fork chairman, president, and chief executive John A. Kanas address the increasingly deleterious effects of the rate environment. The deal would also further the effort by Capital One chairman, president, and CEO Richard Fairbank to diversify his company, once a pure-play credit card issuer, into one that generates about half its profit from cards. The deal would increase its banking revenue percentage to 34%.

"We are now a top 10 bank in the U.S., and … we are truly diversified," he said in an interview Monday, a day after he unveiled his deal.

Mr. Kanas said during the same interview that Capital One would provide "the asset generator" his company needs to withstand an inverted yield curve.

Industry observers said that North Fork had been shopping itself for up to two years.

Whatever the time frame, Ben A. Plotkin, the chairman of BankAtlantic Bancorp.'s Ryan Beck & Co. Inc., said that Mr. Kanas' decision to sell now may send a signal to others, given his stance as an opinion leader in the banking industry.

"This will have an impact on the broader market," Mr. Plotkin said in an interview Monday afternoon.

Mr. Kanas provided few details on the decision to sell, but he did say he negotiated one-on-one with Mr. Fairbank. "We didn't discuss this with anyone else," he said. With respect to timing, he said: "This was not something that jumped out of the box a week ago. I've had plenty of meals and rounds of golf with Richard over the years."

He also cited strategic benefits for the pairing with Capital One rather than another commercial bank, noting that at a recent conference he had said he expected the conventional wisdom on bank mergers would change "and that the old saw of taking two banks and combining them may not be any more efficient .… Embedded in this transaction are some brilliant elements that were better than putting more banks together."

In a conference call to discuss the deal, Mr. Fairbank said he was once reluctant to enter the mortgage business, because of its volatility and margins. However, he said he now believes having a national mortgage platform would be "a very important part of the future success of any company that wants to be an end-game player" in the financial services industry.

Christopher Brendler, an analyst at Stifel Nicolaus & Co. Inc., said that history might have played a role, since Capital One is believed to have been an unsuccessful bidder for GreenPoint, which North Fork acquired October 2004. Mr. Fairbank would not say whether his company had bid on GreenPoint.

During the call, he said that North Fork would provide more than just a mortgage operation and a sizable New York-area branch network - more than 50 of North Fork's 355 branches are located in Manhattan. He also cited it in small-business and middle-market lending.

During the interview, he said Capital One would benefit from North Fork's low-cost deposits - continuing a strategy it used in its November acquisition of Hibernia Corp. of New Orleans - and low chargeoff rates.

Mr. Kanas, 59, would become the president of Capital One's banking operations; J. Herbert Boydstun, also 59, the former Hibernia CEO who is currently leading Capital One's banking division, would report to Mr. Kanas and would oversee Louisiana and Texas as an executive vice president.

Mr. Fairbank, 55, said he could not predict when revenue from credit cards would fall to less than 50%, but Capital One does expect cards to generate just 51% of earnings when his company acquires the $58 billion-asset North Fork. Global financial services would generate 6% of earnings, and auto lending would generate 4%.

Some on Wall Street said the deal was pricey - Capital One would pay a premium of 22.8% over North Fork's closing price Friday, or 15.5 times trailing 12-month earnings.

Christopher Whalen, an analyst at Lord, Whalen LLC's Institutional Risk Analytics, focused on the lack of suitors and questioned the deal's timing. He said in an interview Monday that Capital One could have acquired North Fork "at a cheaper price a year from now."

Mr. Fairbank said during the conference call that the deal was big and "early," since his company is still integrating Hibernia. However, he also said that North Fork provided "a unique opportunity to transform this company."

Observers agreed with his assessment. Sanjay Sakhrani, an analyst at Credit Agricole Group's Calyon Securities, said the deal was "a big step forward" in recognizing that Capital One is emerging as a banking company.

"They're using reverse engineering to … choose the asset classes they want to be in," he said. "Its no longer a company that gets 90% of its earnings from the cards business."

Moody's Investors Service Inc. put Capital One on review for a possible upgrade, because of "the potential benefits" to its financial profile. "The North Fork acquisition would add further to Capital One's growing earnings diversification and further reduce its reliance on earnings from credit cards," Robert Young, a managing director at Moody's, wrote in a note discussing the review.

Fitch Inc. upgraded Capital One's long-term issuer default rating to BBB-plus, from BBB, and removed the company from its Ratings Watch list.

Mr. Fairbank said during the call that Capital One has its "eyes wide open" in dealing with the ultracompetitive New York banking market.

"We're not going to do anything rash," he said. "What we'll do is come in and take an actual look … to figure out what our business model can add."

Capital One would pitch more consumer products at North Fork branches, which, like Hibernia's, would be rebranded. Excluding mortgage operations, just 6% of North Fork's loan portfolio consists of consumer loans.

During the call Capital One executives said that by 2008 it expects $52 million of revenue opportunities from an "enhanced" card business and another $13 million from offering auto loans at North Fork branches.

"I hope that we'll find additional compelling growth opportunities," Mr. Fairbank said.

Mr. Brendler said Monday that selling mortgages to cardholders should be "a lay-up" for Capital One. The only product line missing for Capital One would be student loans, though the company might be content to avoid whole acquisitions until 2008, he said.

By 2008, Capital One plans to cut $110 million of costs, including $30 million in technology, operations, and infrastructure. North Fork has long been recognized as a cost-conscious company; its fourth-quarter efficiency ratio was 41.17%. Also, Mr. Kanas said he expected investments in growth would not slow down.

"We will be more aggressive than in the past with retail banking," he said. "We have plans to add 10 branches next year. We hopefully will open more branches now both in our markets and in contiguous markets. We'll be adding more loan product and more people."

Mr. Sakhrani said he will give Capital One the benefit of the doubt. "This is a big acquisition … so there's a lot of risk, but it seems to me that it makes sense that they can do it."

Capital One said it would incur $580 million of merger-related expenses. The deal would be dilutive to GAAP earnings next year (by 6.5%) and the year after that (1.1%). On an operating basis, it would reduce earnings next year by 4.9% before providing a 0.4% boost in 2008.

The company has shown a willingness to take on risk to further its diversification goals. It delayed and renegotiated the Hibernia deal after Hurricane Katrina hit the Gulf Coast on Aug. 29. Capital One said during Monday's call that the Hibernia integration is on track.