Shout Out to Yodlee

The Case Against Oversharing

Quick Account Openings Get a Nod

Thumbs Up for Gesture Recognition

No More Stupid Emails

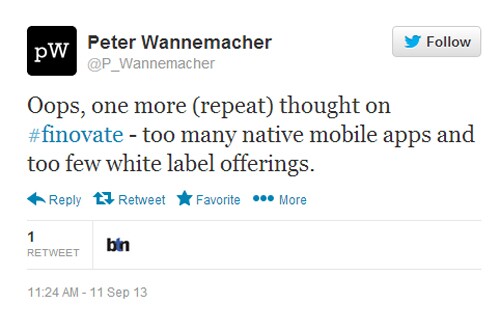

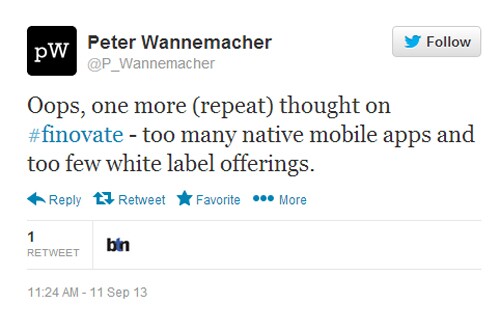

Not Interested in Going Native

Are Banks Really Ready for Biometrics?

The Consumer Financial Protection Bureau and Townstone Financial, a Chicago mortgage lender that it sued in 2020, jointly asked a federal court to vacate a settlement, saying the case should never have been filed.

The firing of National Credit Union Administration board members further erodes the political independence of bank regulators, experts say, in a way that could trickle up to the Federal Reserve.

The Sweden-based payment firm, which recently delayed its IPO due to the trade war, will use Fiserv's Clover point of sale system as it looks to build a market in the U.S. Plus: Payoneer makes a deal in China and other news in this week's global payments roundup.

In internal shakeup, the Office of the Comptroller of the Currency will unify supervision divisions, revive the Chief National Bank Examiner office, and elevate IT oversight as part of a broader streamlining push.

Federal Reserve Chair Jerome Powell warned that actions that undermine the apparent stability of the U.S. economy could have lasting effects on its status as a global safe haven.

The regional bank is offloading a $1.9 billion student loan portfolio in order to focus on its relationships with existing customers, said CEO Bruce Van Saun.