Some are in new roles, some taking their banks in new directions and others most definitely on the hot seat. All eyes will be on these chief executives in the year ahead.

(Image: ThinkStock)

Michael Corbat, Citigroup

Corbat was named CEO in October following the abrupt resignation of Vikram Pandit. The new boss made his first big move in early December when the bank announced it was

Jay Hooley, State Street

Though profitable, State Street has been under immense pressure to get its costs under control, and some investors have publicly questioned whether existing management is up to the task. In the fall, investors demanded that either Hooley or CFO Edward Resch resign, and it was Resch who fell on his sword. Hooley maintains that cost-cutting efforts are on track; State Street is in the midst of a massive tech overhaul that's

Ellen Alemany, RBS Citizens Financial Group

Alemany is

Masashi Oka, Union Bank of California

Union's Japanese-based parent is out to build one of this country's 10 largest banks in the U.S. It's

Kessel Stelling, Synovus Financial

The Columbus, Ga., company is finally making money again after three straight years of losses and it recently unloaded $500 million of bad assets. Its challenge now is to

Dan Rollins, BancorpSouth

When BancorpSouth of Tupelo, Miss., announced early this year that its longtime CEO, Aubrey Patterson, was retiring many analysts thought its days as an independent bank were numbered. That was before the

Michael Tierney, Flagstar Bancorp

Tierney inherited a company in October from Joseph Campanelli that finally returned to profitability in 2012. Still, he will be challenged to

Kevin Cummings, Investors Bancorp

Investors, one of the nation's biggest remaining mutual thrifts, is expected to pursue a second-step conversion in 2013. Doing so would provide a large amount of capital for Cummings, who

Tim Laney, National Bank Holdings

After spending 2012 completing a public offering that integrated some of its previous bank deals, the three-year-old NBH is poised for more acquisitions in 2013. Analysts say the $5.4 billion-asset company

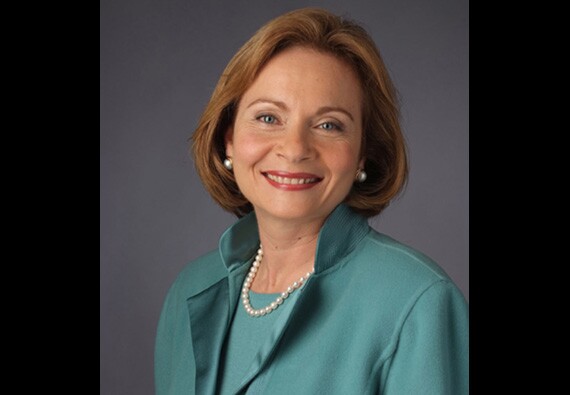

Peyton Patterson, BNC Financial

Patterson famously built NewAlliance Bank into Connecticut's third-largest bank via a series of bold moves before selling it last year to First Niagara Financial Group for $1.5 billion. She's now back as CEO of another small Connecticut thrift with growth ambitions. The question many are asking is