Repossessions Surge

Delinquencies Plummet

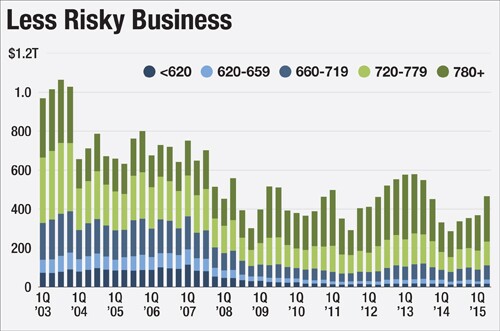

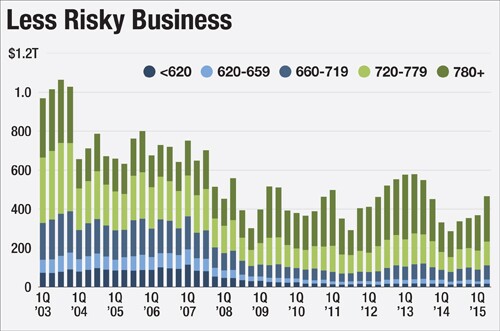

Lenders Still Shun Subprime Borrowers

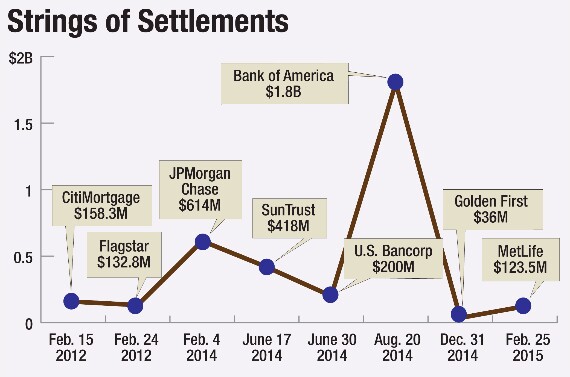

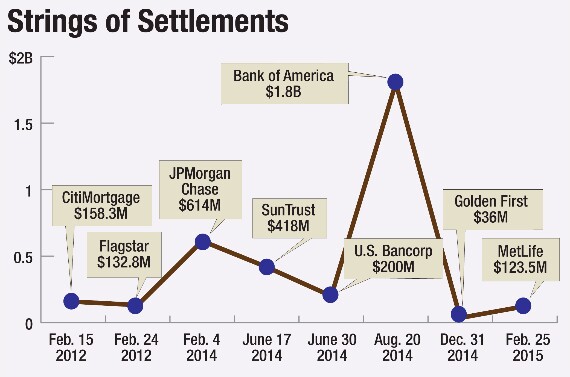

Servicers Still Taking Hits

More Probes of Shoddy FHA Loans

The Federal Reserve withdrew expectations on crypto activity and dollar tokenization, while the Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency also withdrew their versions of the guidance.

The Washington, D.C.-area bank reported a significant boost in provisions to cover emerging vulnerabilities in its $1 billion portfolio of office loans.

Tacoma, Washington-based Columbia Banking System said it will buy Pacific Premier Bancorp, accelerating its growth in Southern California by about a decade. The deal is Columbia's second major acquisition in three years.

A cohort of Democratic senators on the banking committee expressed concern over the Department of Government Efficiency's ongoing efforts to cut Federal Deposit Insurance Corp. staff and contracts, saying they worried the efforts could weaken the nation's deposit insurer and expose sensitive bank data if improperly handled.

At a New York Fintech Week event, speakers urged fintechs to better understand the criminal mindset and to use artificial intelligence to detect and thwart fraud.

Federal Reserve Bank of Cleveland President Beth Hammack said the central bank should not let fears of money-market shakiness cause it to stop balance sheet runoff too soon.