They are spending a lot, just not with you.

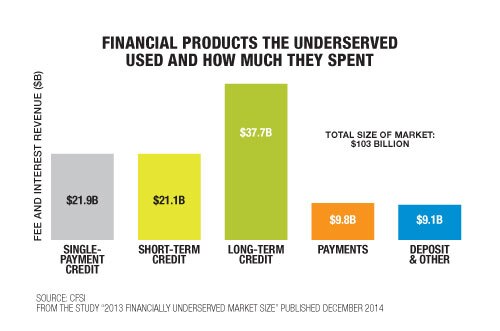

Though they use banks very little or not at all, these consumers do use financial products and services. It is a market segment that generated an estimated $107 billion in fee and interest revenue during 2014, up 4.6% from the prior year, according to estimates from the Center for Financial Services Innovation.

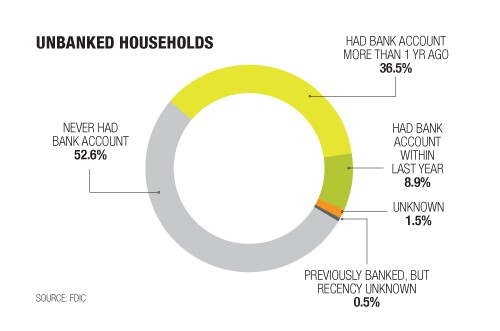

Two recent studies offered some key insights about these so-called "underbanked" and "unbanked" consumers. Here is a quick overview, with charts to illustrate.

(Image: Bloomberg News)

[Conference Program Note: Join CFSI and American Banker for the

Sorry, banks, 28% of consumers are taking some or all of their business elsewhere.

Also, 7.7% of U.S. households were unbanked in 2013. This represented nearly 9.6 million households composed of approximately 16.7 million adults and 8.7 million children.

The highest unbanked rates were among non-Asian minorities, lower-income households, younger households, and unemployed households.

For these groups, the unbanked rates in 2013 were generally similar to what they were in 2011. One exception was Hispanic households, for which the unbanked rate decreased to 17.9% in 2013 from 20.1% in 2011.

The FDIC attributed this change largely to an increase in the levels of employment, income and education among Hispanic households.

The unbanked and underbanked aren't as opposed to using mainstream financial services as you might think.

Of those, 49% say they expect to open an account again within a year, with that jumping to 75% for the ones who recently had an account. A quarter of households that have never been banked also say they expect to open an account.

It's possible banks could use some simple tactics to help keep people from exiting the banking system.

Among households that recently became unbanked, 34.1% experienced either a significant income loss or a job loss that they said contributed to the household becoming unbanked.

Roughly the same percentage of the recently unbanked (34.2%) also reported that receiving direct deposits was the main reason they initially opened an account.

Keith Ernst, associate director of the FDIC's Division of Depositor and Consumer Protection, says banks might be able to come up with ways to maintain ties with these consumers, instead of losing them to the ranks of the unbanked.

"For example, maybe instead of waiving the account fee for direct deposit above a threshold, an institution might consider [waiving the fee for those who use] bill pay," he says. "Because if you're losing the job, you might not have the direct deposit, but you'll almost certainly have a bill that needs to be paid."

Also worth noting: Among households that recently became banked, 19.4% reported that a new job contributed to their opening a bank account.

Mobile phones offer a way for banks to strengthen ties with the underserved.

"You can see what consumers are doing with these phones: They're checking their balances, and they're taking advantage of unique functionality like text alerts to get information in a timely manner to help them better manage their accounts," says the FDIC's Ernst. "You can imagine for households, some of whom have had challenges managing their accounts in the past, that is just an incredibly valuable opportunity."

The FDIC survey also indicates that mobile phones are prevalent among the underbanked and the unbanked. Among the underbanked, 90.5% had access to mobile phones (versus 86.8% for the banked) and 64.5% had access to smartphones (versus 59% for the banked). Notably smaller, but still significant, proportions of unbanked households had access to mobile phones (68.1%) and smartphones (33.1%).

More banks should consider making mobile accounts available to those who don't use online banking.

At the same time, underbanked households were less likely to have used online banking as their main banking method (26.6%) compared with fully banked households (35.1%).

One takeaway for banks is the need to offer mobile accounts, independently of online banking, the FDIC's report says.

Oftentimes, mobile banking is restricted to users who have access to an online banking account. In some cases, this could prevent access by the underserved who cannot, or do not wish to, use online banking.

Innovations such as mobile account opening could play a role in expanding access to banking among the unbanked too, the FDIC says.

(Image: Fotolia)

Don't give up on branches yet.

"Part of what comes through in the paper is the notion that it would be a mistake to think about mobile financial services in a vacuum," he says. "Eight in 10 consumers, for example, still tell us that they used a bank branch in the last year."

Among households that primarily used either online or mobile banking to access their account, use of additional methods was common. One popular method was bank tellers, which were used by more than 70% of both groups.

In addition, one in three of the banked and underbanked households overall (32.2%) used bank tellers as their primary method of account access, and 17.5% used bank tellers as their only method of account access.

Among the group of people who used primarily tellers to access their account were: roughly half (54.7%) of households age 65 or older, 55.7% of households without a high school degree, and 47.5% of households with annual income under $15,000.

(Image: Thinkstock)

Short-term credit is on an upward trend, while single-payment credit is on the decline.

The CFSI study suggests that "providing products that support financial health represents a vast market opportunity."

The 26 financial products that target the unbanked and underbanked fall into the five broad categories, which are listed in the chart above. These products generated a total of $103 billion in revenue in 2013, which is up 7.1% from 2012, according to the study.

Short-term credit includes such offerings as title loans and subprime credit cards, both of which contributed to an upward trend in this category. Although rent-to-own spending did not grow from 2012 to 2013, it is projected to regain positive growth in 2014, adding momentum to short-term credit's rise, the study says.

"Up until this year, single-payment credit has always been higher in terms of revenue growth than short-term credit," says Sarah Parker, CFSI's director of insights and analytics. "But this year we actually saw the reverse."

Short-term credit grew by 11.2% in 2013 and is projected to grow by 8.2% 2014, while single-payment credit revenue grew only 1.5% in 2013 and is expected to fall by 3.4% for 2014. CFSI attributed the downward trend for single-payment credit to regulatory actions that have curtailed online payday lending through the Justice Department's Operation Choke Point, slowed uptake of overdraft services through opt-in requirements in Regulation E, and the discontinuation of deposit advances in early 2014 following FDIC and OCC guidance.

Prepaid cards could be a gateway to the financial mainstream for some.

The study says revenue growth for prepaid cards slowed significantly in 2014, with the market nearing saturation.

Still, prepaid cards appear to be a way for banks to make inroads with unbanked consumers, because the card users are more likely be interested in opening bank accounts than the rest of the unbanked. In the FDIC's survey, about half of unbanked households that used prepaid cards in the past 12 months 47% indicated being "very likely" or "somewhat likely" to open a bank account within the next 12 months. This compares to 32.6% for unbanked households that had not used prepaid cards.

Notably, whether banked or unbanked, only one in 10 households that used prepaid cards got them from a bank branch, according to the FDIC survey.

Those elusive millennials are among those using prepaid cards more lately.

(Image: iStock)