Credit union merger approvals dipped in the second quarter, according to data from the National Credit Union Administration.

Approvals totaled 25, down more than 20% from the first quarter, according to the data. Despite that decline, the overall pace of mergers has not largely changed despite the pandemic. Fifty-nine deals were approved in the first half of the year, compared with 61 in the first half of 2019.

Only two credit unions with assets over $100 million received approval to merge into other institutions in the second quarter. That reflects an ongoing trend that the bulk of the industry’s consolidation is happening at the bottom end of the asset spectrum.

Analysis from CEO Advisory Group, a credit union research and consulting firm, showed nine credit unions on the acquiring end of these deals had assets over $1 billion.

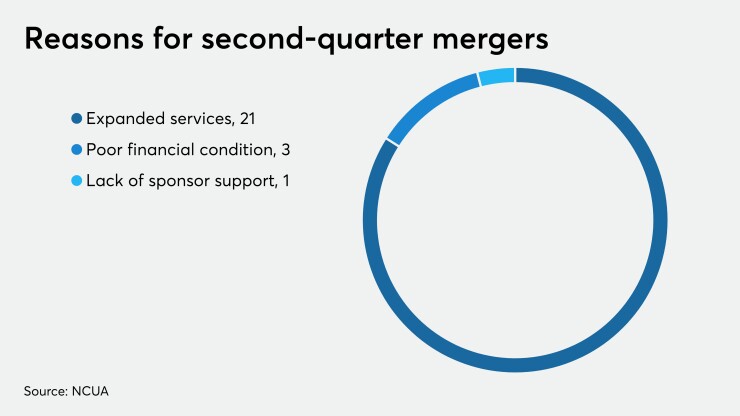

Of the 25 CUs merging, 18 reported losses. The overwhelming majority of merging credit unions cited expanded financial services as their primary reason for merging, though a few also noted poor financial condition or lack of support from its sponsor group. Many credit unions, particularly smaller ones, frequently also merge due to the difficulties in succession planning.

Two credit unions have seen their members reject merger plans already this year — a rarity for the industry — and many institutions have had to rethink their member-voting process as a result of the pandemic, including shifting those votes to online platforms and holding member meetings virtually.