-

How to reconfigure retail-delivery networks to suit the next generation of customers was top of mind for bank CEOs Tuesday, even as news headlines dwell on new regulations and sluggish growth.

December 10 -

A grocery chain's decision to shutter its Chicago stores will reportedly shrink JPMorgan Chase's (JPM) branch count in the city by 12%.

December 12 -

The $18.4 billion-asset company said in a regulatory filing Wednesday that it will shutter 37 branches inside Chicago-area Jewel-Osco stores and a branch in downtown Minneapolis.

December 11

For years, bankers have bemoaned the looming death of the traditional bank branch. Now it looks like its actually starting to happen. Finally.

Last week brought a slew of announcements about branch closures from banks including

After years of bank executives acknowledging that they will eventually have to do something about their outdated and expensive branch networks, PNC Chief Executive William Demchak appears to be taking the plunge. Besides

"We'll drop the operating costs out of it, and it will deliver a service that tomorrow's bank client expects," Demchak said last week at a Goldman Sachs (GS) financial services conference.

This sort of dramatic, ambitious plan is long past due. Bankers have spent a lot of time

The increasing availability of remote deposit capture has accelerated this change in customer behavior, at least in my own experience. I used to visit my bank infrequently, mostly to deposit checks I sometimes receive as holiday or birthday gifts, but now that my bank allows me to do that by snapping a photo of any spare checks I luck into, I havent been past my local branchs ATM lobby in months.

Perhaps Im biased since I live in Manhattan, where ubiquitous megabank branches have done more to homogenize the streetscape than Starbucks. But you dont have to be a harried New Yorker to see that the industry is overbranched and unevenly so. Banks arent holding onto branches as a way to expand their services into "underserved" areas, or to make sure that low-income or more rural customers have better access to them. Instead theyre using and even

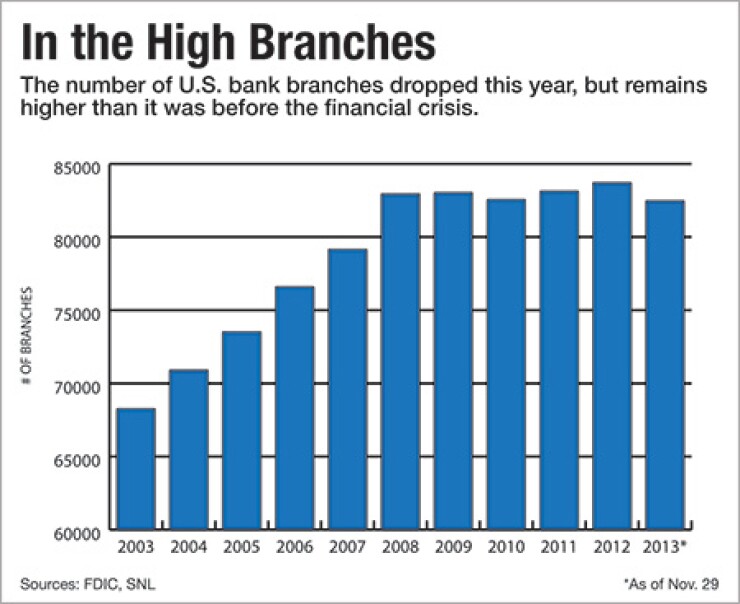

The financial crisis, while dramatically shrinking the number of banks, actually saw the survivors expand their physical presence. The overall number of U.S. banks has dropped by 19% since the end of 2007, when the FDIC

Many industry members expect the number of branches to drop more in coming years. And bankers recognize that the days of spending an

But before PNCs decision, none of these banks have been eager to be the leader in giving up on branches. More than six in 10 banks said they want to expand their branch networks, according to a

All of the current branch shrinkage has been incremental and fairly conservative, which is to some extent understandable. Closing branches haphazardly, without a firm and well-researched strategy to make sure banks will not lose customers, is obviously a bad idea. But so is ignoring the irrevocable changes in what most customers expect from their banks especially when such willful blindness carries ongoing operating and real estate costs. Now that PNC has taken the leap to redirect the future of its branches, hopefully more banks will move past their baby steps.

Maria Aspan is the national editor for American Banker. The views expressed are her own.

Paul Davis contributed reporting to this post.