The London-based neobank plans to invest $500 million in the U.S. over the next few years amid stiff competition from fintechs, other neobanks and legacy banks.

Experts say regulators will be looking more closely at know-your-customer compliance in the wake of U.S. strikes on Iran.

-

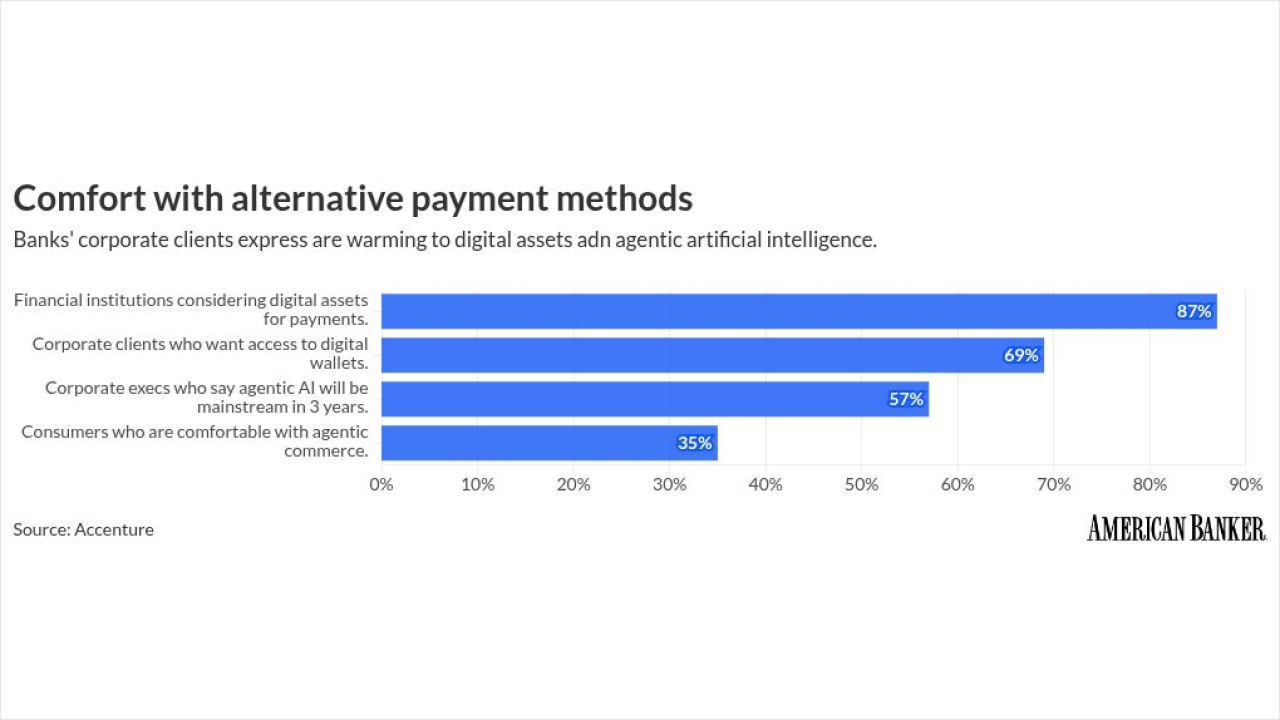

Fintechs and the technology behind cryptocurrency are becoming popular, putting trillions in transaction value at risk for banks, according to Accenture.

-

Federal Reserve Vice Chair for Supervision Michelle Bowman played down the significance of Kraken Financial receiving a master account, saying the central bank is treating it as a pilot program.

-

Panelists at a JPMorganChase webinar said oil shipping security is shaky, creating risk of a new wave of inflation that would impact energy finance. Other analysts said the war will create pressure for some parts of the payments industry.

Stripe has expanded its Shared Payment Tokens, a foundational building block to protect agentic commerce, to work with Visa and Mastercard's tokens. It's also added Affirm and Klarna.

Midland States Bancorp had struggled in 2025 with accounting-related issues and bottom-line losses.

Industry stakeholders say the Federal Reserve's renewed focus on reforming the discount window — the central bank's 'lender of last resort' facility — is welcome. But replacing the system with one that works better is easier said than done.

-

Branchless and out-of-state banks are harvesting deposits in Florida and lending them out elsewhere, a situation that leads to serious underinvestment in desperately needed infrastructure and affordable housing.

-

New research sheds light on the real causes of bank failures; and the economic numbers aren't adding up to a recession, yet.

-

If we allow algorithms to inherit yesterday's incentives — maximizing return, minimizing empathy — then tomorrow's system will be flawlessly efficient at reproducing inequality.

-

In the highest-priced housing markets, some buyers see adjustable-rate mortgages as the only loan they may initially qualify for, Cotality found.

-

TransUnion cuts VantageScore 4.0 to $0.99, aiming to boost lender choice and affordability as FHFA pushes mortgage score modernization and competition.

-

Cybercriminals say they stole sensitive records by exploiting an unpatched vulnerability known as React2Shell and using the password Lexis1234.

-

Glen Herrick, a veteran bank director, penned a resignation letter criticizing the West Virginia company's executive-compensation policies and what he described as a failure to focus on core profitability.

-

While this only shows a 2-basis-point rise in the 30-year fixed since last week, the Lender Price product and pricing engine data is 30 basis points higher.

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

-

The annual rankings honor the notable performances of individuals in banking and finance and as teams.

-

Call for submissions for women 40 years and younger who are rising leaders at their bank or financial institution.

-

Think your credit union has one of the best workplaces in the country? Here's how to apply for American Banker's ranking of the Best Credit Unions to Work For.

The 23rd annual ranking of women leaders in the banking industry.

- Partner Insights from Alloy

- Partner Insights from Moody's

-

-